Confirmed Buy– Signal generated on the close of January 22 (click here for more details)

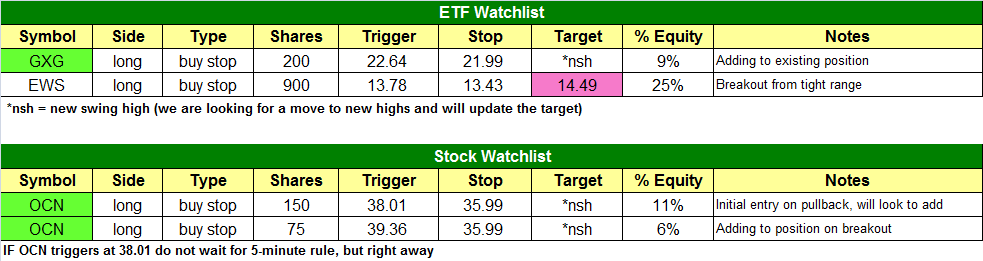

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

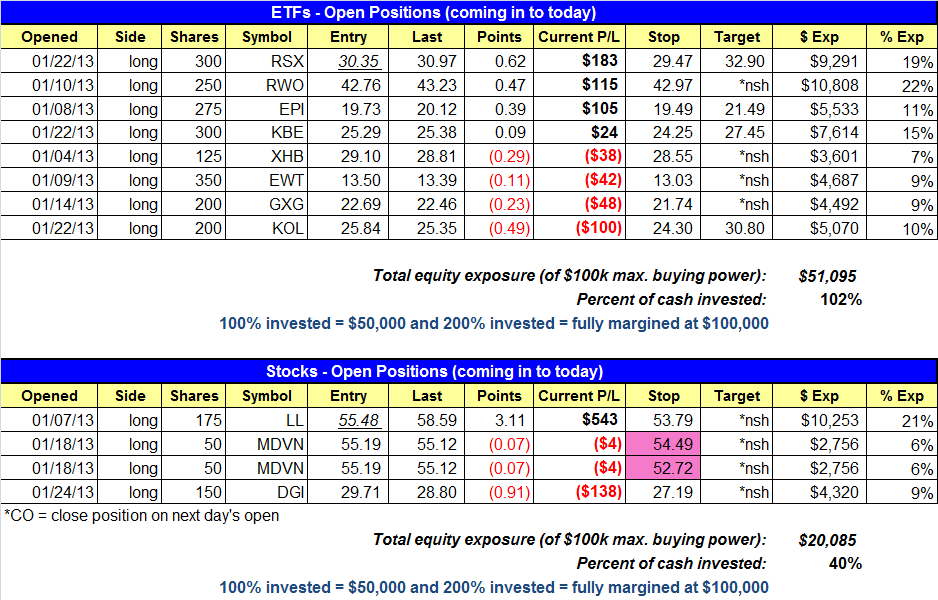

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Net P/L figures are based on two separate $50,000 model portfolios (one for ETFs and one for stocks). Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

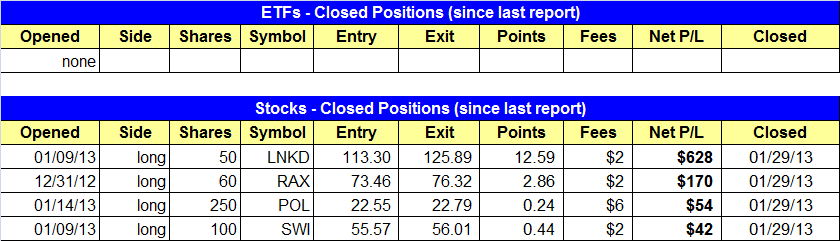

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- No trades were made.

stock position notes:

- Sold, $LNKD, $POL, $SWI, and $RAX

- We are waiving the 5-minute rule in $OCN for tomorrow on the 38.01 entry since it already triggered the day before. See commentary below.

ETF, stock, and broad market commentary:

Stocks ended the day in mixed territory once again, with the S&P 500 up 0.5% and the Nasdaq Composite down -0.2%. However, the session was a productive one on the Nasdaq, as the index printed a bullish reversal candle after undercutting a two-day low in the morning. Volume confirmed the bullish action on Tuesday, rising 17% on the NYSE and 6% on the Nasdaq.

When a market is in runaway mode and refuses to pull back, most investors think “I am not buying at this level, I’ll just wait for a pullback”. That pullback will eventually come, but sometimes after a multi-month advance. This is why we find it much easier to focus on leadership stocks rather than the major averages in a trending market. As long as there is rotation among leadership, with new breakouts emerging, the market will continue to push higher (averages must also avoid distribution).

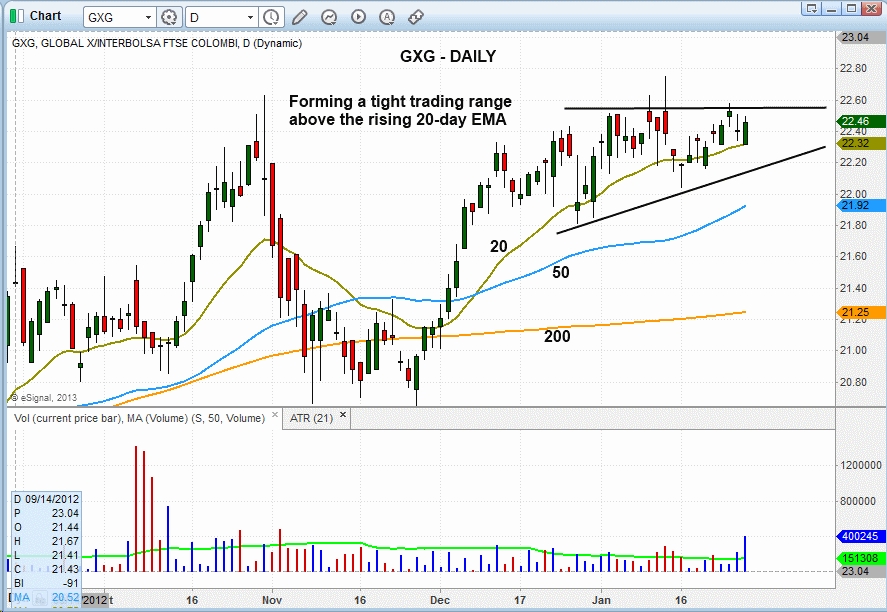

Since the false breakout action on Jan. 15, Global X InterBolsa FTSE Colombia20 ($GXG) has pulled back to and held support of the 20-day EMA, while setting a higher swing low.

The price action has tightened up nicely since mid-December and could finally be ready to break out above 22.60. We have a buy stop to add 200 shares to our existing position over the high of January 25, with a fairly tight stop below the January 16 low.

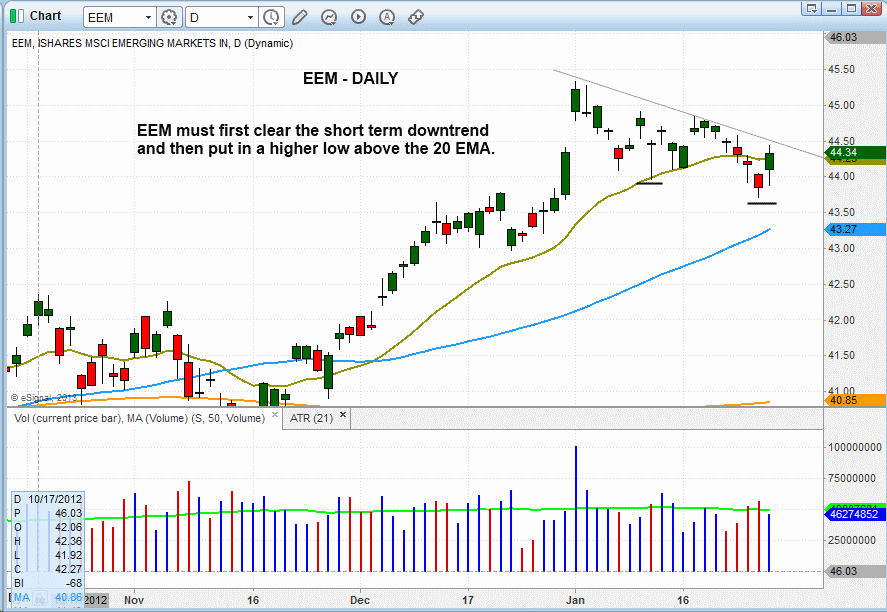

We first mentioned iShares MSCI Emerging Markets Index ($EEM) last week, as a potential buy setup if it made a higher swing low above the 20-day EMA. Although the price action did not hold above the 20-day EMA, a dip below the average and a quick rally back above would keep the setup intact.

If $EEM can break the downtrend line and put in a higher low, then we might be able to grab a low-risk entry point as early as next week.

We were a bit busy on the stock side yesterday. $LNKD hit our tight stop and we locked in a decent $600 gain. We may be able to re-enter IF $LNKD pulls back or forms some sort of bull flag. $RAX gapped lower due to news and triggered our tight stop, allowing us to hold on to about $170 in profits. $POL and $SWI stops triggered for small, scratch gains.

Yesterday’s action in $MDVN was ugly……a full day of selling! We raised the stop on half the position to yesterday’s low and the other half beneath the Jan. 18 reversal candle low. If it holds great! If not, on to the next setup.

After further analysis, we decided to remove the tight stop listed in yesterday’s report in $LL. The action has stalled a bit, but overall looks pretty bullish, so we moved the stop back down to the original level for the full position to give the setup room to breathe. Please cancel yesterday’s stop on half the position at 57.69.

$OCN produced a buy signal yesterday, on a move above the Jan. 24 high. $OCN is a leader within its group and has a 98 relative strength ranking. Since the setup has already produced a buy signal we are waiving the 5-minute rule if $OCN triggers before 9:35am. We plan to add to the position on a breakout above the handle high (over 39.25). Again, if $OCN triggers on open please enter immediately, do not apply the 5-minute rule.

If you are a new subscriber, please e-mail [email protected] with any questions regarding our trading strategy, money management, or how to make the most out of this report.

relative strength combo watchlist:

Our Relative Strength Combo Watchlist makes it easy for subscribers to import data into their own scanning software, such as Tradestation, Interactive Brokers, and TC2000. This list is comprised of the strongest stocks (technically and fundamentally) in the market over the past six to 12 months. The scan is updated every Sunday, and this week’s RS Combo Watchlist can be downloaded by logging in to the Members Area of our web site.