market timing model: BUY

Current signal generated on close of November 13.Portfolio exposure can be anywhere from 25% to 50% long. If positions are holding up well, then one can add exposure beyond 50%.Past signals:

- Neutral signal generated on close of November 6.

- Buy signal generated on close of September 9

- Neutral signal generated on close of August 15

- Buy signal generated on close of July 11

- Neutral signal generated on close of July 5

- Sell signal generated on close of June 24

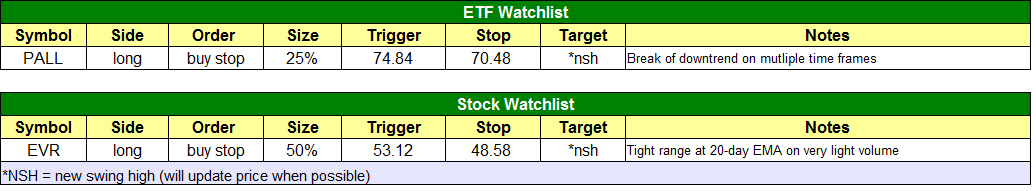

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

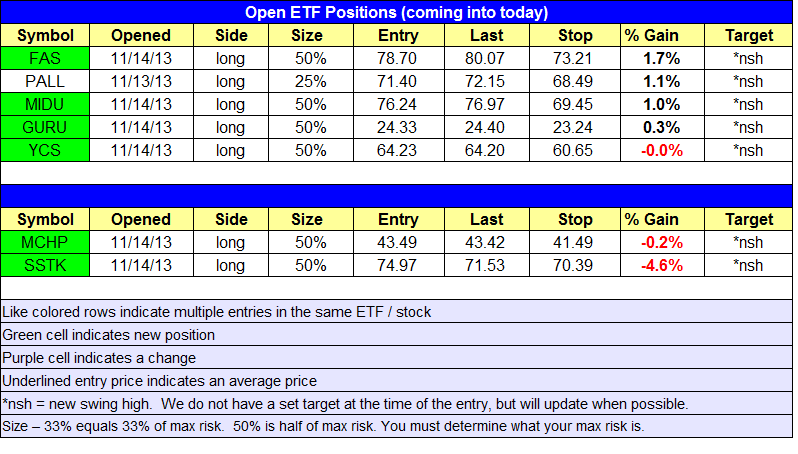

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- Buy setups in $GURU, $FAS, $MIDU, and $YCS triggered.

stock position notes:

- Buy setups in $SSTK and $MCHP triggered.

ETF, stock, and broad market commentary:

Stocks extended slightly higher on Thursday, with decent gains in the S&P 500, S&P 400, and Dow Jones. The small-cap Russell 2000 was a noticeable laggard, unable to add to Wednesday’s gains and closing slightly negative on the day.

Although leading stocks have been a slight disappointment as of late, most broad market averages are full steam ahead with the exception of the Dow Jones and Russell 2000. The Dow recently broke out to new highs, so there is the potential for a false breakout over the next few days. The Russell 2000 is in better shape than the Dow, but unlike the S&P 400, the Russell has yet to set a new swing high.

The market is picking up steam, and that is a good sign, but the leading stock portion of our timing model is lagging a bit. That said, we remain bullish, as the majority of leading stocks continue to form bullish basing patterns.

For the time being, money has flowed out of the Russell 2000 and NASDAQ and into the S&P 500 and Dow, which is a defensive move. However, it could simply mean that the Russell and NASDAQ need a few weeks of rest before taking the lead once again. Risk seems to be still on to some degree, as the Midcap S&P 400 has made new highs.

After a breaking down below a significant support level at $25 earlier this year, iShares Silver Trust ($SLV) has formed a five month consolidation pattern at the lows. After a few months above the 50-day MA, the price action cracked the 50-day MA in early November and broke the uptrend line.

The 20-day EMA is below the 50-day MA, and the 50-day MA is now sloping lower. The 200-day MA remains in a clear downtrend as well, so all the major moving averages are in order.

With $SLV breaking the swing low from 10/1/13, it is now too obvious of a short and due for some sort of bounce over the next week or two. The daily chart above shows the declining 20-day EMA around 20.80, so if $SLV can push higher, then the 20-day EMA could potentially provide us with a low-risk short entry point.

After a strong move off the l0-week MA in late October, Financial Bull 3x ($FAS) has basically traded in a tight range on light volume. The 10-day MA caught up this week to provide support.

The light volume over the past four weeks is a bullish sign, especially after two weeks in a row of heavier than average volume off the lows. We look for $FAS to resume its uptrend after a 15-week consolidation with a close above $82.

We now have five open long positions in the ETF portfolio, with three of those positions highly correlated to the movement in the S&P 500. We will look to add more exposure next week as new setups emerge.

On the stock side, we established two new positions in $SSTK and $MCHP. $MCHP looks to be in good shape, but $SSTK was basically a false trigger yesterday on the open.

When a stock opens at or above an entry point and immediately sells off, it is usually the sign of a false trigger. Most of the time we will have a 5-minute rule in effect to avoid this type of action, but we waived the 5-minute rule yesterday in order to simplify the entry process with six potential entries going off at the open.

Broad based averages may continue to lead while higher beta issues take a break. Although we are on buy mode, there is the potential for more leadership stocks to break down over the next few weeks. We must remain patient to avoid overexposure to the long side, especially since our focus in on small and mid-cap growth and momentum names..