market timing model: (Confirmed) Buy

Current signal generated on close of September 9.

We are now in confirmed buy mode, so portfolio exposure can be more than 100% if you have a marginable account. However, please make sure that current long positions in your portfolio are working before adding new ones. Portfolio exposure should be at least 75% to 100% (or more) right now.

Past signals:

- Neutral signal generated on close of August 15

- Buy signal generated on close of July 11

- Neutral signal generated on close of July 5

- Sell signal generated on close of June 24

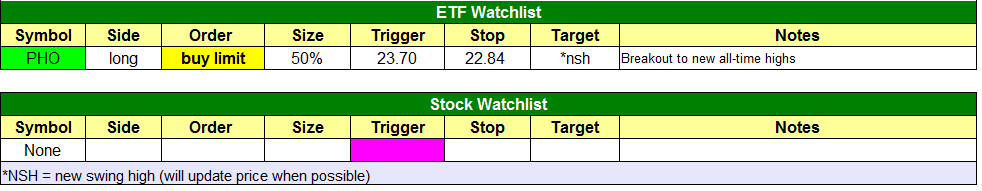

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

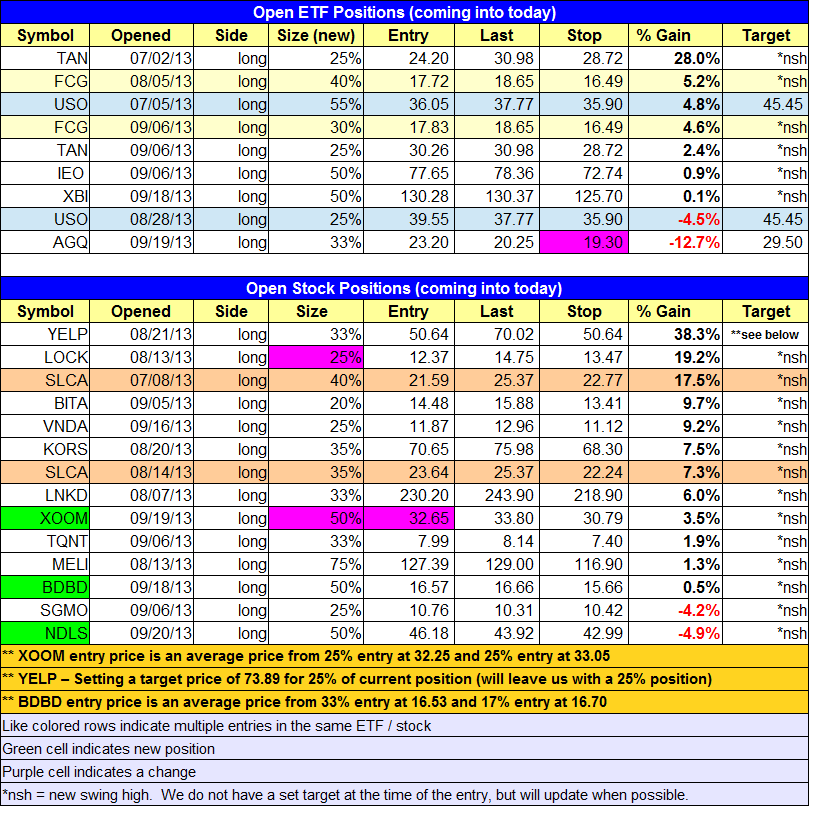

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits. Click here to learn the best way to calculate your share size.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

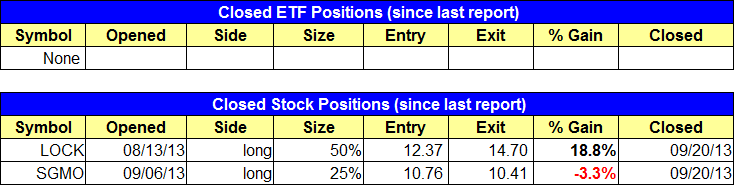

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- Note the slight adjustment in to the stop price in $AGQ to give us a little more breathing room. Also, the 5-minute rule will not apply to the $PHO buy limit order because we are looking to enter on weakness (not strength).

stock position notes:

- $LOCK hit our target for half the position and we are out with an 18% gain. $NDLS and $XOOM buy entries triggered.

ETF, stock, and broad market commentary:

Stocks closed out the week on a negative note, as broad market averages slid lower across the board on higher volume. The losses were limited to -0.4% in the NASDAQ Composite and Russell 2000, but the S&P 400, S&P 500, and Dow Jones all closed at least 1.0% lower. The divergence in performance isn’t a big shocker, as the weekly charts of the NASDAQ and Russell 2000 are in much better shape, which we will cover in more detail below.

The late week reversal action in the main averages wiped out Wednesday’s strong advance and created a false breakout to new highs in the S&P 500 and Dow Jones.

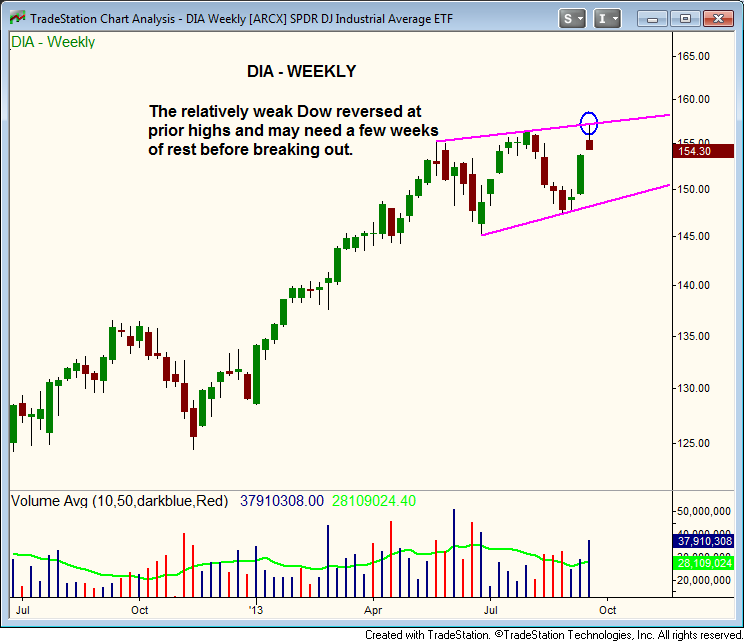

As mentioned above, there is quite a bit of divergence in the weekly charts of $DIA and $SPY when compared to $IWM and the $NASDAQ Composite. On the charts above, the Dow has yet to produce a clear higher high the past few months and is basically range-bound. While the chart of $SPY is more bullish with a clear higher low in place, the top trendline is still pretty flat, just like $DIA. Notice how the top trendlines on the charts of $IWM and the NASDAQ Composite are at a much steeper angle.

The relative strength on the weekly charts of $IWM and the NASDAQ Composite is easy to see, with a clear sequence of higher highs and higher lows in place since April. While the $DIA must overcome prior highs to breakout, there isn’t much in the way of resistance for $IWM, other than the top trendline, which is about 3% to 4% away. The NASDAQ chart is pretty much the same, but may need to rest after touching the top trendline last week. However, any pullback should be short-lived, as there isn’t much in the way of resistance until 4,000.

Our pullback buy entry in $PHO remains live. Just a reminder, we placed a buy limit order, which means that the we will only buy $PHO if the price action pulls back to our trigger point or lower.

On the stock side, we added to our position in $XOOM. The $NDLS buy entry triggered and exploded higher early in the day, but failed to follow through and sold off with the market in the afternoon. The weekly chart looks pretty ugly, but it would not make much sense to change the stop now.

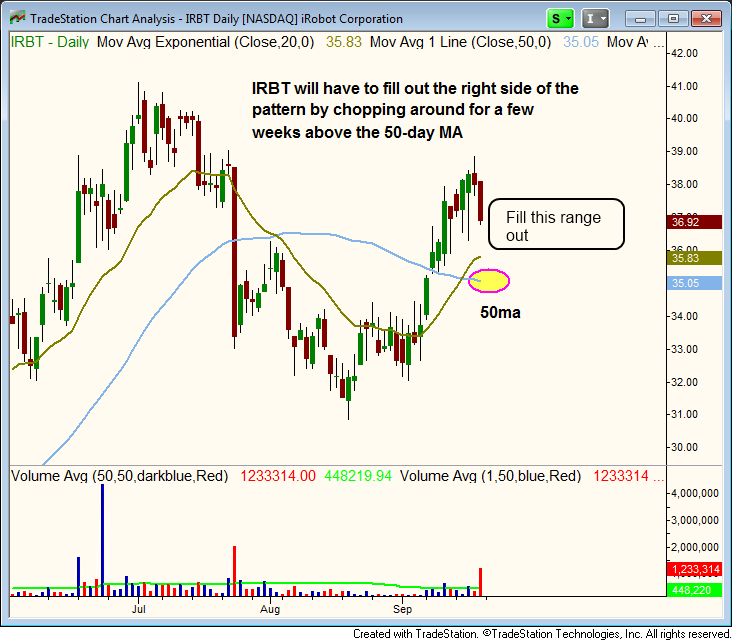

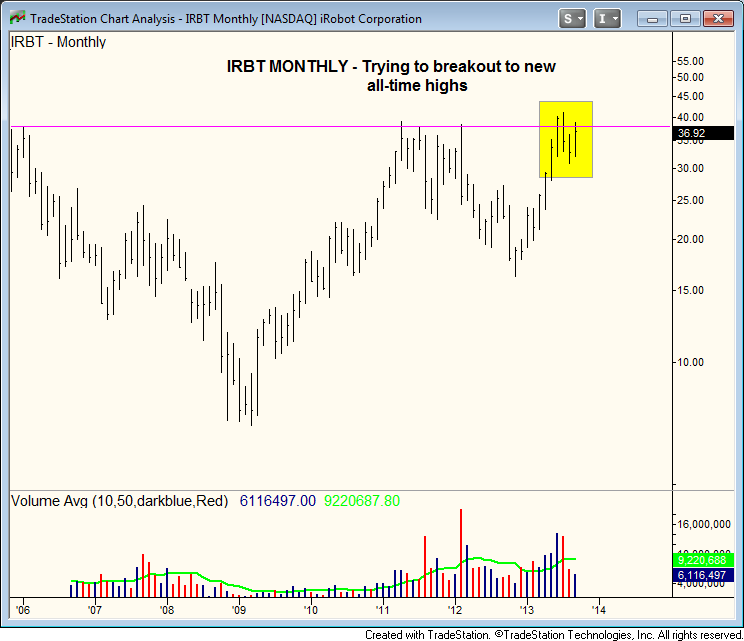

As far as potential setups go, our scans dried up a bit over the weekend, but we are keeping an eye on a few pullback scenarios in $EGOV, $AMBA, $SCTY, $SYNA, $P, and $IRBT.

$IRBT looks great on all time frames. Note the monthly chart below, which shows $IRBT potentially breaking out to new all-time highs, which can sometimes produce an explosive uptrend for several months.

The daily chart needs a bit more time to fill out the right side of the pattern, which has a cup and handle like appearance, although the handle portion has to form. We would like to see two to three weeks of sideways action to produce the handle portion, which should hold above the 50-day MA, minus a shakeout bar or two. The goal, as always with a cup and handle type pattern, is to locate a low risk entry point within the handle, where we can place a stop 4% to 7% away from the entry.