market timing model: BUY

Current signal generated on close of November 13.

Portfolio exposure can be anywhere from 75 to 100% long. If positions are holding up well, then one can add exposure beyond 100% (for experienced traders only).

Past signals:

- Neutral signal generated on close of November 6.

- Buy signal generated on close of September 9

- Neutral signal generated on close of August 15

- Buy signal generated on close of July 11

- Neutral signal generated on close of July 5

- Sell signal generated on close of June 24

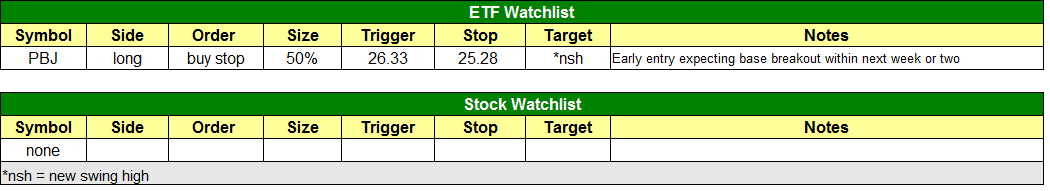

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

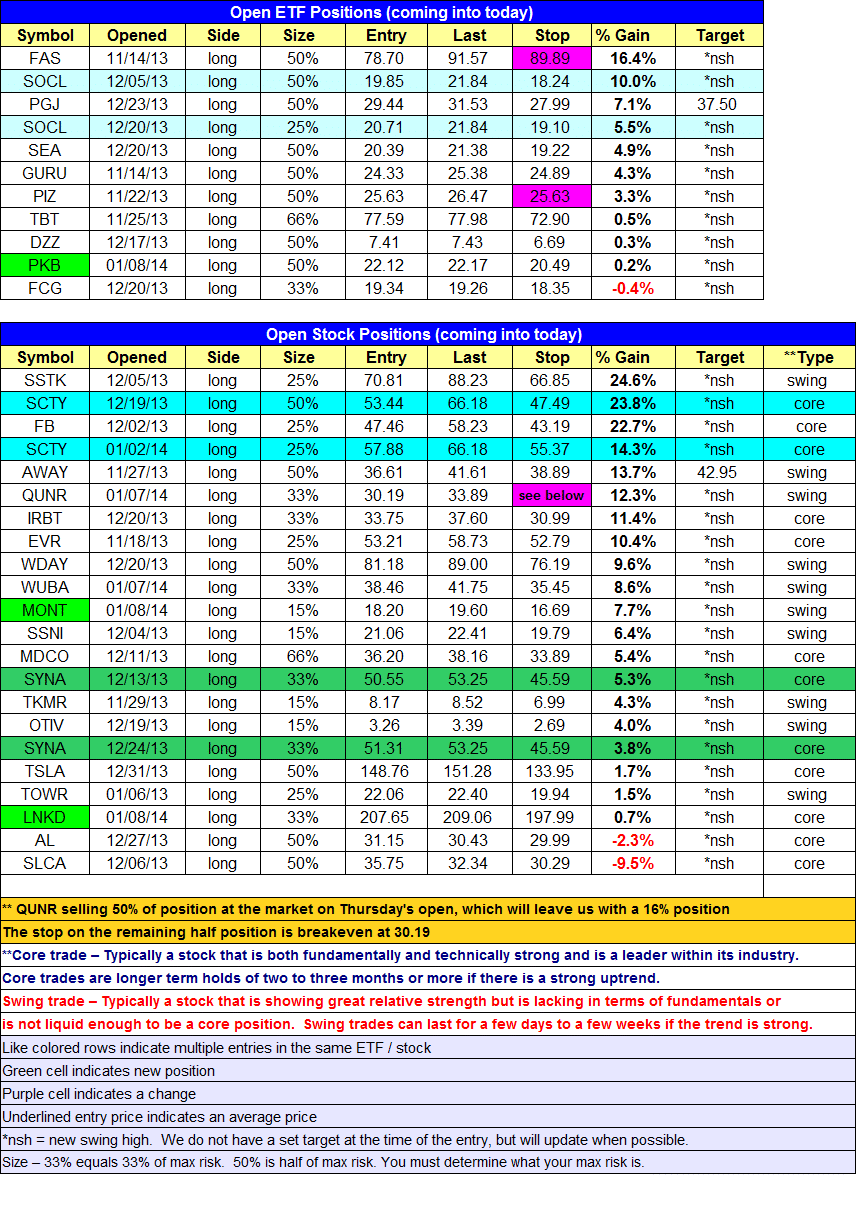

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

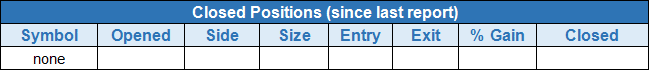

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- $PKB entry triggered.

stock position notes:

- $MONT buy entry triggered over the 5-minute high. $LNKD buy limit entry triggered late in the session and we are long.

ETF, stock, and broad market commentary:

Stocks closed mixed on the day, with the NASDAQ Composite and NASDAQ 100 pushing higher while the Russell 2000, Dow Jones, and S&P 500 formed a tight-ranged inside day.

The current buy signal remains in good shape. Leadership stocks are either breaking out to new highs or forming bullish patterns, while the main averages chop around in a tight range just off the highs.

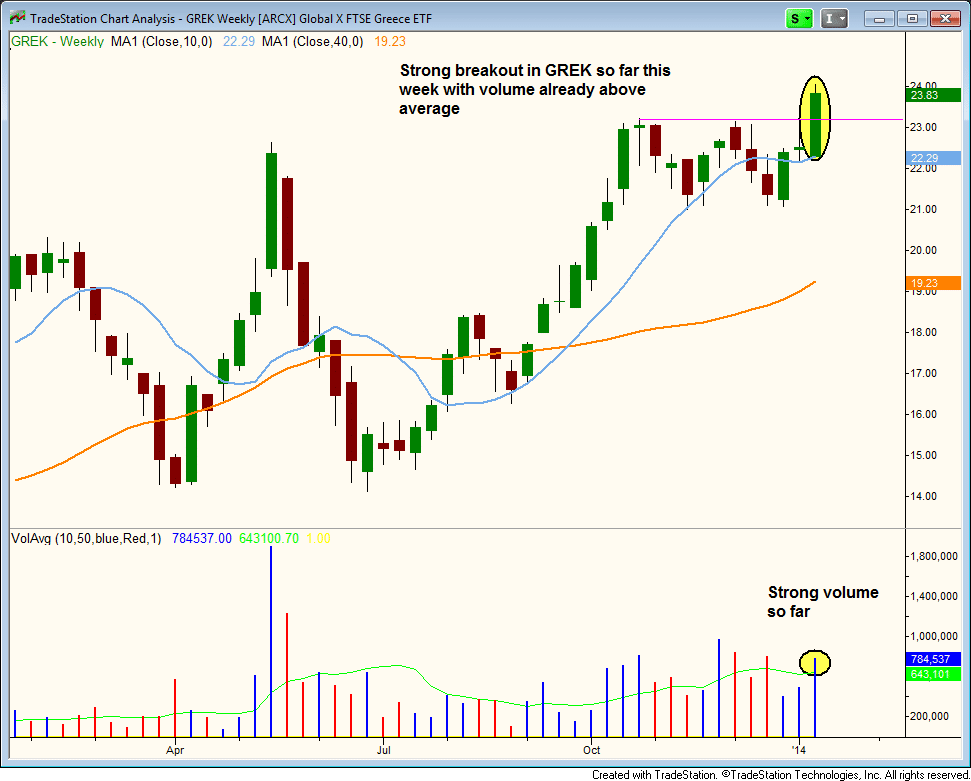

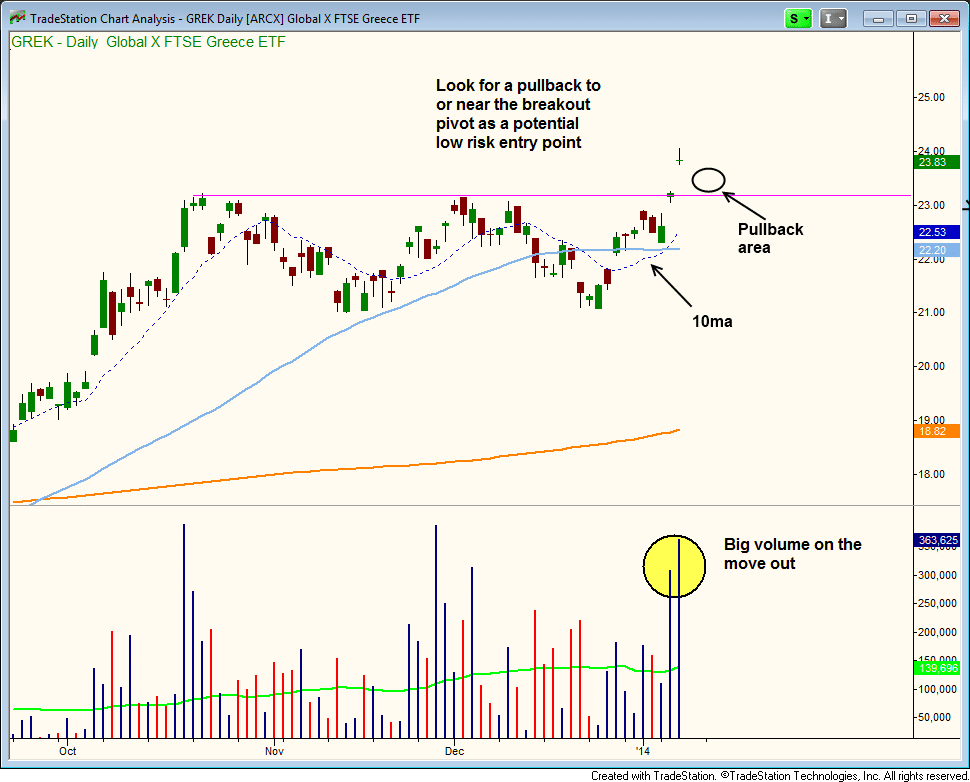

Global X FTSE Greece 20 ETF ($GREK) has broken out to new highs this week. Volume has confirmed the move, as it is already well above the 10-week moving average of volume after two days of trading.

The consolidation starting from late October was pretty tight and shallow, giving back less than 33% of the last wave up (from late August to late October).

Rather than chasing the price action up here, the plan is to patiently wait for a short-term pullback to produce a low-risk buy point. If the pullback is a sideways, bull flag like pause, then we will probably wait for the 10-day MA to catch up. If the pullback is a bit deeper, then we will look for support at or just above the prior swing highs at $23.

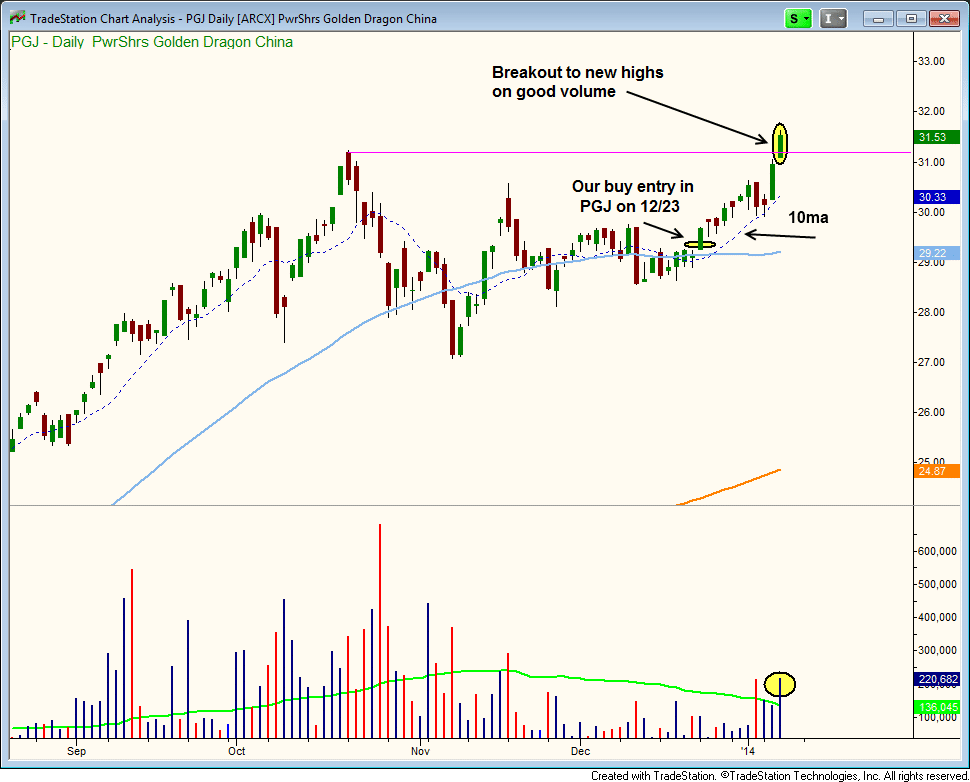

Our long position in PowerShares Golden Dragon China ($PGJ) broke out to new highs yesterday on above average volume.

Look for the rising 10-day MA to provide support on any pullback within the next week or two.

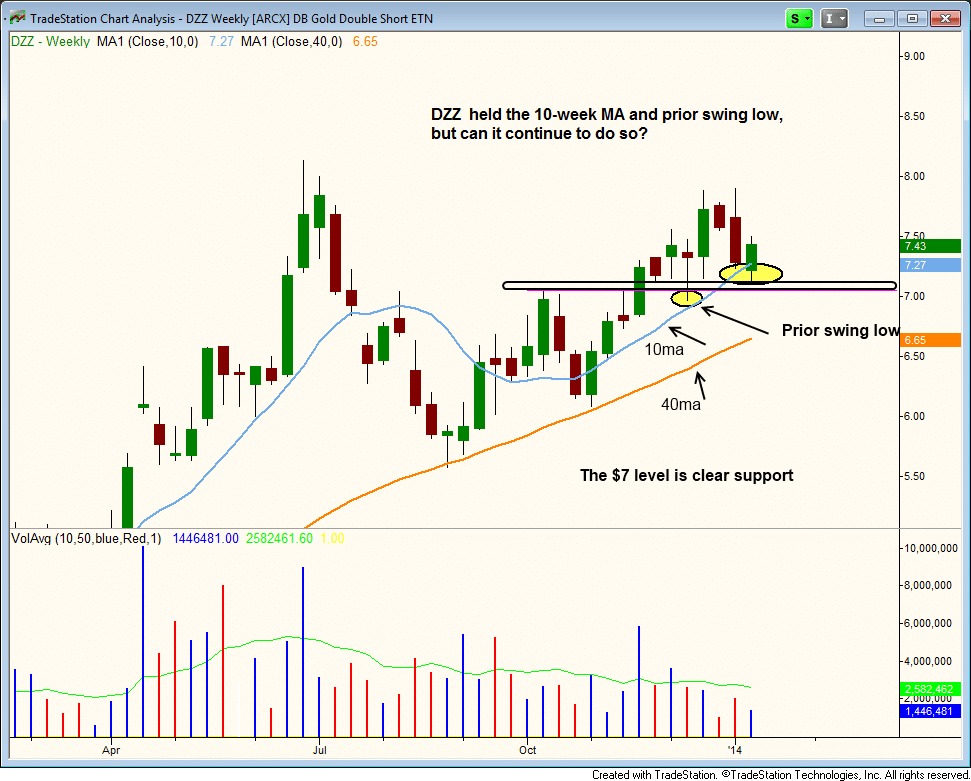

We remain short gold through a long position in DB Gold Double Short ETN ($DZZ). $DZZ seems to have found support at the rising 10-week MA for the time being, but cam this level hold up? The line in the sand for this pattern appears to be $7, where there is support from prior highs and a test of those highs (prior swing low).

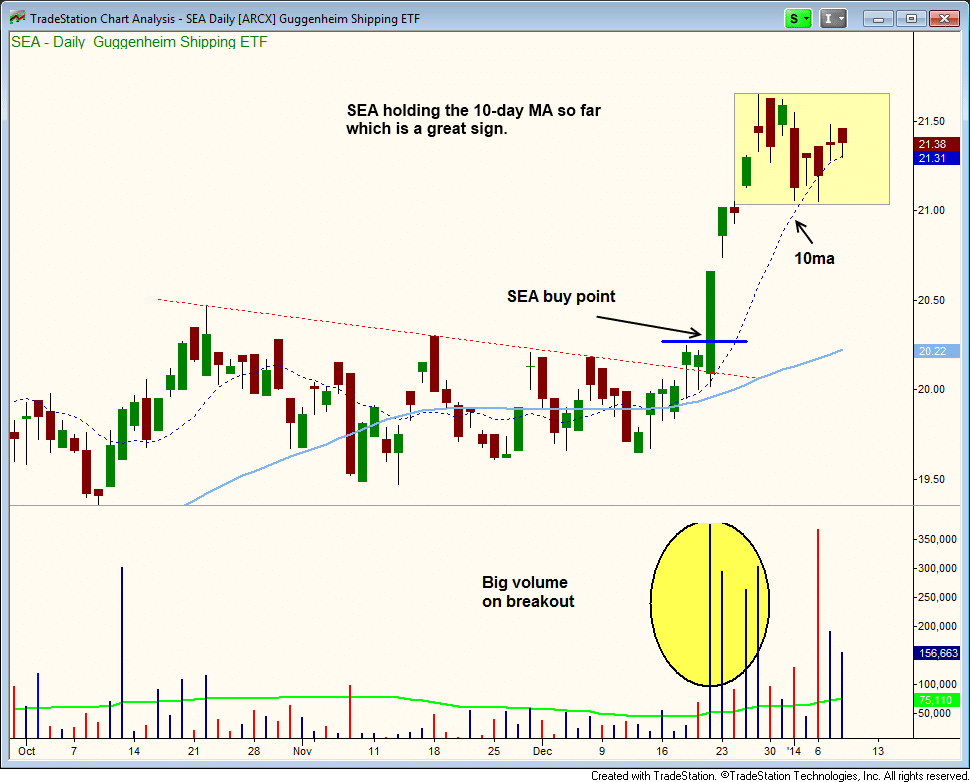

Guggenheim Shipping ETF ($SEA) is in really good shape after a strong breakout. We are long $SEA from a downtrend line breakout entry on 12/20. The price action is holding the 10-day MA, which is exactly what we like to see on a strong breakout.

On the stock side, $LNKD triggered late in the day and $MONT triggered above the 5-minute high. Please note that we are selling half of $QUNR on the open tomorrow.

There are no new official setups for today. Buy setups in non A rated stocks $CAMT, $THRM, and $ARCW could be ready to move tomorrow over the prior day’s high or a two-day high. These setups are not official and are for experienced traders who feel comfortable on their own.