market timing model: (Confirmed) Buy

Current signal generated on close of September 9.

We are now in confirmed buy mode, so portfolio exposure can be more than 100% if you have a marginable account. However, please make sure that current long positions in your portfolio are working before adding new ones. Portfolio exposure should be at least 75% to 100% (or more) right now.

Past signals:

- Neutral signal generated on close of August 15

- Buy signal generated on close of July 11

- Neutral signal generated on close of July 5

- Sell signal generated on close of June 24

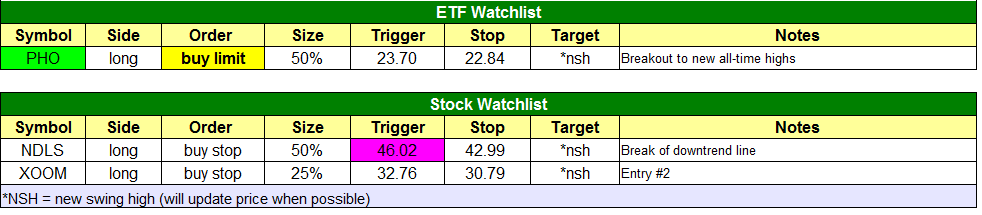

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

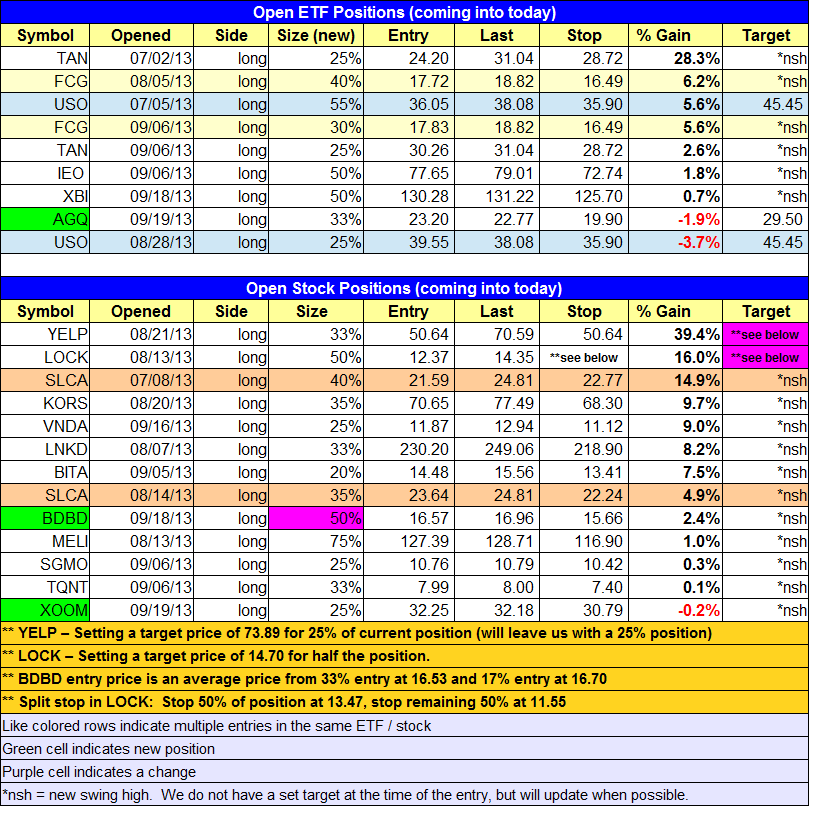

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits. Click here to learn the best way to calculate your share size.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- Bought $AGQ on the open.

stock position notes:

- $XOOM buy entry #1 triggered. $BDBD add triggered. $SCTY buy setup is canceled for now.

ETF, stock, and broad market commentary:

We aplogize for the late send tonight, which was due to the free webinar this evening at 9 pm. If you were unable to attend and would like to receive a copy, please send an email to [email protected].

The major averages chopped around in a tight range on Thursday, closing near the highs of the prior day’s candle on light volume. As long as the volume is quiet, it is bullish for a market to digest gains with a few days of rest after a strong advance. With four out of five major averages setting new 52-week highs, the current rally is beginning to build momentum. We could potentially see a mutli month rally develop from here, but as you know, we shy away from predictions and prefer to take it one day at a time.

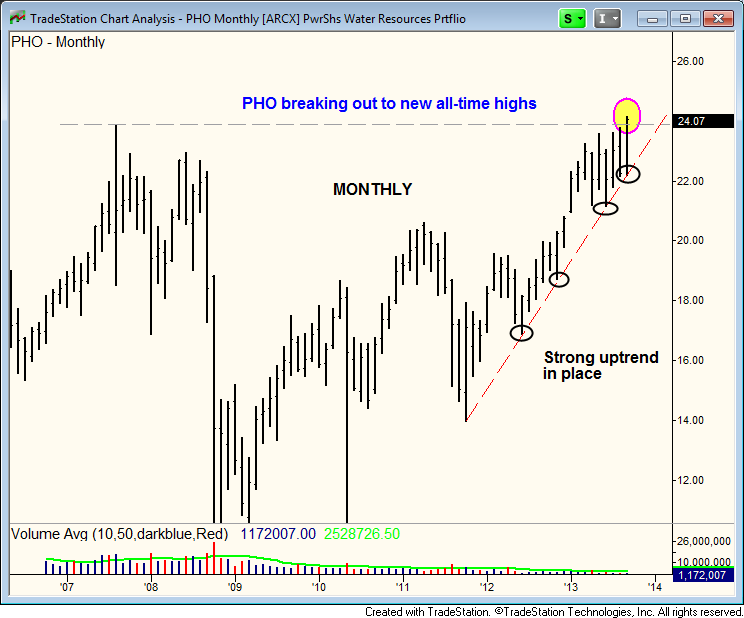

Powershares Water Resource Portfolio ($PHO) has broken out from a six-month long consolidation this week. The breakout also set a new all-time high, as evidenced by the monthly chart below. Normally, a breakout to a new 52-week high by itself is powerful, but when combined with a breakout to new all-time highs, it has explosive potential.

On the weekly chart, notice how $PHO found support at the rising 40-week MA twice during the consolidation. We also see higher swing lows within the base, and a tightening of the price action prior to the breakout. Another bullish sign is the dry up in volume within the base, which occurs when most investors give up on the price action after several weeks of trendless chop. Very often we will see volume quiet down and the price action tighten up right before the breakout.

We are looking for a short-term pullback within the next few days for a low-risk buy entry in $PHO. Trade details can be found in the watchlist section above.

On the stock side, we added two new positions in $BDBD and $XOOM. Buy entry #1 in $XOOM triggered, but buy entry #2 is still live. The weekly chart below details why we like $XOOM for a swing trade:

On the weekly chart in $XOOM, the big volume spike last week smacks us in the face when we are scanning through the charts at night. This is exactly what we like to see, big volume as a stock moves back through the 10-week MA, which is where professional money managers accumulate a position. Also, notice how the correction off the highs found support at the top of the last base, which is a very bullish sign. We look for the price action to breakout above the current week high within a few days.