Buy– Signal generated on the close of December 31 (click here for more details)

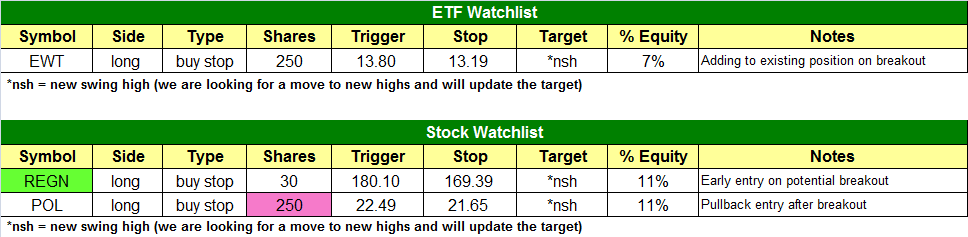

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

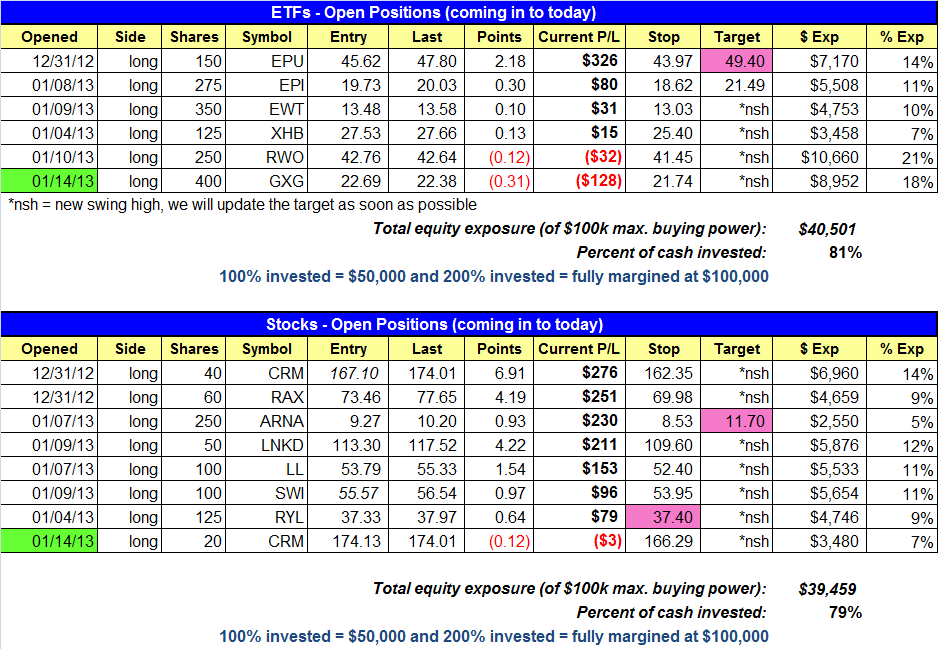

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Net P/L figures are based on two separate $50,000 model portfolios (one for ETFs and one for stocks). Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- $GXG buy setup triggered.

stock position notes:

- $CRM add triggered.

ETF, stock, and broad market commentary:

For the second session in a row, stocks struggled early but staged a decent rally in the afternoon to close well off the lows of the day. Most averages closed in the -0.1% to 0.1% range, so not much of a change. Weakness in $AAPL weighed on the Nasdaq, but the loss was contained to -0.3%. But the loss on the Nasdaq was enough to produce a bearish distribution day due to a 5% pick up in volume. However, once again, it’s tough to label Monday’s action as pure distribution, as the Nasdaq did not close near the lows of the day or even in the bottom half of the day’s range.

The market continues to chop around, shaking out the weak hands early and recovering late in the day. This is generally a sign of bullish price action. That being said, the market is by no means in cruise control, as the averages have yet follow through on the the large gap up on January 2. We must give our setups time to develop, but if heavy volume distribution hits the market we may be forced to reduce exposure and/or raise stops. Let us be clear, we are not predicting that the current rally will fail. We are just thinking out loud and letting you know what would cause us to go on the defensive.

$GXG triggered a buy entry for us on the open, however; the price action failed to follow through and closed near the lows of the day. The lack of follow through was disappointing, but as long as the action holds above the 20-day EMA we could see buyers return later in the week. There are no new setups today, but the $EWT setup remains on the watchlist.

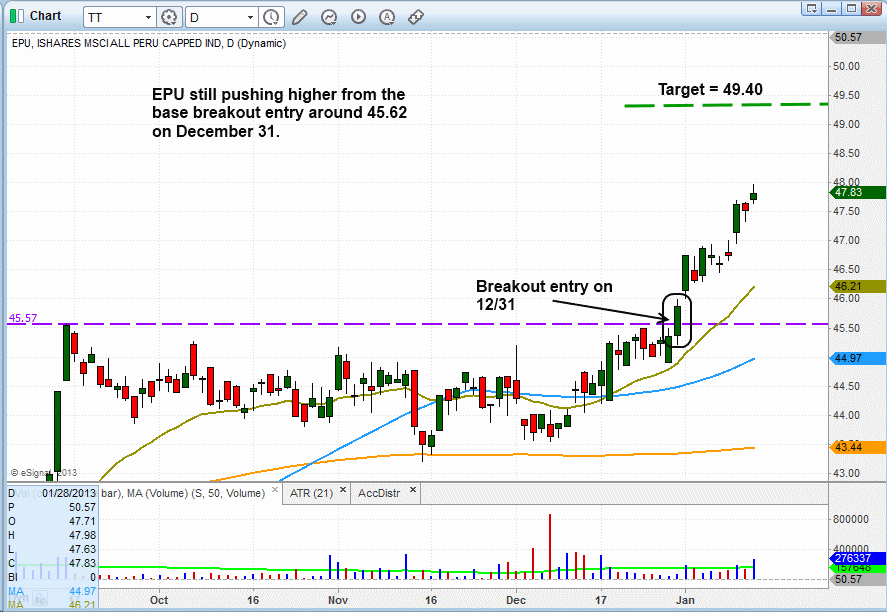

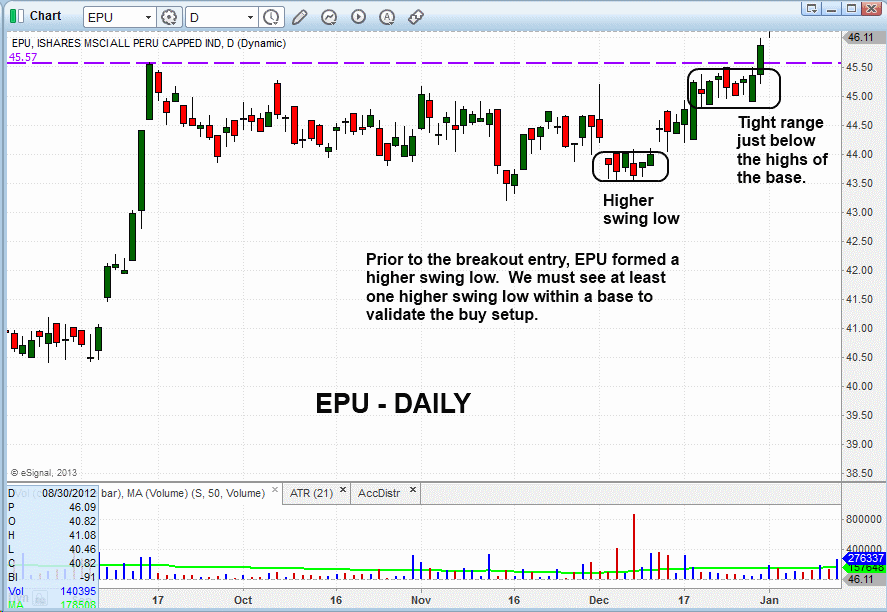

The chart below details our buy entry and new target in the iShares MSCI All Peru Capped ($EPU). We bought $EPU on the breakout above the range high at 45.62. The price action continues to push higher, and we are looking for a move to the 49.40 level as the official target.

The price action leading up to the breakout in late December in $EPU is a good example of what we look for in a bullish consolidation. Once a clear base has formed we are looking for higher swing low to develop within the base, which lets us know that momentum is on our side. 90% or more of our entries will have some sort of a higher swing low in place prior to our entry.

After a higher swing low is established, we then look for a tight, short-term price range to develop below the highs of the base. This tight price range developed in the last two weeks of December, as $EPU chopped around just below the 45.50 level.

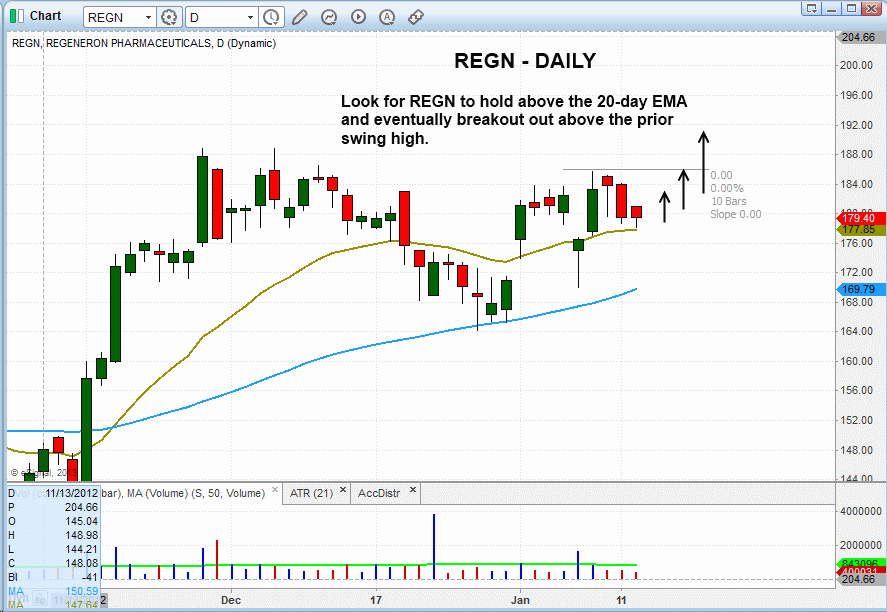

On the stock side, we added to our position in $CRM but the breakout failed to extend much and closed right at our entry point. The higher stop is for the shares we just added in $CRM only. The $POL breakout remains intact and we added one new setup in $REGN. $REGN is a leading stock in the biotech sector and one of the few with high relative strength AND great earnings momentum. Our buy entry is just above $180.00.

Due to the lack of follow through in the market, we really do not want to go on margin without further confirmation that a true bull market is under way. Because of this, we are making room for potential buy entries in $REGN and $POL by placing a break-even stop in our weakest performing open position, $RYL.

If you are a new subscriber, please e-mail [email protected] with any questions regarding our trading strategy, money management, or how to make the most out of this report.

relative strength combo watchlist:

Our Relative Strength Combo Watchlist makes it easy for subscribers to import data into their own scanning software, such as Tradestation, Interactive Brokers, and TC2000. This list is comprised of the strongest stocks (technically and fundamentally) in the market over the past six to 12 months. The scan is updated every Sunday, and this week’s RS Combo Watchlist can be downloaded by logging in to the Members Area of our web site.