Current signal generated on close of 7/3

Past signals:

- Sell signal generated on close of June 24

- Neutral signal on the close of June 20

- Buy signal on the close of June 13

- Neutral signal on close of June 12

- Buy signal on the close of April 30

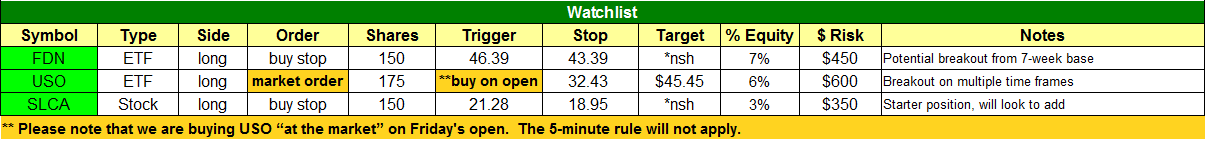

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

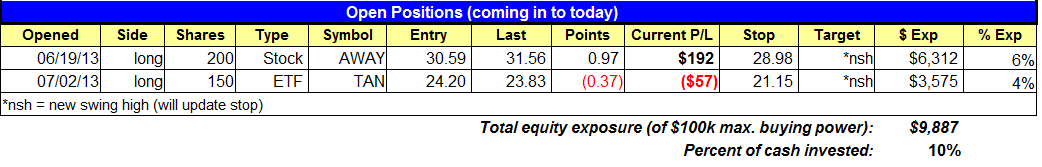

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Net P/L figures are based a $100,000 model portfolio. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- No trades were made.

stock position notes:

- No trades were made.

ETF, stock, and broad market commentary:

After several days of stalling action at key technical resistance levels, the major indices showed positive price action in Wednesday’s holiday-shortened session. Stocks gapped lower on the open, but reversed to close with modest gains across the board. The Nasdaq Composite turned a 0.3% opening loss into a 0.3% closing gain. Action in the S&P 500, which edged 0.1% higher, was more dull. Given the early closing time of the stock market, turnover across the board was substantially lower than the previous day’s levels.

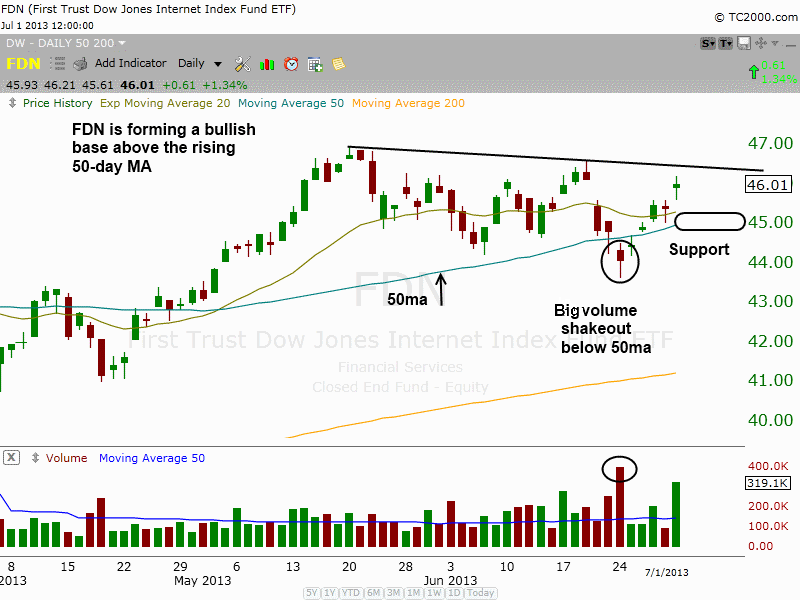

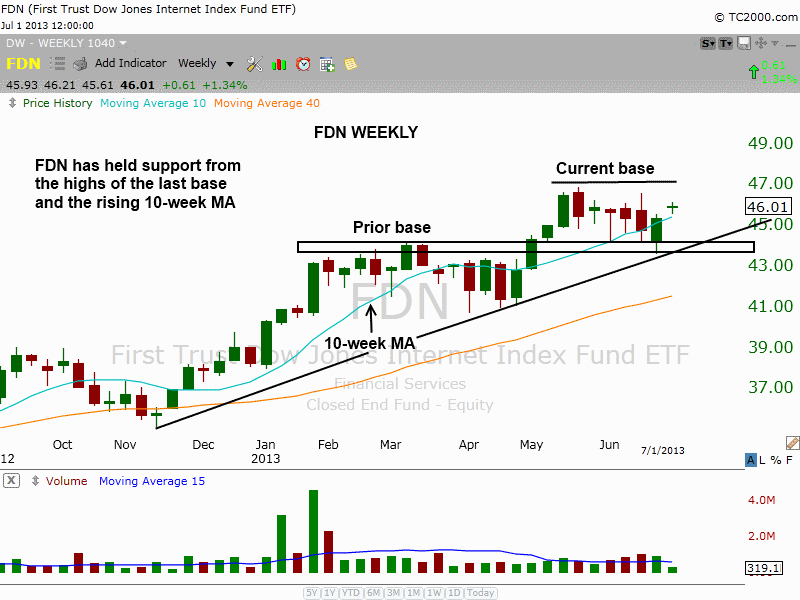

In the July 2 issue of The Wagner Daily, we pointed out the relative strength and bullish chart pattern of First Trust DJ Internet Index ($FDN). To refresh your mind, below are the annotated daily and weekly charts we showed you at that time:

Although a quick pullback to support of the rising 50-day moving average would have provided a low-risk buy entry, it now looks as though such a pullback may not occur before the breakout. This is because the price action has traded in a tight and narrow sideways range over the past three days.

Showing relative strength in the July 3 session by gaining 0.7% versus the 0.3% gain of the Nasdaq, $FDN could now trigger a valid buy entry on a rally above the 3-day high. As such, notice we have listed $FDN as a potential buy entry on the “Watchlist” section of today’s newsletter. The updated daily chart of $FDN below shows the setup:

In our July 1 commentary, we said we were stalking US Oil Fund ($USO), a commodity ETF that tracks the price of crude oil, for potential breakout entry on its weekly chart. At the time, we said a buy entry was not yet actionable because the ETF was still trading roughly 2.5% below pivotal horizontal price resistance. However, over the past three days, $USO has surged higher and convincingly broken out on its weekly chart, as shown below:

Although it cannot be seen on the weekly chart above, $USO jumped 1.8% in the most recent session. More importantly, that price gain was accompanied by a volume spike that was the highest turnover of any day so far this year (about 200% the average daily volume of $USO). This is important because the increasing volume confirms the presence of institutional buying, which therefore decreases the likelihood of a failed breakout.

Because this breakout is from such a lengthy base of consolidation, our price target in $USO is quite substantial (test of May 2011 highs, which is roughly 27% above the current price). Obviously, this means we also intend to maintain a longer than usual holding period for $USO than with our typical swing trade (estimate of 1 to 2 months).

Although the price of $USO is slightly extended beyond the actual breakout level, we still plan to buy at market on Friday’s open. We are not concerned about paying up slightly because this is such a significant breakout on the weekly chart timeframe (more powerful than just a breakout on the daily chart). Furthermore, we like that $USO is a commodity ETF because it will be less prone to gyrations of the main stock market indexes (lower correlation to the broad market).

Leading stocks continue to hold up well, which suggests that the current currection will eventually lead to further upsside. Although we are still waiting for the volume patterns in the NYSE and NASDAQ to improve, we feel comfortable enough with current conditions to begin initiating new positions with reduced size.

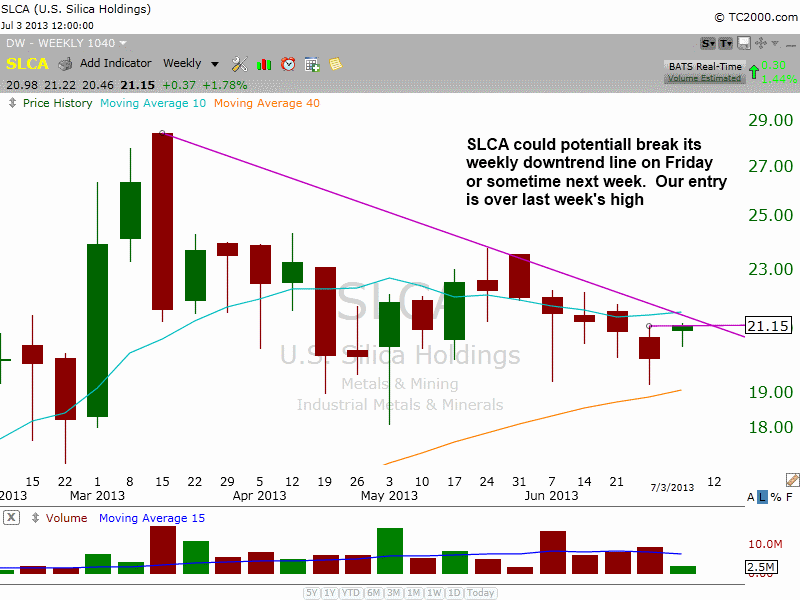

US Silica Holdings ($SLCA) is an IPO from 2012 with solid fundamentals and a relative strength ranking of 87. After topping out at $28 earlier this year $SLCA has formed a 16-week base with a higher low in June. Our buy entry is over last week’s high, which could produce a downtrend line break on the weekly chart below and lead to a test of $23 level. The share size is small (about 1/3 of max risk), but we plan to add to the position as the right hand side of the pattern forms.