market timing model: (Confirmed) Buy

Current signal generated on close of September 9.We are now in confirmed buy mode, so portfolio exposure can be more than 100% if you have a marginable account. However, please make sure that current long positions in your portfolio are working before adding new ones. Portfolio exposure should be at least 75% to 100% (or more) right now.

Past signals:

- Neutral signal generated on close of August 15

- Buy signal generated on close of July 11

- Neutral signal generated on close of July 5

- Sell signal generated on close of June 24

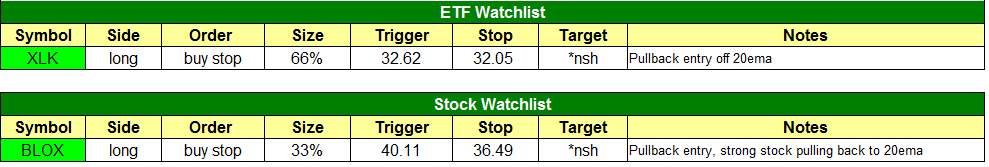

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

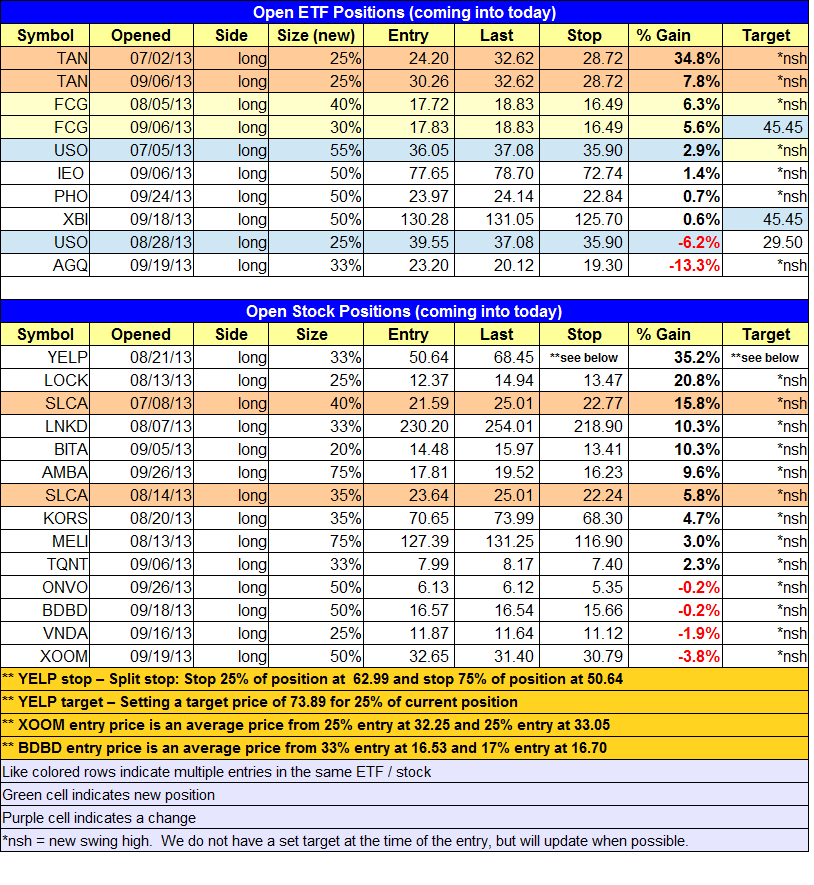

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits. Click here to learn the best way to calculate your share size.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- No trades were made. We canceled the $EWJ buy setup in favor of $XLK.

stock position notes:

- No trades were made.

ETF, stock, and broad market commentary:

Yesterday’s price action was a step in the right direction for the Dow Jones and S&P 500, as both averages held above the prior day’s low and are beginning to find some traction on the hourly chart.

For the Russell 2000 and NASDAQ Composite, it was business as usual, with both averages consolidating in a very tight range near the swing high.

After breaking out above range highs on 9/18, Technology Select Sector SPDR ($XLK) has pulled back into a logical support area, formed by the prior breakout level and the rising 20-day EMA just above $32. There is also support from the rising 10-week MA on the weekly chart, which is currently sitting at $32.01.

We are looking for a buy entry above Thursday’s high, with a faily tight stop below the 20-day EMA.

After two weeks of consolidating in a tight range, our long position in $TAN is now in great shape due to yesterday’s big volume advance above $32. We look for the price action to follow through to the upside next week and potentially hit our target of $36.50 in a few weeks.

$BLOX has been a monster mover so far in 2013, as it rallied more than 80% from a base breakout around $24. We like the current pullback to the 20-day EMA, and although we would prefer a slight undercut of the four day low before entering, we do not want to miss the next move out. As such, we are placing $BLOX on today’s watchlist as an official buy just above $40. We are basically buying the pullback to the 20-day EMA with a wide stop (about 9% away), which is also beneath the low of the 9/6 gap up.