Global X FTSE Colombia 20 ($GXG), an international ETF, was initially listed in the ETF trading section of our Wagner Daily newsletter a few weeks ago, due to the strong base of consolidation that was forming on the weekly chart. Presently, we still like the price action of $GXG, and its weekly chart continues to show bullish price action after breaking above the 10 and 40-week moving averages in early September. The current base building action is shown on the weekly chart pattern of GXG below:

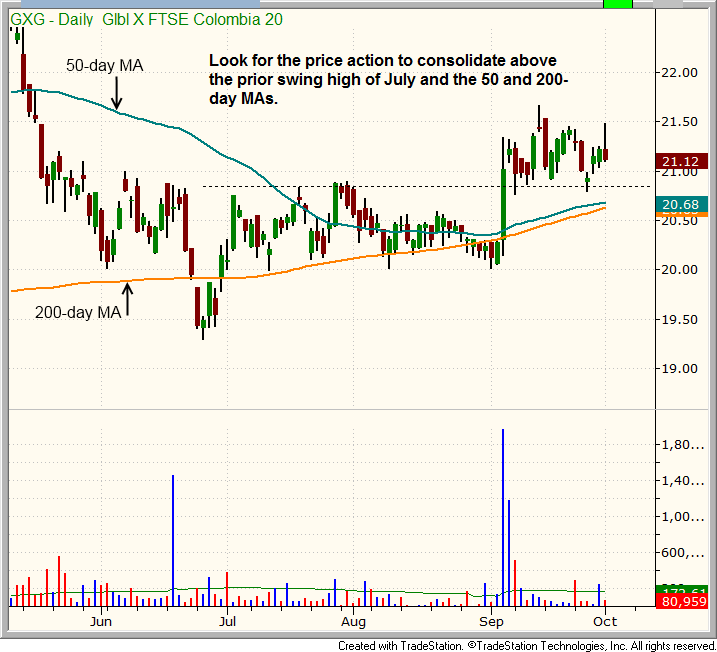

$GXG may still need another week or two of basing action above its 10 and 40-week moving averages, as well as new support of its prior swing highs from July, before breaking out. As such, we do not yet have a low-risk entry point in this ETF swing trade setup, but we will continue to monitor the action closely. If it meets our technical criteria for “official” trade entry, newsletter subscribers will be notified in advance of our exact trigger, stop, and target prices. Here’s a closer look at recent price action on the shorter-term daily chart: