market timing model: Buy

Current signal generated on close of September 9.Portfolio exposure can be anywhere from 70% to 100% long or more, meaning that conditions are strong enough to be on margin.Past signals:

- Neutral signal generated on close of August 15

- Buy signal generated on close of July 11

- Neutral signal generated on close of July 5

- Sell signal generated on close of June 24

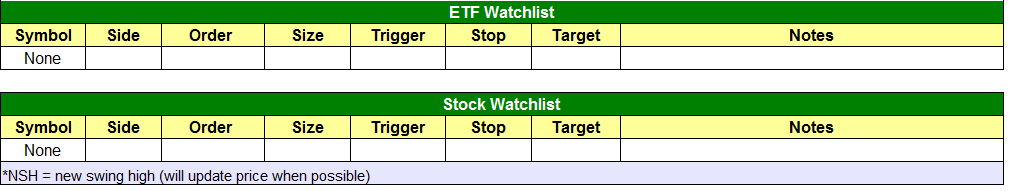

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

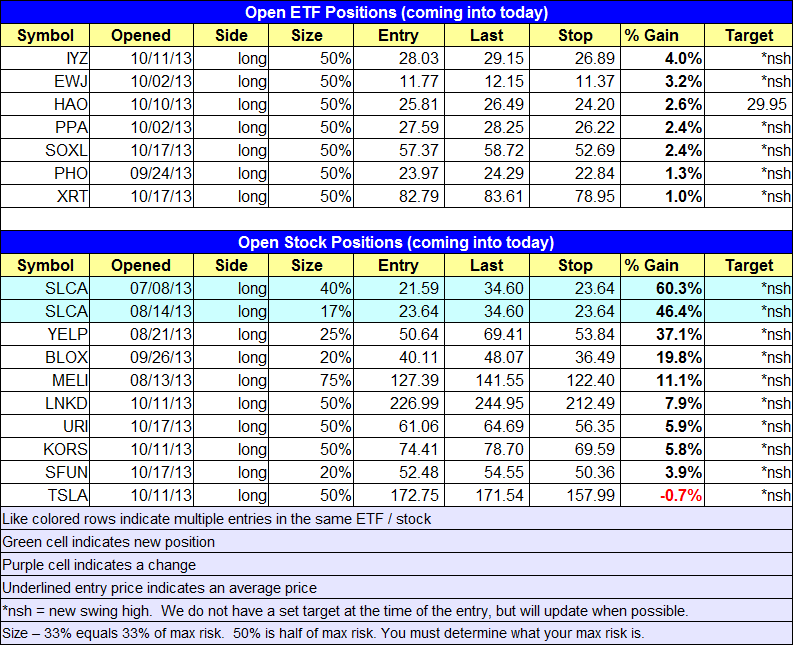

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits. Click here to learn the best way to calculate your share size.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

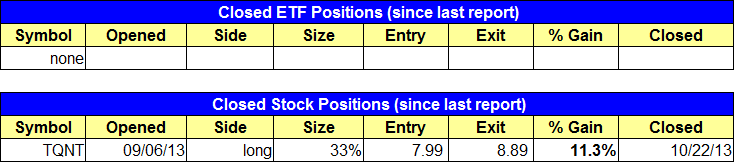

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- No trades were made.

stock position notes:

- Sold $TQNT for an 11% gain.

ETF, stock, and broad market commentary:

Tuesday’s action produced moderate gains across the board; however, there was a noticeable pick up in volatility in the broad based averages intraday, as well as some stalling action on the daily charts of the NASDAQ Composite and Russell 2000. That being said, all major averages remain in a very strong uptrend, and have yet to break the 20-period EMA on the hourly chart since October 9.

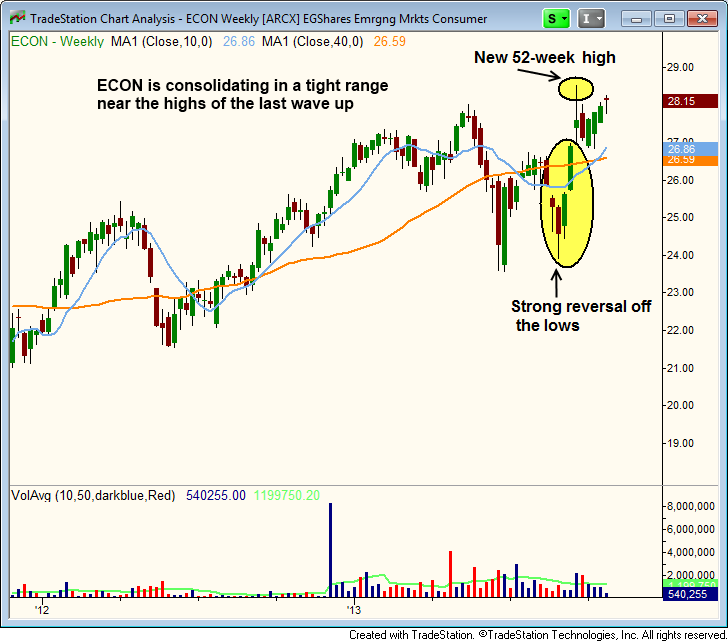

With the market extended in the short term, most of our focus is on monitoring key support levels for low-risk entries on a pullback. The EGShares Emerging Markets Consumer ETF ($ECON) is one of a few pullback setups we are currently monitoring. The daily chart below shows the sharp rally off the lows, which was followed by a few weeks of consolidation above the rising 20-day EMA. We are looking for a pullback to or near the 20-day EMA, around the $27.50 – $27.75 area. Note the bullish moving average crossover, with the 50-day MA crossing above the 200-day MA. This type of moving average crossover is not a buy signal, but it does tell us that the trend is beginning to turn up.

The weekly chart of $ECON shows the sharp rally off the lows that led to a move to new 52-week highs just five weeks ago. Since there is very little resistance above, a close above $29 on the weekly chart could spark a strong rally.

On the stock side, we continue to lay low waiting for new setups to emerge. So far it has been pretty tough to add to existing positions, as the volatility has picked up in many leading stocks the past two weeks. For example, $BLOX pulled back in yesterday for two hours before reversing just shy of the 10-day MA and surged 8% higher in the afternoon.

We sold $TQNT into strength yesterday, as it hit our target early in the morning, locking in a decent 11% gain. For those who did no sell, please remember that $TQNT is scheduled to report earnings after the close on Wednesday.

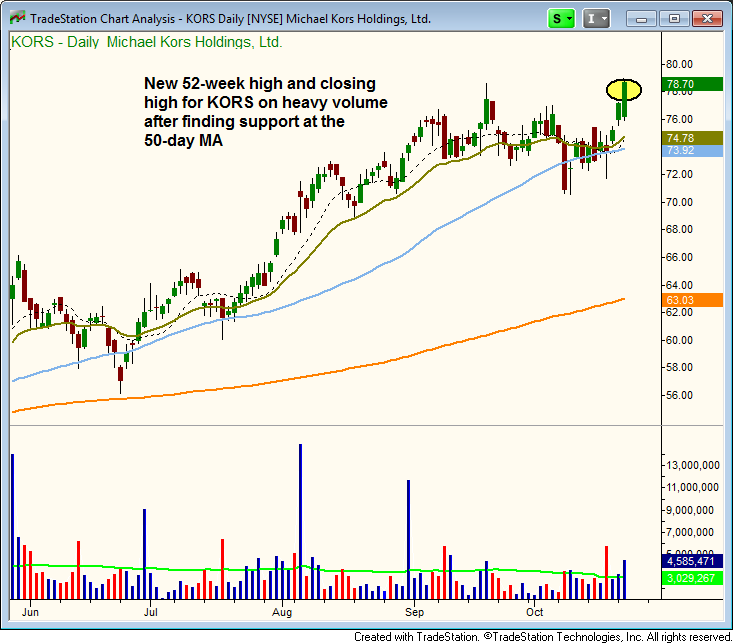

$KORS has been in consolidation mode since early September, but yesterday’s breakout on heavy volume set a new all-time closing high. If $KORS gets going we will be in good shape, as this stock has great potential and could easily run 40 to 50% or more in 2 months.

Please note that we will be sending an abbreviated version of the Wagner Daily on the night of October 24 for the Friday, October 25 session. In this version, we will only update the open positions section. The chat room will be closed on Friday as well.