market timing model:

Neutral – Signal generated on the close of December 27 (click here for more details)

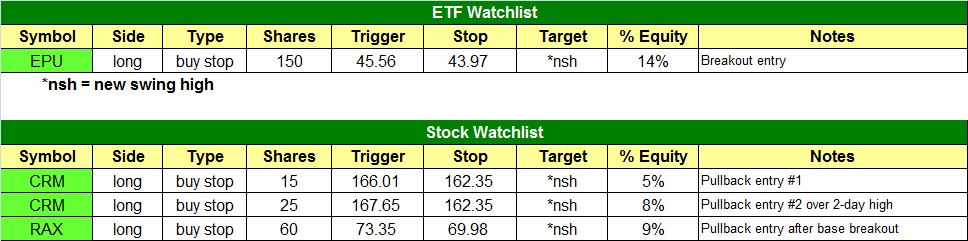

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

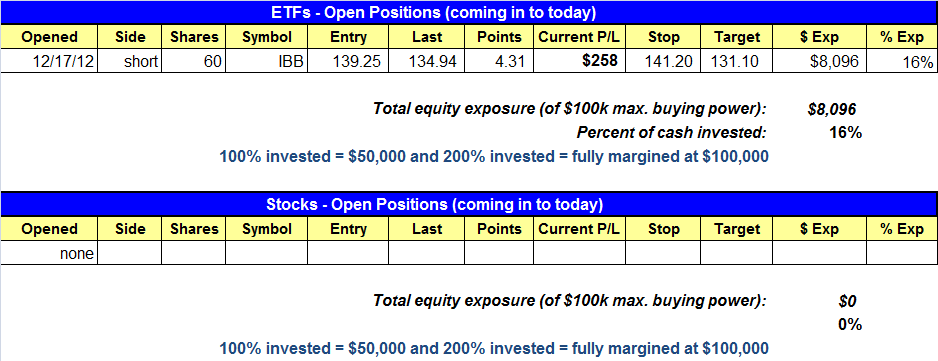

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Net P/L figures are based on two separate $50,000 model portfolios (one for ETFs and one for stocks). Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

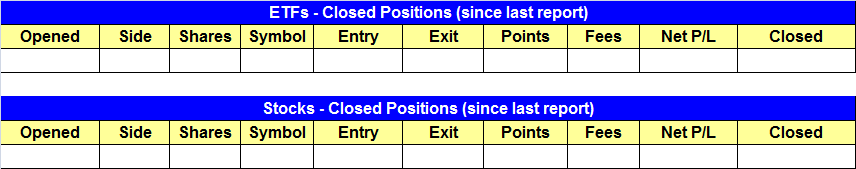

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- No trades were made.

stock position notes:

- No trades were made.

Commentary and charts:

Stocks failed to follow through on Thursday’s late reversal action and gapped lower on Friday, with all averages closing in negative territory down about 1% on average. The Dow Jones Industrial Average was the only major average to break Thursday’s low and in doing so also broke its 200-day moving average. The only broad market charts that are in decent shape right now are the small and mid-cap averages (Russell 2000 and S&P Midcap 400), as they are currently trading around the 20-day EMA.

Although most averages were down considerably on Friday, total volume was noticeable lighter on the NYSE and Nasdaq, which prevented the major averages from suffering another distribution day. Volume fell off Thursday’s pace by 15% on both exchanges. Our market timing model remains in neutral territory, since most breakouts in leadership stocks have failed to impress over the past few weeks. Should leadership stocks begin to breakdown en masse and the market suffer more distribution, then we would probably see the model shift to a sell signal.

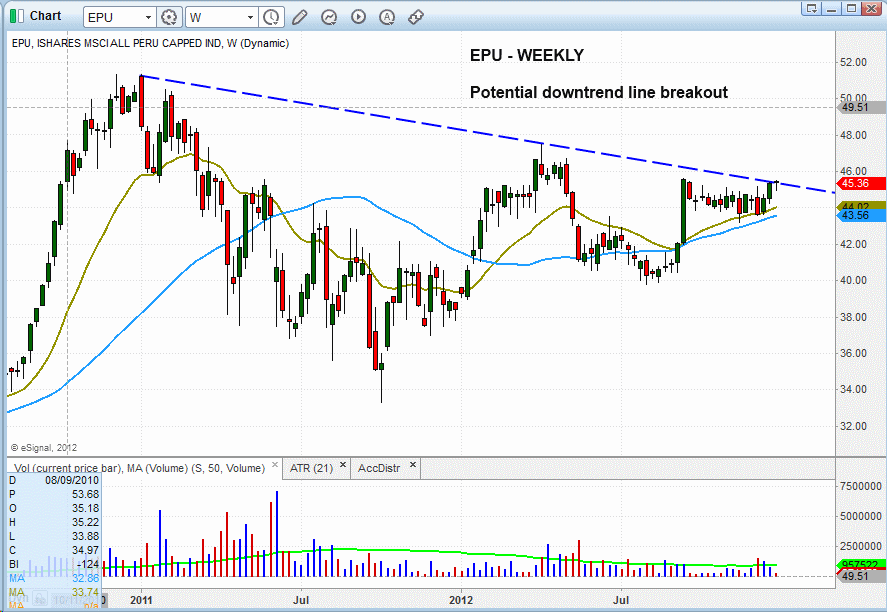

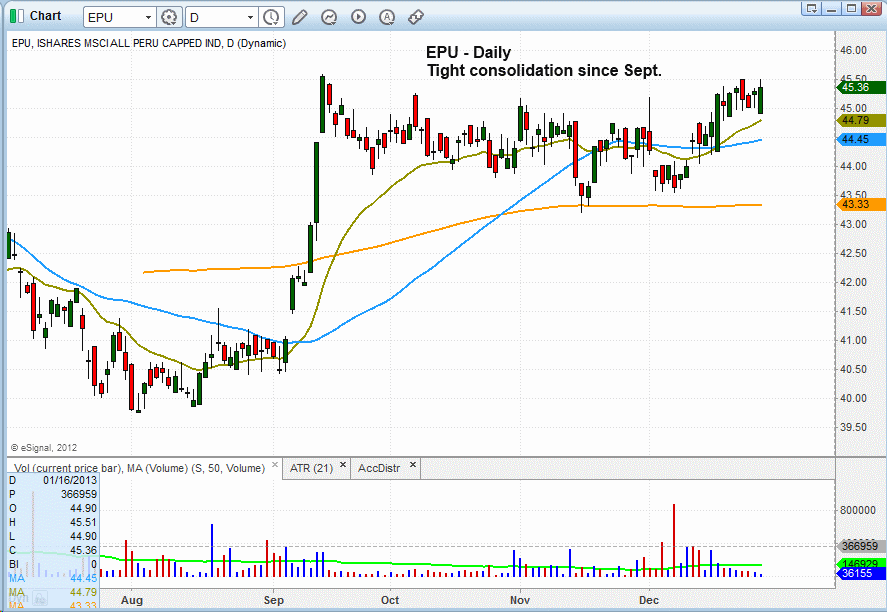

With the market in short-term oversold territory, the reward to risk ratios do not favor establishing new short positions at current levels. However, our long watchlist did produce a few potential buy candidates and one new watchlist setup in the iShares MSCI All Peru Capped Index Fund ($EPU). The weekly chart below is showing a potential long-term downtrend line breakout after a tight ranged, multi-month consolidation.

The daily chart of $EPU is showing a tight consolidation above the 200-day MA, with the 50-day MA recently crossing above the 50-day MA. Note the higher swing low within the base in early December. We always want to see the price action set higher lows in a base just before breaking out. We are placing $EPU on the watchlist, and trade details can be found in the Wathclist section above.

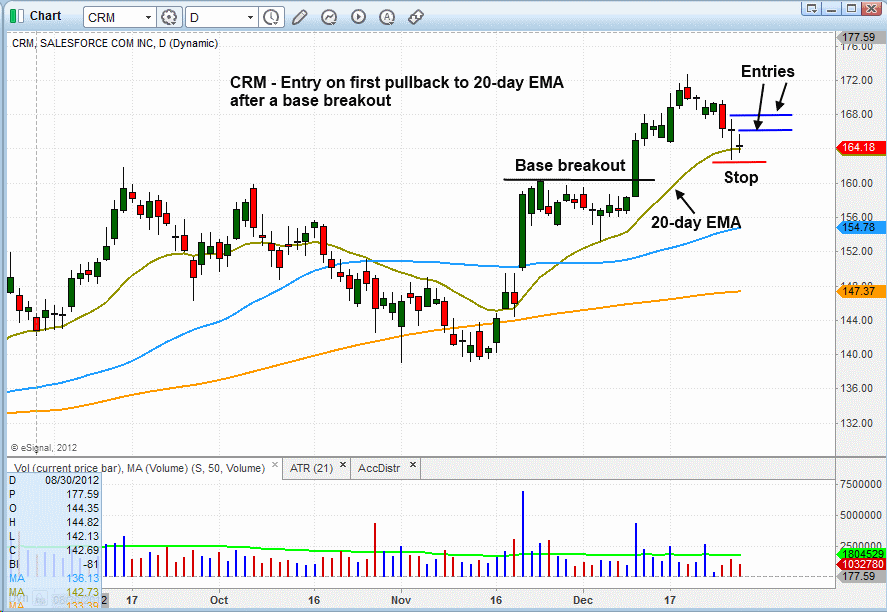

On the stock side, our scans produced a few solid buy candidates in $CRM and $RAX. Both setups can be found in today’s watchlist section above. The daily chart of $CRM below shows the natural pullback to the 20-day EMA after a base breakout. We have two entry points with one stop just below Thursday’s reversal candle low.

If you are a new subscriber, please e-mail [email protected] with any questions regarding our trading strategy, money management, or how to make the most out of this report.

relative strength combo watchlist:

Our Relative Strength Combo Watchlist makes it easy for subscribers to import data into their own scanning software, such as Tradestation, Interactive Brokers, and TC2000. This list is comprised of the strongest stocks (technically and fundamentally) in the market over the past six to 12 months. The scan is updated every Sunday, and this week’s RS Combo Watchlist can be downloaded by logging in to the Members Area of our web site.