market timing model: Buy

Current signal generated on close of September 9.We are no longer in confirmed buy mode, but remain in buy mode. Portfolio exposure depends on how well positions have held up, but anywhere from 50% to 100% (if positions are in good shape) is okay. Anything less than 50% long exposure right now is too light.

Past signals:

- Neutral signal generated on close of August 15

- Buy signal generated on close of July 11

- Neutral signal generated on close of July 5

- Sell signal generated on close of June 24

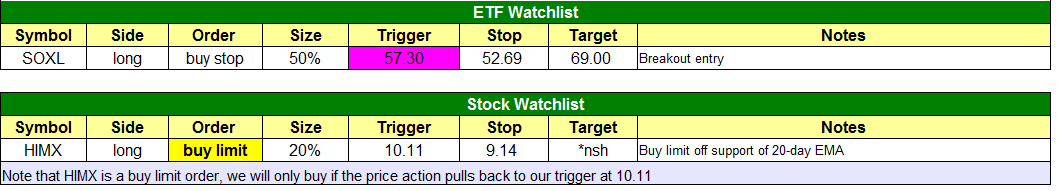

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

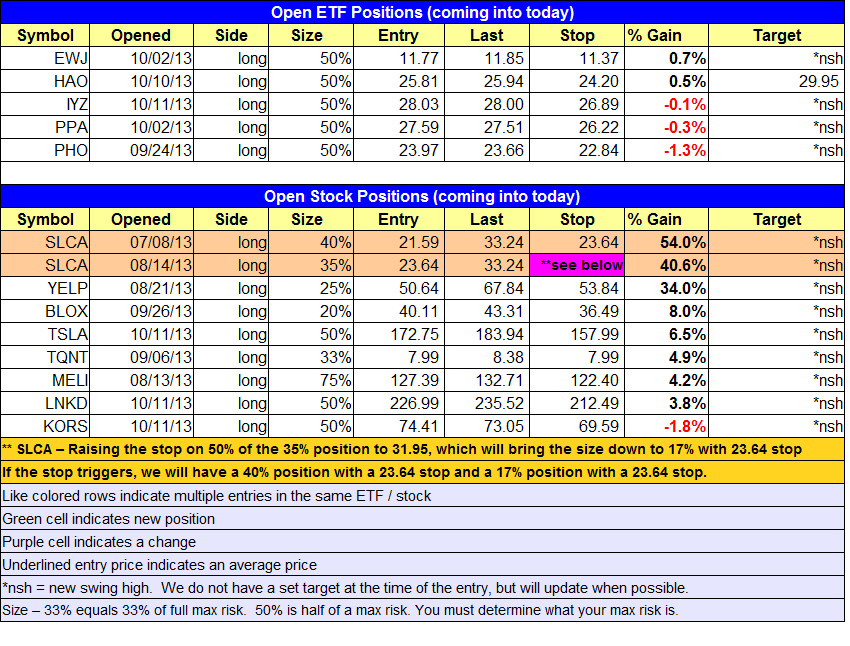

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits. Click here to learn the best way to calculate your share size.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- No trades were made.

stock position notes:

- No trades were made.

ETF, stock, and broad market commentary:

After a three bar rally in the market on light volume, the averages sold off yesterday on a pick up in volume, with the NASDAQ stalling at prior swing highs and closing near the lows of the day. The stalling action in the NASDAQ suggests that a short-term pullback, or some sort of shallow, bull flag like pattern could develop over the next few days.

Wall Street continues to be held hostage by Congress, and the media does a great job of building up that fear with its non stop coverage. We try our best to ignore it, as we feel it’s way more constructive to focus on the price and volume action of leadership stocks. Some leaders were hit last week, but recovered late in the week along with the broad market averages. If true market leaders begin to break down below their 50-day moving averages on a pick up in volume, then we will know the market is in trouble. Whether this happens next week, or in two months from now, what caused the selling is not nearly as important as the selling itself.

iShares S&P Global 100 Index ($IOO) is currently in base mode, and has recently set a second higher swing low within its base, with back to back bullish reversal candles, that undercut but closed above the 10-week moving average. The moving averages look to be in good shape as well, as the 10-week is above the 40-week and both are trending higher. Volume has died down since the first selloff in June, which is a good sign. A pullback to the 10-week MA around $72 would be an ideal, low risk entry point, rather than climbing aboard on a breakout above $73.50. $IOO is not on today’s watchlist but we will continue to monitor the action.

After a 33% rally from its last base breakout at $15, Global X Social Media Index ETF ($SOCL), is now in base mode the past few weeks. The first pullback to the rising 10-week MA after a strong breakout is usually an area that is supported by institutions, and we clearly see that last week, as $SOCL dipped below the 10-week MA but closed back above it by the end of the week. The base looks like it needs a few more weeks of consolidation, which should hold above $19, minus a few shakeouts. We will continue to monitor the action for a low risk entry point off the 10-week MA.

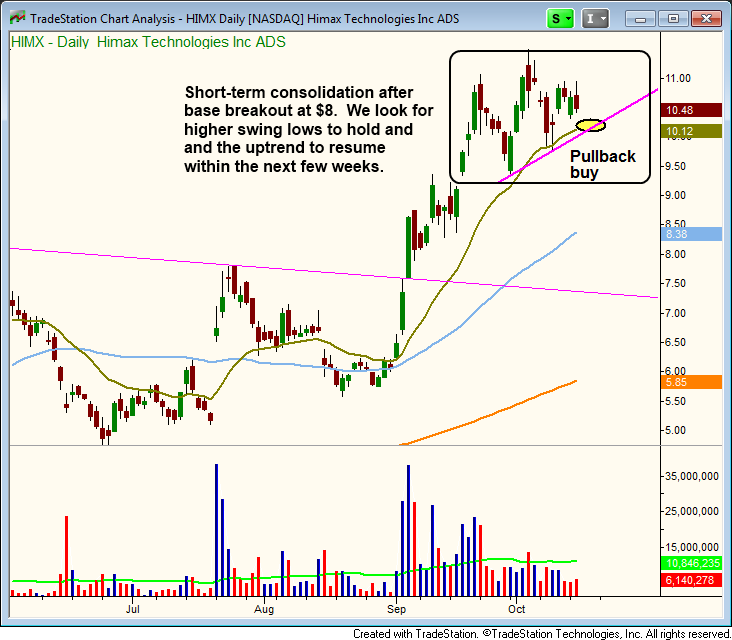

On the stock side, our buy limit order in $HIMX remains live. The chart below details the setup, as we are looking for an entry on weakness to support of the rising 20-day EMA.

We continue to see bullish setups from our scans, but most charts could use a short-term pullback to produce low risk entry points, as most stocks on our list are slightly extended due to the swift run up off the lows in the market. Patience is key here.

Please note that we have raised the stop in $SLCA for 50% of the 35% entry at 23.64. The stop is just below the hourly 20-period EMA and the steep uptrend line on the hourly chart. If triggered, the stop out will leave us with 17% size on our 23.64 entry. We still have the 40% entry from 21.59, so combined we are at a 57% position.