Both the large-cap Dow Jones Industrial Average ($DJIA) and benchmark S&P 500 Index ($SPX) continue to push higher, and both indexes closed at fresh, multi-year highs yesterday. However, we are now seeing bearish divergence in small-cap stocks, as the Russell 2000 Index ($RUT) has just broken below near-term technical support of its 20-day exponential moving average. This breakdown in the Russell is noteworthy because most of the individual stocks we swing trade are either small or mid-cap growth stocks.

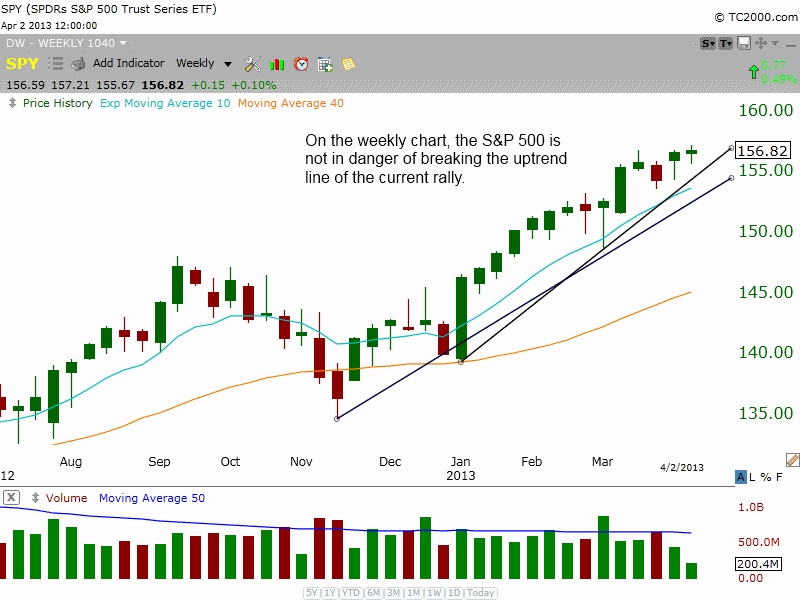

Just for some initial perspective, let’s check out the weekly chart pattern of the S&P 500 SPDR ($SPY), an ETF that mirrors the underlying index. As you can see on the chart below, $SPY is currently trading well above the dominant uptrend line of the current rally:

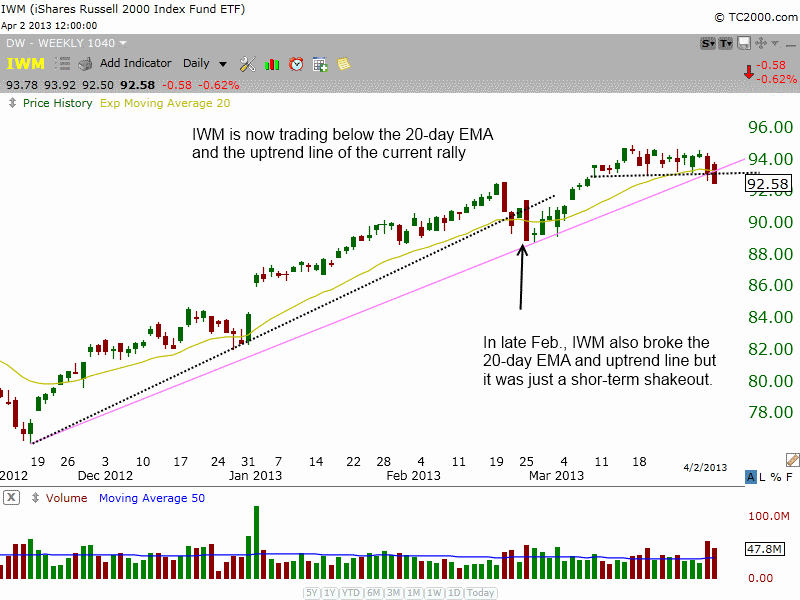

By comparison, the daily chart of the iShares Russell 2000 Index ETF ($IWM) shows the recent weakness that has led to a breakdown below three different levels of technical price support: the low of the multi-week trading range (around $93), the 20-day exponential moving average (beige line), AND the dominant uptrend line (which began with the November 2012 low):

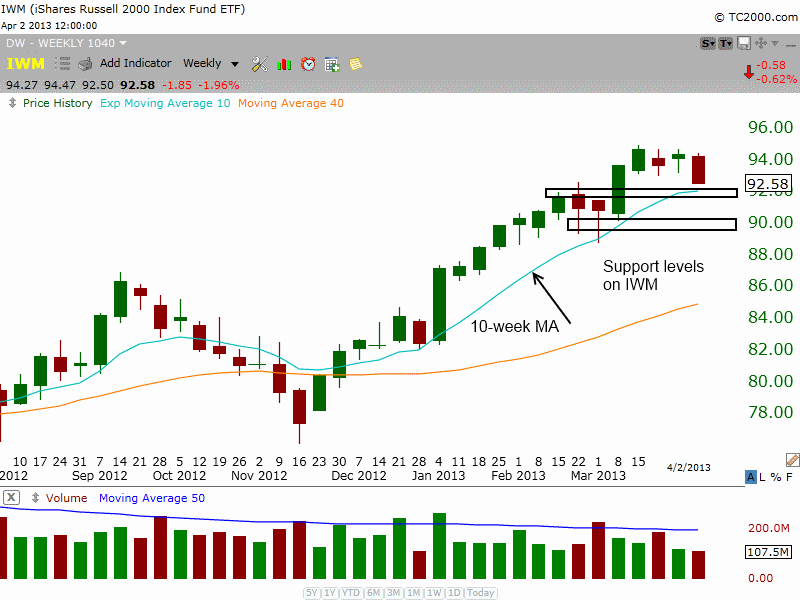

Scaling out to the weekly chart of $IWM below, we see two clear support levels at the $92 and $90 area. Please think of support as an area, rather than just a line that must be held to the penny. Stocks and averages can and frequently do “undercut” obvious levels of price support for a few days and bounce right back (we like those plays for buy entry):

The $92 level is support because it was a prior resistance level for three weeks in February. Remember that a prior level of resistance becomes the new level of support, after the resistance is broken (technical analysis 101). The rising 10-week moving average (or 50-day moving average) is also converging at the same $92 level. The second level of support is formed by the “swing lows” of late January and late February (around $89 – $90).

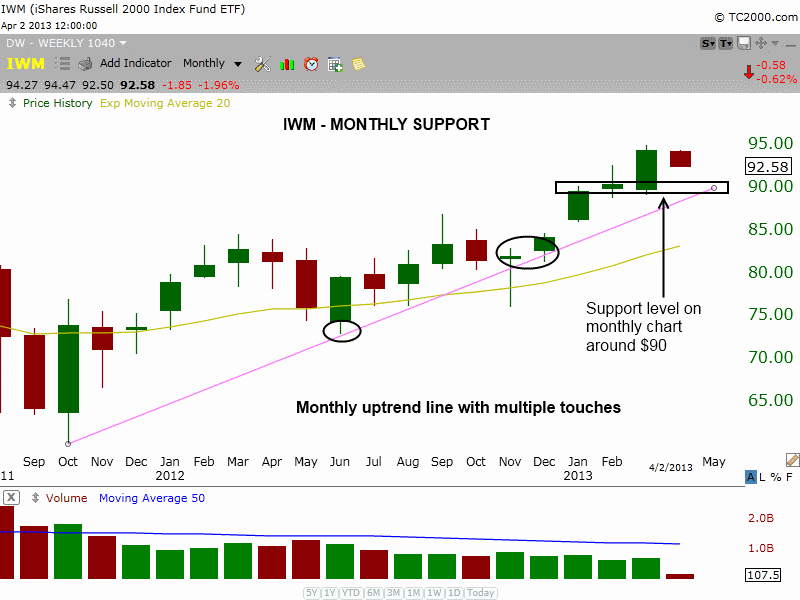

Now, let’s assess the “big picture” by turning to the long-term monthly chart of $IWM. Upon doing so, we see there remains a clear uptrend line, with multiple anchor points along the way, that should also provide support around $90 (or slightly higher).

On both the weekly and monthly chart intervals, there is significant support around the $90 level. The more timeframes and indicators that converge near a certain price, the more substantial that support should become. If the price of $IWM was to retrace down to this level, it would only be a 5%-6% pullback off the highs of the rally. Within a bull market, a shallow correction of just 5-6% that holds near that level would be a bullish sign that could lead to a strong Q3 and Q4 of this year.

The past few days have not been kind to individual leading stocks (which are typically small to mid-cap equities). Most stocks that broke out in late February and early March have been running out of steam over the past several days, and are now in pullback mode. Furthemore, stocks that have been forming bullish consolidation (basing) patterns in recent weeks are also beginning to break down. Oil Refiners and Homebuilders are two examples of industry sectors with disappointing price action over the past two weeks.

If leading technical setups like $PRLB, $URI, $SODA, $AMBA, $ALNY, $DGI, $CHUY, $PHM, $DHI, and $AMZN begin to roll over, and the broad market suffers just one more ugly “distribution day,” it would be clear signals that the current stock market rally may be entering at least a short-term correction. Still, by highlighting the relative weakness in the Russell 2000 Index above, it’s important to realize we are NOT calling a top in $IWM. Rather, we want to make you aware of key support levels to monitor if recent weakness in small-caps persists in the coming days.