Current signal generated on close of August 15.

Portfolio long exposure can be anywhere from 30% to 100% (if your stocks are holding up).

Past signals:

- Buy signal generated on close of July 11

- Neutral signal generated on close of July 5

- Sell signal generated on close of June 24

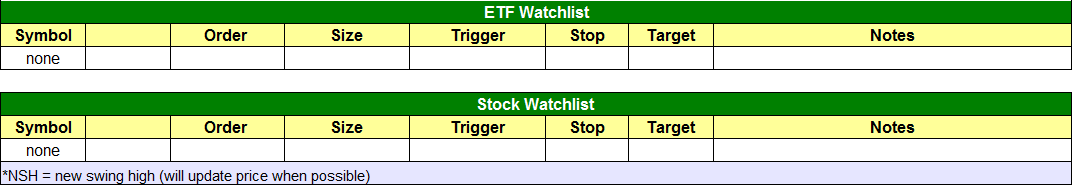

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

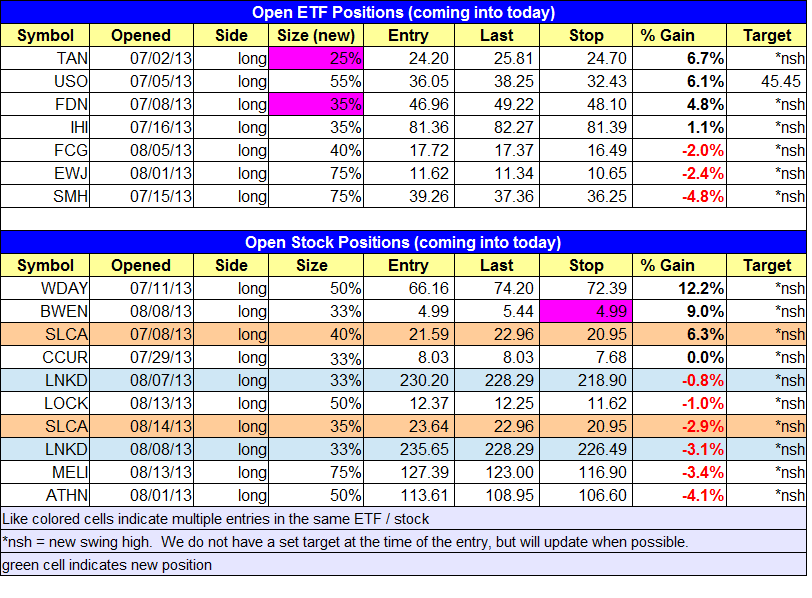

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits. Click here to learn the best way to calculate your share size.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

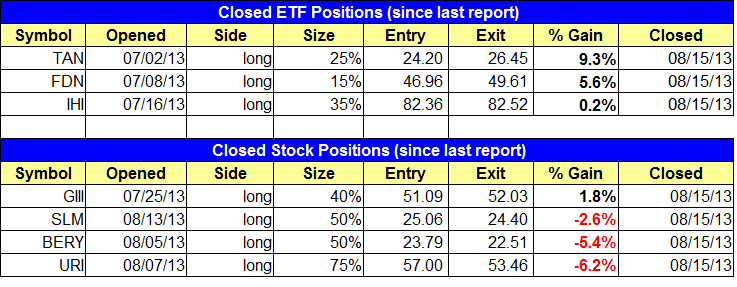

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- Sold partial size in $TAN, $FDN, and $IHI.

stock position notes:

- Sold $GIII, $SLM, $MELI, and $BERY.

ETF, stock, and broad market commentary:

It was ugly right out the gate yesterday, as all broad based averages gapped significantly lower on the open, breaking down below prior swing lows and the 20-day EMA (the NASDAQ Composite was the only index to to not break a prior swing low). By the close, all broad based averages were down at least 1.4%, with the Russell 2000 down 1.9%.

Total volume picked up on both exchanges, producing a clear cut and very ugly distribution day. Due to the breakdown of support levels and the recent distribution, the timing model has shifted into neutral mode. The only reason we are not calling the rally dead is because top leadership stocks continue to hold up. Yes, overall leadership is narrowing, and that is to be expected as the rally loses steam. If/when big leaders like $KORS, $TSLA, and $LNKD begin to crack on higher volume, then we will reassess, but for now the model is in neutral mode.

Although the iShares U.S. Home Construction ETF ($ITB) has shown a ton of relative weakness to the broad market over the past few months, it managed to put in a bullish reversal candle on very heavy volume Thursday, after gapping down below a pivotal support level around $21.20. If the bullish reversal holds up tomorrow, then we could see a weak bounce to the upside over the next few weeks, which may provide a decent shorting opportunity down the road. Note that the 10-week MA has crossed below the 40-week MA, which is a bearish trend reversal signal.

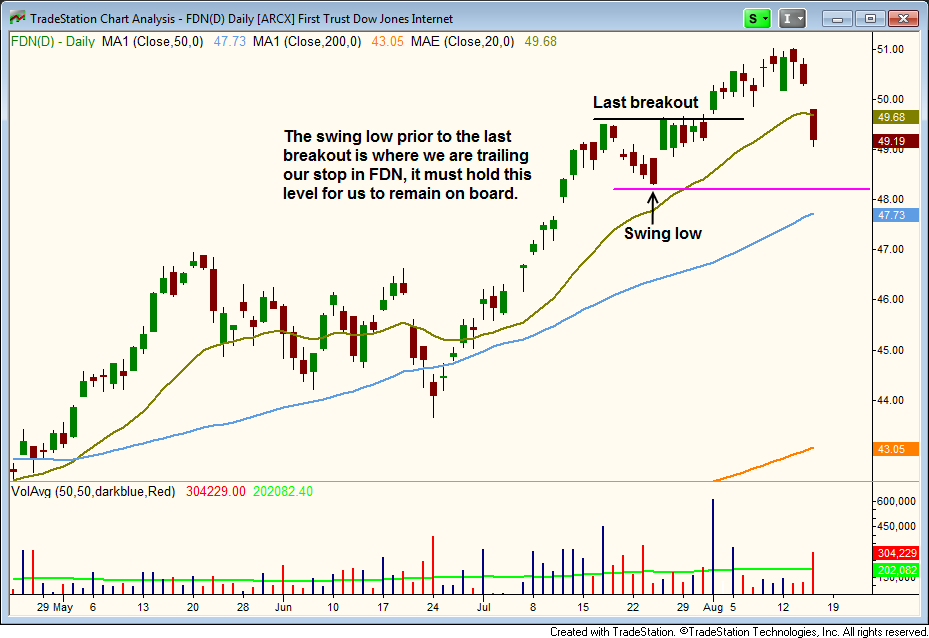

Along with the broad market, First Trust DJ Internet Index ($FDN) gapped significantly lower on the open, blowing through our tight stop for partial size. We are still holding 2/3 of our position with a stop below the last swing low. When trying to ride the trend, it is best to let the market take us out of our full position rather than to predict when a trend will end, unless there is a prior resistance level in the way.

On the stock side, we took a few hits on the open in $URI, $SLM, and $BERY. $WDAY managed to hold up well along with $SLCA. $SLCA has basically chopped around above the 10-week MA the past few weeks on lighter volume and could be ready to breakout soon.

$MELI sold off but volume was very light. Unfortunately, unless $LNKD can catch a bid tomorrow, it looks as though we may stop our of partial size at the very least.

Due to the shift into neutral and the ugly gap down, we are not in a hurry to add new positions today. However, we will scan over the weekend and depending on what we find, we may look to establish new longs in strong stocks that have pulled back in on light volume. Going to neutral doesn’t mean we can’t buy anything, we are simply a little more cautious in our approach until the market finds some traction.