Current signal generated on close of July 11.

Portfolio exposure should at least be 75% to 100% long or more (if you can go on margin).

Past signals:

- Neutral signal generated on close of July 5

- Sell signal generated on close of June 24

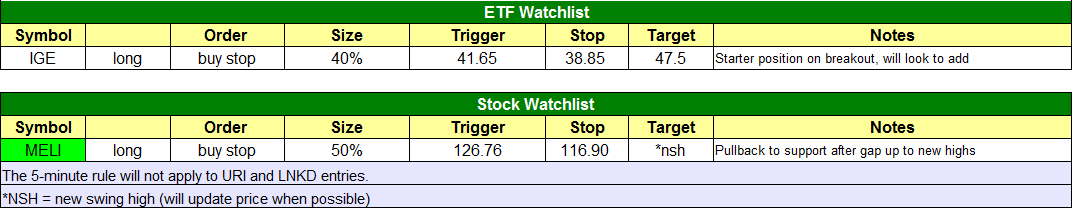

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

open positions:

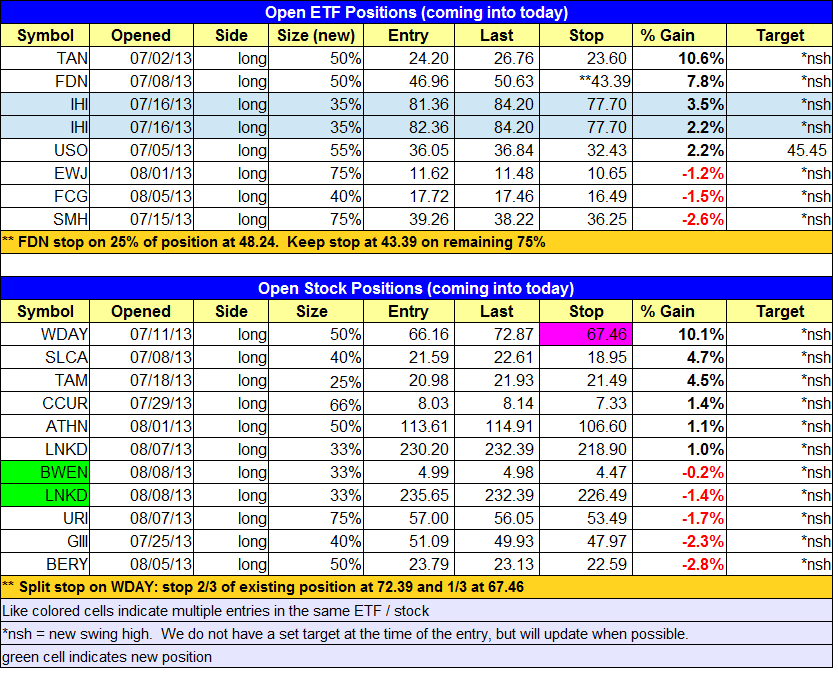

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits. Click here to learn the best way to calculate your share size.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- No setups triggered

stock position notes:

- $PDFS hit our stop and we are out with a solid gain. Protective stops in $SCTY and $TUMI triggered and we are now out of both positions. $BWEN buy setup triggered.

ETF, stock, and broad market commentary:

After a sharp selloff in the first hour of trading, the major averages found support around Wednesday’s close and worked their way higher the rest of the session to close near the highs of the day. Despite the distribution days in the NASDAQ as of late, both the NASDAQ Composite and NASDAQ 100 remain above the 10-day moving average, while other indices are still above the 20-day moving average and still in pretty good shape.

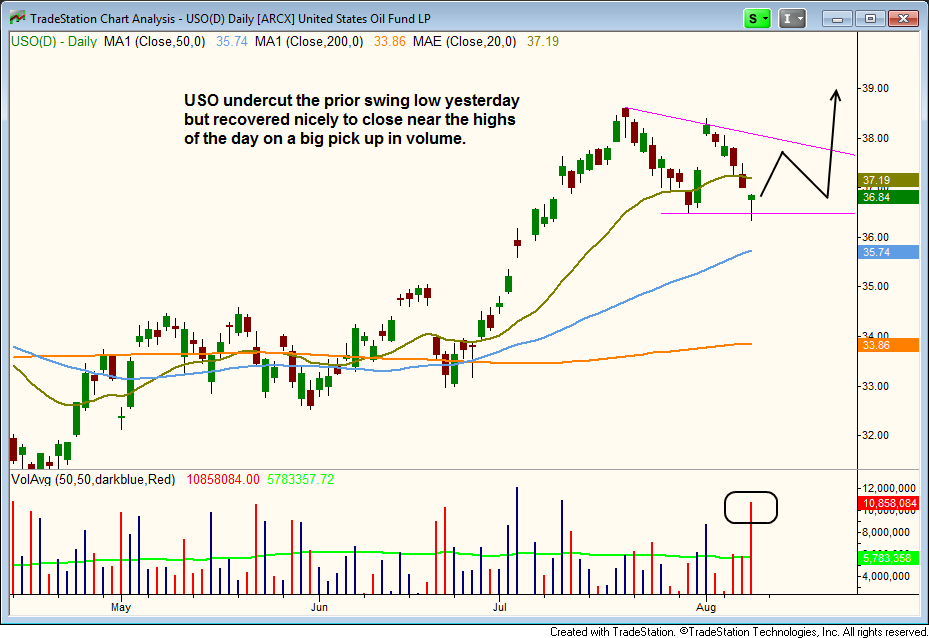

After reversing off the 20-day EMA last week and stalling at the prior high, United States Oil Fund ($USO) pulled back once again to the 20-day EMA yesterday. Before forming a bullish reversal candle on higher volume, the price action dipped below the prior swing low, shaking out some of the weak longs with tight stops.

Since $USO has failed to clear $38.50 on two attempts, but has also held support around $36.50 on both pullbacks, if yesterday’s reversal holds, then we can assume that $USO is range-bound. We’d like to see the price action tighten up over the next two weeks while in between the trendlines on the daily chart below.

We will continue to monitor $USO for a low risk entry point to add to our existing position.

On the stock side, we added to our position in $LNKD and bought $BWEN just before the close. We sold $TUMI on an earnings gap down below our stop. We also sold $SCTY as it triggered our stop below the 50-day MA. $PDFS also triggered its stop and we sold the remaining position for a decent gain.

Please note that we have a very tight stop in place to lock in 2/3 of our position in $WDAY. $WDAY has stalled at an upper trend line of a channel on the daily chart, so we are playing it safe and locking in profits. We will try to keep a loose stop on the remaining 1/3 position.

We have one new setup on today’s watchlist in Mercadolibre – $MELI. $MELI has top fundamentals, and recently broke out to new highs on an earnings gap up. We like the pullback into support from the highs of the left side of the pattern. Our buy entry is over the two day high. The stop for now is about 8% to allow some wiggle room, but we will tighten it up as soon as possible, especially if the price action finds support at the 10-day MA.