market timing model:

Buy – Signal generated on the close of August 16 (click here for more details)

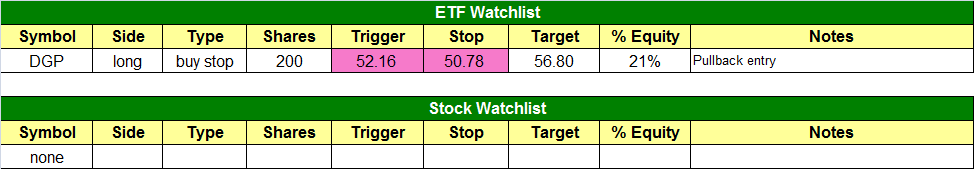

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

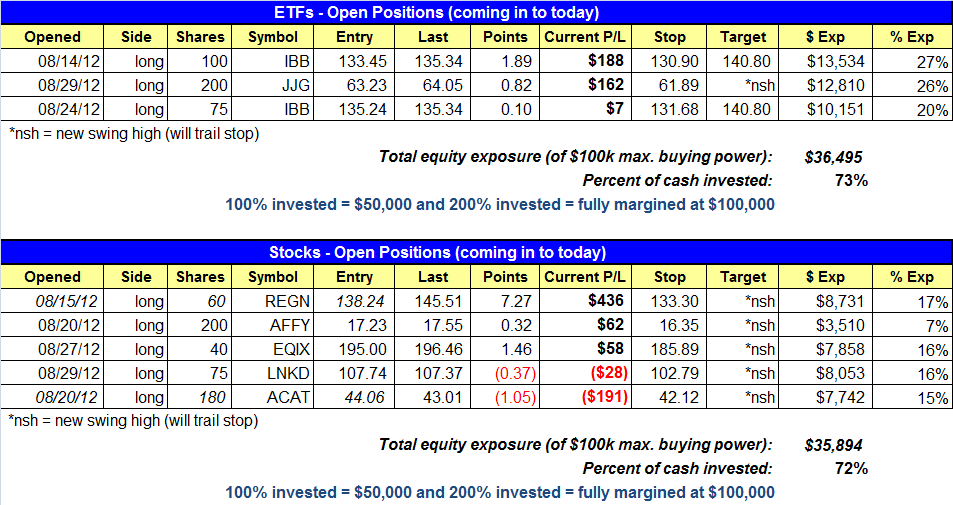

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Net P/L figures are based on two separate $50,000 model portfolios (one for ETFs and one for stocks). Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

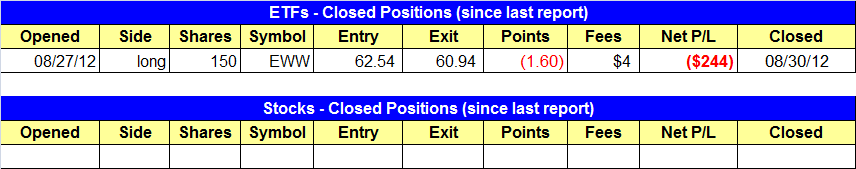

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- EWW triggered our sell stop and we are out. Re-entering EWW was the right thing to do because the setup was still valid. Re-entering without a valid setup is revenge trading, and that is something we never do. EWW now needs to build a few higher lows (over 2-3 weeks) and climb back above the 50-day MA before it can be considered for a low risk entry point.

stock position notes:

- We removed DVA from the watchlist. The setup remains valid but we are holding off on new entries until next week.

ETF and broad market commentary:

As mentioned in yesterday’s report, today’s letter will be an abbreviated version without ETF and stock commentary. The only thing we wanted to point out was that despite yesterday’s broad market decline the averages sold off on lighter volume and avoided a bearish distribution day. Our timing model remains on a buy signal.

NOTE: On Monday, August 3, the US stock markets will be closed for the Labor Day holiday. As such, The Wagner Daily will not be published that day, but regular publication will resume on August 4.

stock commentary:

PETM, TOL, RYL, DVA, ONXX, ALXN, Z, and CAB are a few stocks we are monitoring for an entry next week. Z is interesting because it is a recent IPO with huge short interest at 77% of the shares in float, which makes it a potential short squeeze candidate. A short squeeze occurs when a heavily shorted stock breaks out and the short sellers are forced to buy back the stock to cover, which in turn creates plenty of fuel for the breakout (especially when the shorts refuse to take a loss).

If you are a new subscriber, please e-mail [email protected] with any questions regarding our trading strategy, money management, or how to make the most out of this report.

relative strength combo watchlist:

Our Relative Strength Combo Watchlist makes it easy for subscribers to import data into their own scanning software, such as Tradestation, Interactive Brokers, and TC2000. This list is comprised of the strongest stocks (technically and fundamentally) in the market over the past six to 12 months. The scan is updated every Sunday, and this week’s RS Combo Watchlist can be downloaded by logging in to the Members Area of our web site.