Buy

– Signal generated on the close of April 30

Due to the recent distribution in the Nasdaq, we are no longer in confirmed buy mode (now is not the time to step on the gas). We remain in buy mode, but if market conditions continue to deteriorate the timing model will shift to sell mode.

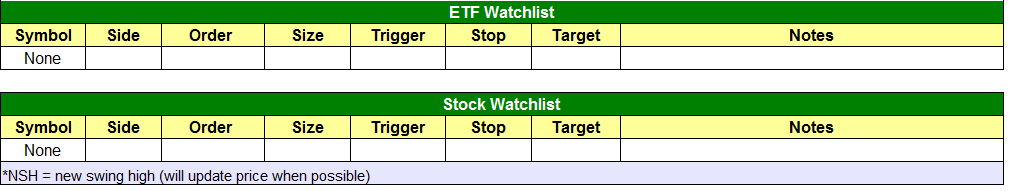

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

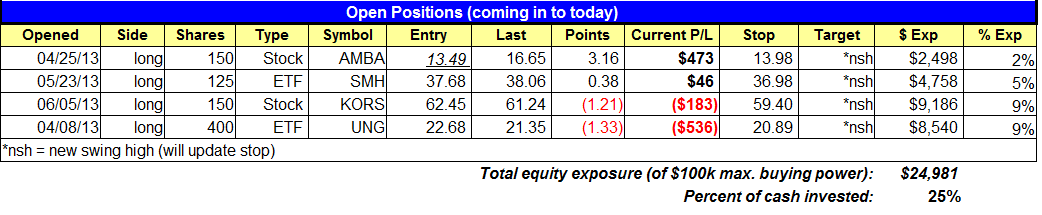

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Net P/L figures are based a $100,000 model portfolio. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

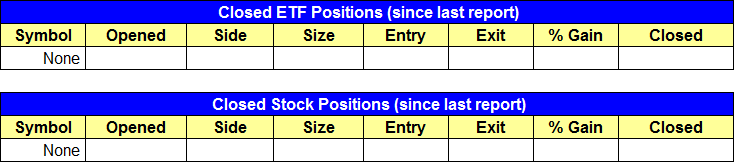

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- No trades were made.

stock position notes:

- No trades were made.

ETF, stock, and broad market commentary:

The correction off the May 22 highs deepened yesterday, as the main stock stock market indexes plunged 1.3% to 1.4%. Stocks open slightly lower, trended steadily south throughout the first half of the day, then oscillated in a sideways range throughout the afternoon before finishing at their intraday lows. Volume edged 1% higher in the NYSE, indicating that institutions are still in “sell” mode. However, turnover in the NASDAQ was 1% lighter than the previous day’s level.

In the May 3 issue of The Wagner Daily, we said that now is NOT the time to step on the gas pedal in your trading operations. We also suggested that sometimes the best move in stock trading is to play defense, and that now may be one of those times.

In the trading session that immediately followed those comments, the major indices formed bullish reversal candles on their daily charts, as several of the indexes “undercut” near-term support of their 20-day exponential moving averages. Without a doubt, this fooled many bulls into thinking the worst of the broad market correction was over. But traders who have been paying attention to the bigger picture of what’s happening avoided jumping back into the market so quickly, and yesterday’s breakdown to new “swing lows” shows they were correct in doing so.

Despite Monday’s bullish reversal candles, we continued playing defense because one of the most important and reliable indicators of technical analysis is the volume patterns of the broad market (this was the focus of our May 3 commentary). Until we start seeing the return of convincing, higher volume “up” days (accumulation), as well as a cessation of higher volume “down” days (distribution), there is no reason to aggressively jump back into the stock market. Furthermore, we need to see healthy patterns and breakouts once again begin re-emerging in leading stocks.

The good news about the current state of the broad market is that the benchmark S&P 500 Index is now nearing triple convergence of key support levels: intermediate-term support of its 50-day moving average, the long-term uptrend line from its November 2012 low, and a substantial level of horizontal price support. Below, this is annotated on the daily chart of S&P 500 SPDR ($SPY), a popular ETF proxy for the S&P 500 Index:

Typically, the first pullback of a stock or index to its 50-day moving average (following a strong rally) sparks the return of institutional buying activity. As you can see on the chart above, $SPY could easily come into contact with its 50-day MA with just one more substantial down day in the broad market. There is also the equally important uptrend line that has been in place for approximately 8 months.

Nevertheless, a simple test of the 50 day MA does NOT automatically give us the “all clear” signal to go ahead and start buying like a maniac. Rather, it simply tells us we should definitely be on the lookout for the possible return of institutional buying and money flow into leading stocks. If that happens, be assured we will be fully prepared to take advantage of entering new swing trades in the stocks and ETFs that have been showing the most relative strength during the correction, as those are the equities that are likely to lead the market higher when the uptrend attempts to resume.

Having not even pulled back to touch its 20-day exponential moving average yet, Guggenheim Solar ETF ($TAN) remains one of the strongest ETFs in the market right now. Market Vectors Semiconductor ETF ($SMH) is also holding near its 20-day EMA and continues to show relative strength to the Nasdaq. Still, neither are yet presenting us with valid, actionable re-entry points.

Frankly, there’s not much value in our team analyzing and discussing a bunch of stocks and ETFs that are not yet close to being actionable, so our daily analysis will be more brief than usual until we see the new emergence of potential trade setups worth talking about. Until then, we are fully content to manage existing positions and mostly watch from the sidelines.

While stocks are in correction mode, this is a great time to try out the “Pullback” scan of the new MTG Stock Screener. In our nightly Wagner Daily newsletter, we always hand pick the best pullback trade setups and provide you with the exact entry and exit points for trading them. But for those of you who are more the “do-it-yourself” type, you will enjoy using the preset stock scans of our screening software, and will likely find some stocks to put on your radar screen as potential buy candidates in the coming days and weeks. Please note pullback scan is designed to work best with shorter-term pullbacks of 3 to 5 days. However, it may still find a diamond or two in the rough”

Actionable long setups have dried up this week, as most leading stocks are in need of one or two weeks of consolidation to produce low-risk entry points.

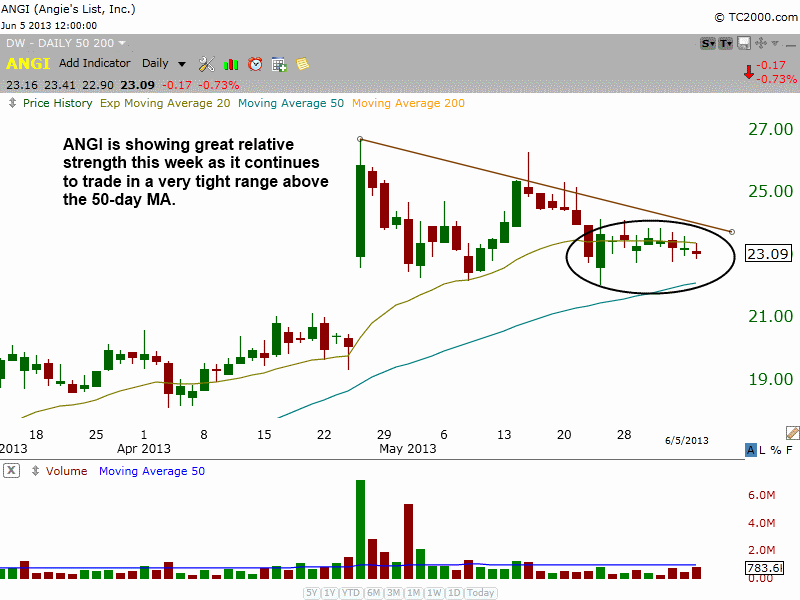

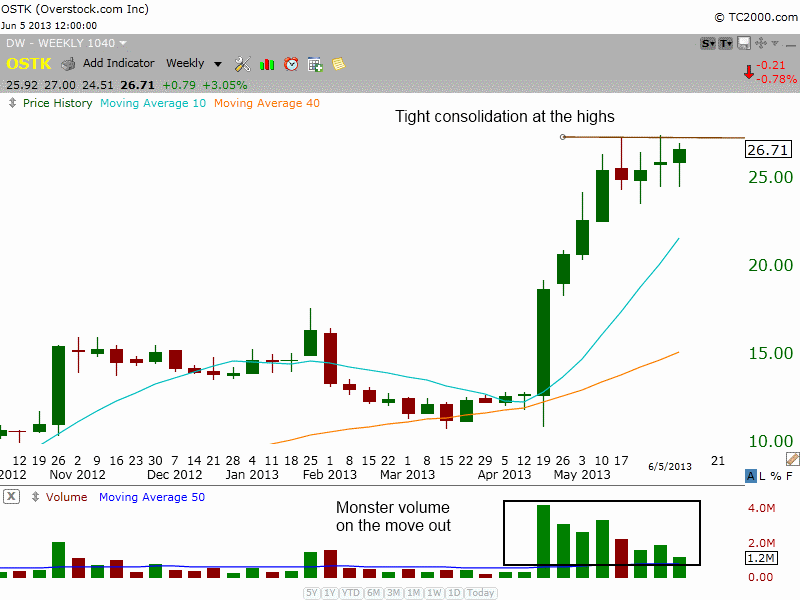

With the market in pullback mode, it is easier to spot stocks with relative strength, as they are the ones trading in a tight range above the 50-day MA. $OSTK and $ANGI are two examples of relative strength:

$OSTK exploded off the 200-day MA on monster volume back in April. Since stalling out below $28, the price action has formed a tight range while holding the rising 20-day EMA. Look for $OSTK to breakout above the range high if/when the market is able to find some traction.

$ANGI is in great shape, trading in a tight range above the rising 50-day MA. These are the setups we look for when the market is in pullback mode.