market timing model: Buy

Current signal generated on close of September 9.We are no longer in confirmed buy mode, but remain in buy mode. Portfolio exposure depends on how well positions have held up, but anywhere from 50% to 100% (if positions are in good shape) is okay. Anything less than 50% long exposure right now is too light.

Past signals:

- Neutral signal generated on close of August 15

- Buy signal generated on close of July 11

- Neutral signal generated on close of July 5

- Sell signal generated on close of June 24

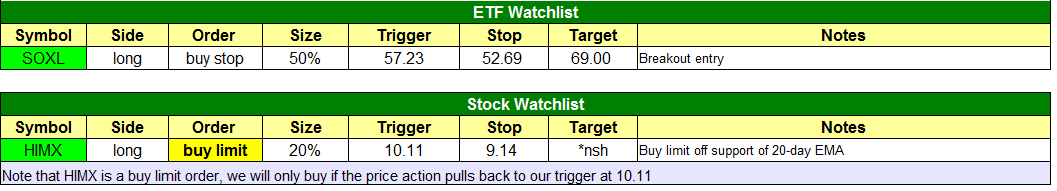

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

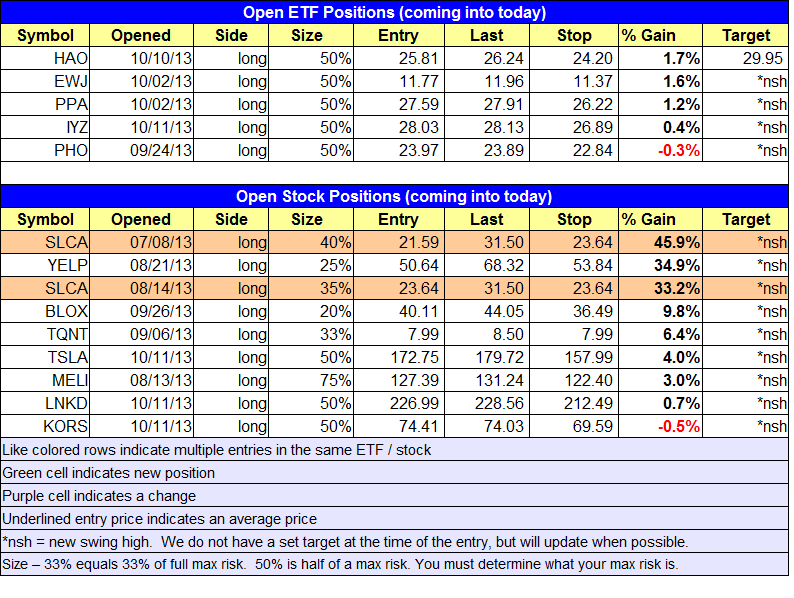

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits. Click here to learn the best way to calculate your share size.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

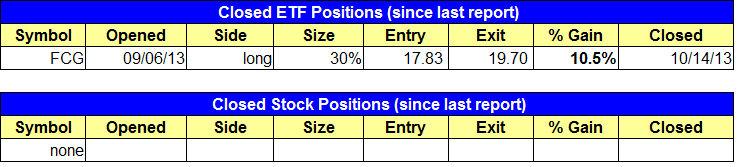

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- $FCG hit our target. No alert was sent out to confirm the exit, but all targets are set in stone. IF you remain long please exit on tomorrow’s open.

stock position notes:

- No trades were made.

ETF, stock, and broad market commentary:

Stocks responded favorably to a -0.6% gap down on the open in the S&P 500, and basically held their ground through the morning session. By 1 pm, stocks were breaking out to new intraday highs and continued to run higher until the close, where all major averages finished with gains in the +0.4% to +0.6% range.

Volume was lighter on both exchanges, so for the third straight session in a row neither the S&P 500 or NASDAQ Composite has logged an accumulation day. The lack of volume might be an issue for many who are waiting for a resolution from Washington, but we continue to see leading stocks act well and new breakouts emerge, such as $SAVE the past few days.

On Friday, and once again on Monday, our remaining long position in First Trust ISE Revere Natural Gas ($FCG) hit its sell target of $19.70, locking in a 10.5% gain on the remaining shares. For those who are still long you can exit on tomorrow’s open. The chart below details our entry and exit prices.

Our target in $FCG was set at 19.70 to play it safe, but for those who feel that there is more upside, $FCG can be held for a move to the prior highs of 2011, just below $22.

Semiconductor stocks broke out above range highs yesterday, just a few days after last week’s ugly two day washout on 10/8 and 10/9. The chart of Direxion Daily Semiconductor Bull 3X ($SOXL) below details the shakeout.

The nasty shakeout to the 50-day MA in $SOXL was followed by a sharp reversal and breakout above range highs yesterday. In terms of the trend, the moving averages in $SOXL point to a strong uptrend, with the 20-day EMA now above the 50-day MA, and the 50-day MA above the 200-day MA. All three averages are also trending higher (this moving average analysis can be done on $SMH with the same result). We are placing $SOXL on today’s watch-list. Trade details can be found above.

Since $SOXL is a 3x leveraged product, it is not something that we would use for an intermediate to long-term hold, but for our purpose, which is to catch a strong 3-6 week advance, it will do just fine. Our target is just below the highs of 2011.

On the stock side, we continue to see new breakouts and long setups emerge from our scans, which is a pretty good sign that the market should be headed higher once the guys in Washington wake up.

While so many traders wait on Washington before getting back in to the market, we prefer to let the price and volume action lead us in and out of stocks. For example, one may think that the market is in big trouble from last week’s plunge, and one could be right…who really knows for sure. However, aside from $LNKD cracking the 50-day MA, $KORS, $SLCA, $YELP, $YY, $MELI, $BLOX, $AMBA, $SFUN, $P, $QIHU, $NOAH, and many others have held up really well. If half of these names were below the 50-day MA and unable to bounce, then we would certainly be very cautious, but that is not the case. Yes, we are still a bit cautious, as we have not been throwing out a ton of buy recommendations here, but we did establish three new long positions last Friday.

We have one new buy setup in $HIMX, which is a buy limit order on a pullback to the 20-day EMA. Please note that we are buying on weakness, so the price will have to pull back in to the trigger for the trade to be executed.