Current signal generated on close of November 13.

Portfolio exposure can be anywhere from 75 to 100% long. If positions are holding up well, then one can add exposure beyond 100%.

Past signals:

- Neutral signal generated on close of November 6.

- Buy signal generated on close of September 9

- Neutral signal generated on close of August 15

- Buy signal generated on close of July 11

- Neutral signal generated on close of July 5

- Sell signal generated on close of June 24

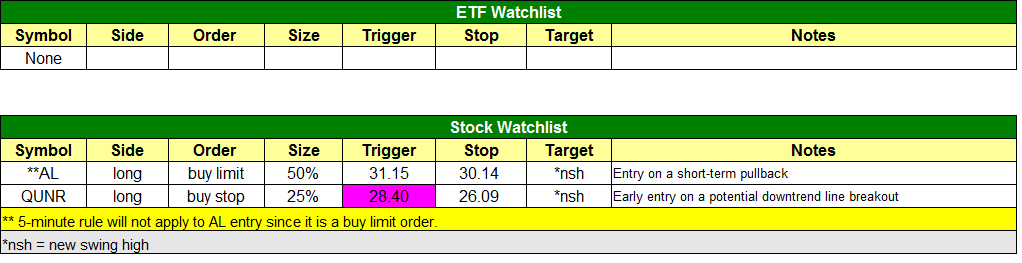

today’s watchlist (potential trade entries):

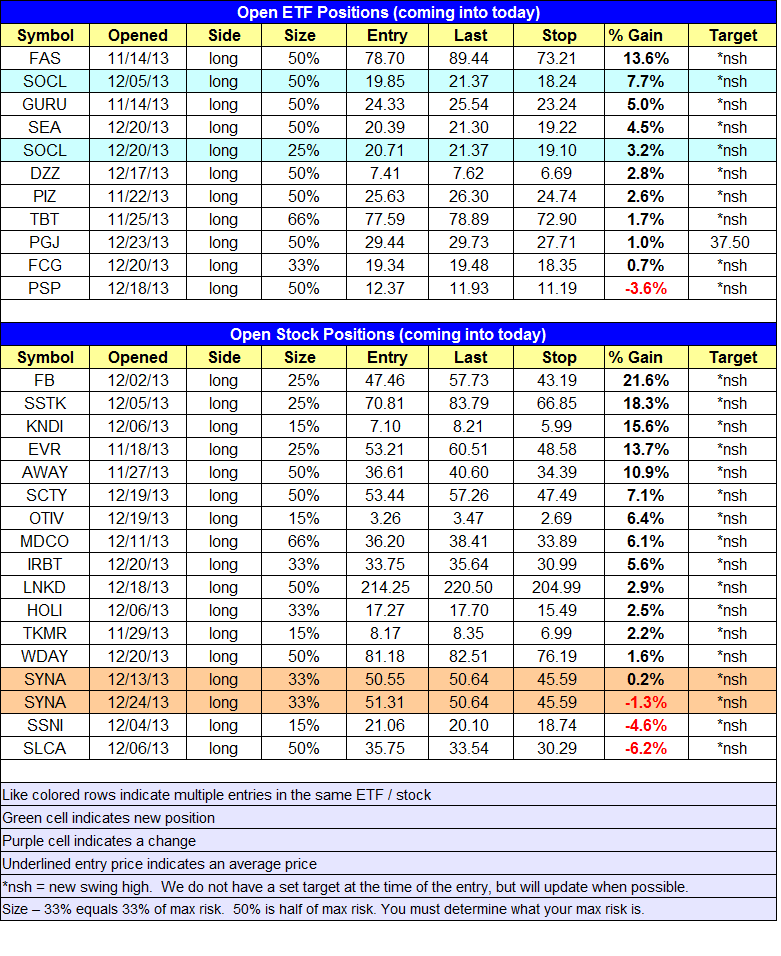

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

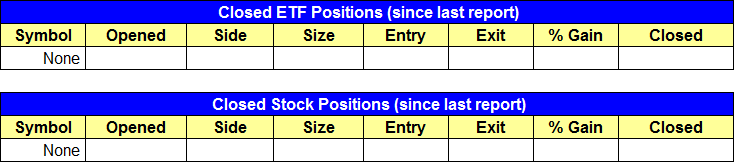

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- No trades were made.

stock position notes:

- Note that the 5-minute rule applied to the $QUNR entry yesterday. The new buy point is listed above.

ETF, stock, and broad market commentary:

This week’s holiday schedule:

- Tuesday Dec. 24 – Market will close early at 1 pm EST

- Wednesday Dec. 25 – Market is closed (no newsletter or webinar on that day).

- Thursday Dec.26 & Friday Dec. 27 – An abbreviated version of the Wagner Daily will be published. There will be no (or very light) commentary, but we will update the watchlist, open, and closed position sections.Happy Holidays!

Per the holiday schedule above, we are publishing an abbreviated version of the newsletter tonight. There is no commentary, but we have updated the watchlists.

A few smaller stocks are looking pretty good. $USAK, $OME, and $LXFT are offering potential buy points above this week’s high. These setups are not official. Also, keep in mind these stocks are not very liquid, so please be sure share size is in line. For example, if one has a 50% position in a strong stock like $MDCO, one should have no more than 10-20% position in these smaller stocks.