market timing model: Buy

Current signal generated on close of September 9.

We are no longer in confirmed buy mode, but remain in buy mode (which is holding on by a thread). Portfolio exposure depends on how well positions have held up, but anywhere from 50% to 100% (if positions are in good shape) is okay.

Past signals:

- Neutral signal generated on close of August 15

- Buy signal generated on close of July 11

- Neutral signal generated on close of July 5

- Sell signal generated on close of June 24

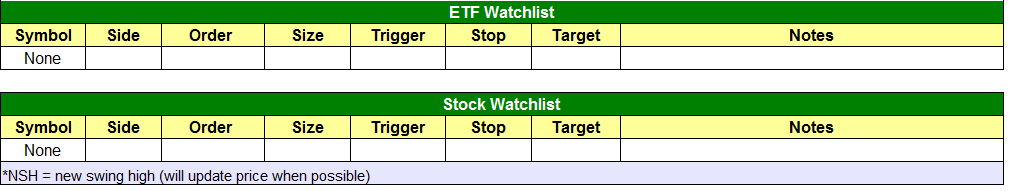

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

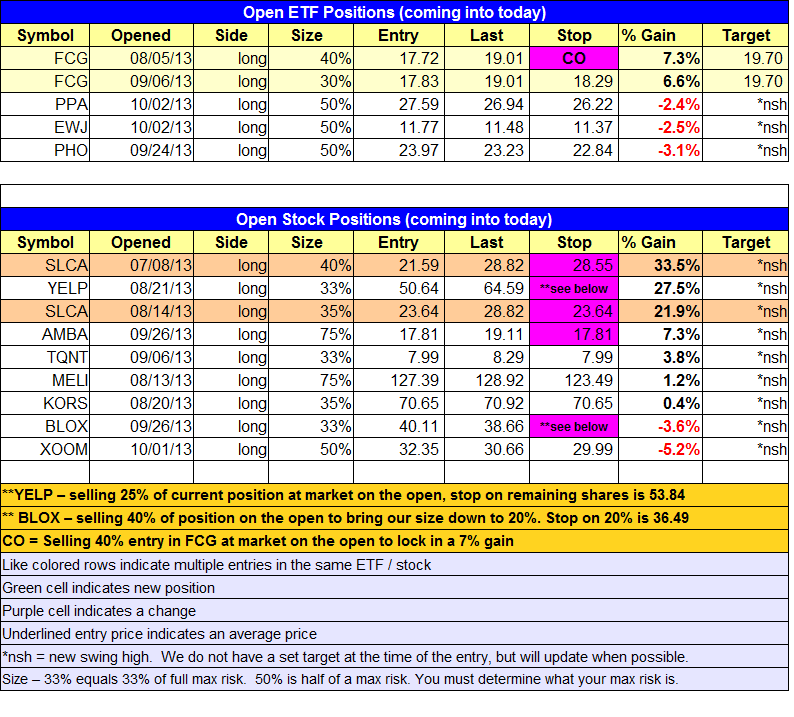

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits. Click here to learn the best way to calculate your share size.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- Stops triggered in $XBI and $TNA.

stock position notes:

- $LNKD sell stop triggered, for a small loss on the first entry and a 4% loss on the new entry. $LOCK stop triggered, locking in a 13% gain. $BITA stop triggered for a 36% gain.

ETF, stock, and broad market commentary:

Yesterday’s selloff was broad based and ugly, with just about every sector getting hit with the exception of utilities. The NASDAQ Composite and Russell 2000, the leading market averages, were hit the hardest with losses of -2.0% and -1.7% respectively. The NASDAQ Composite is now the only index still trading above the 50-day MA (but not by much).

Leadership stocks were hit hard as well, with $LNKD breaking the 50-day MA on a 200% increase in volume. $QIHU, $VIPS, $SFUN, $P, $MELI, $PCLN, and $AMZN are a few names that sold off on heavy volume as well. Although $PCLN and $AMZN had a rough day, they are still trading above the 50-day MA.

The market rally is just barely hanging on, but if leading stocks begin to crack the 50-day MA in numbers, then our timing model will be forced into a sell signal.

We are selling about 60% of our current long position in $FCG on Wednesday’s open to lock in gains. The stop on the remaining shares is just beneath the prior swing low.

With the broad market averages in pullback mode, there isn’t much in the way of actionable setups on the ETF side. We continue to monitor the potential bullish reversal action in United States Natural Gas Fund ($UNG). $UNG undercut a prior swing low in August and formed a bullish reversal candle. Since then, the price action has traded in a tight range just below $20.

On the weekly chart, we see a bullish downtrend line break, but the price is still below the 40-week MA, and the 10-week MA is still below the 40-week MA. We could possibly see an early entry point develop (for partial size) IF the price action tightens up for a few weeks just below the 40-week MA.

On the daily chart, we see a potential higher swing low in place, but since the prior downtrend was four months in length and broke the 200-day MA, we would prefer to see a second higher swing low develop before we begin to buy. Also, the 50-day MA is still trending lower and has yet to turn up. $UNG is not currently actionable, but we will continue to monitor the action for a low risk buy entry.

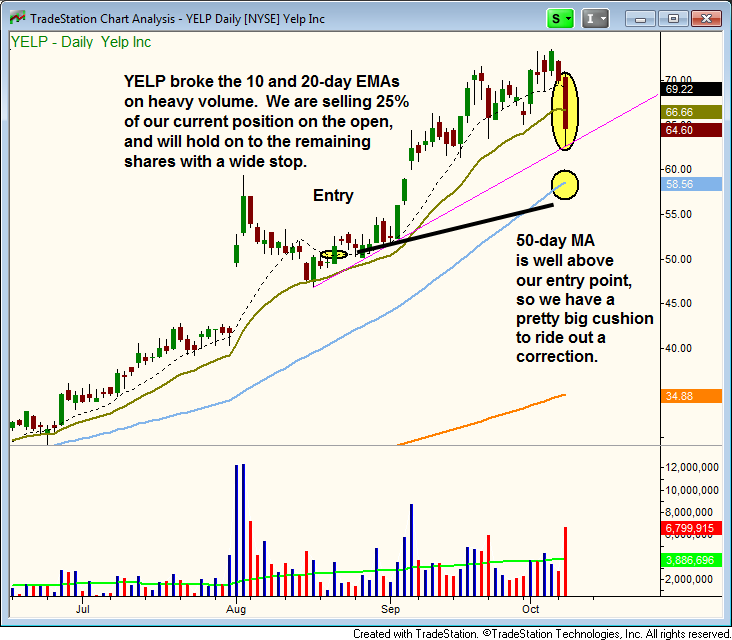

We plan to sell partial size in $YELP on the open due to yesterday’s big volume selloff. The plan is to hold on to the remaining shares with a pretty wide stop because we have a big cushion from our early entry. Also, the 50-day MA is well above our buy point, which is a great sign, as we can use that moving average as our stop.

For those who sold $YELP, you can re-enter on the open to match our position. We are going with a very tight stop in $SLCA on the 40% entry, and a break-even stop on the 35% entry. The stop in $AMBA is now break-even as well to match the other break-even stops in $KORS and $TQNT. We are also selling 40% of our position in $BLOX on the open due to yesterday’s ugly break down below swing lows. The 40% sell will bring out exposure down to 20%, where the stop remains at 36.49.