market timing model:

Confirmed Buy – Signal generated on the close of September 4 (click here for more details) (we are on a buy signal from the close of Aug. 16)

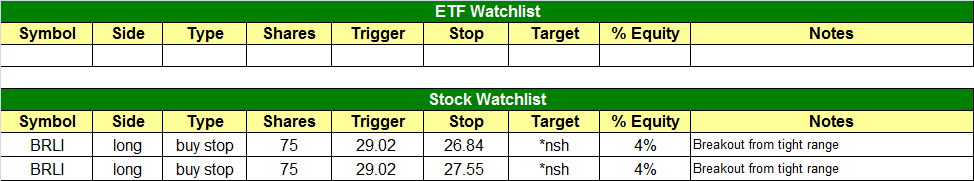

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

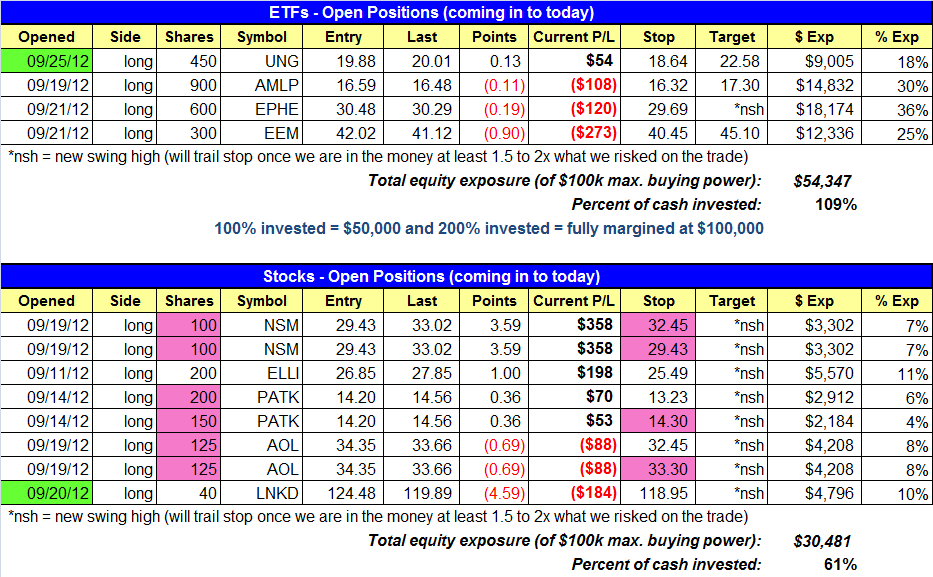

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Net P/L figures are based on two separate $50,000 model portfolios (one for ETFs and one for stocks). Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

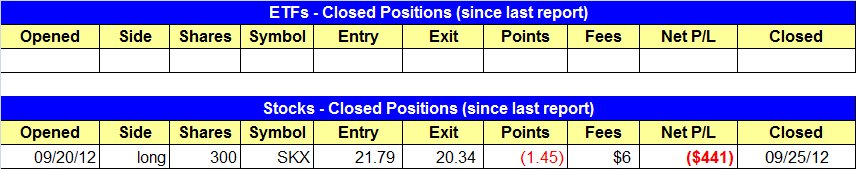

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

ETF position notes:

- RJA was removed from the watchlist. UNG buy entry triggered.

stock position notes:

- SKX stop triggered and we are out. LNKD buy entry triggered.

ETF and broad market commentary:

After getting off to an encouraging start in the first two hours of trade, stocks reversed course and settled into a steady intraday downtrend that persisted into the close. All the main stock market indexes closed substantially lower, with the blue-chips holding up the best. The Dow Jones Industrial Average ($DJIA) lost 0.8%, the S&P 500 ($SPX) fell 1.1%, and the Nasdaq Composite ($COMPQ) shed 1.4%. Small and mid-cap stocks, which have recently been showing the most relative strength, registered the largest losses. The small-cap Russell 2000 Index ($RUT) declined 1.5%, as the S&P MidCap 400 ($MID) similarly posted a 1.6% decline. All the major indices closed at their dead lows of the day, indicating the bears firmly had control into the close.

Turnover ticked higher across the board, causing both the S&P 500 and Nasdaq to register a bearish “distribution day.” Total volume in the NYSE increased 22% above the previous day’s level, while volume in the Nasdaq swelled 15%. This time, market internals were pretty week as well. In the NYSE, declining volume trounced advancing volume by a ratio of more than 8 to 1. The Nasdaq ADV/DEC volume ratio was negative by a margin of approximately 4 to 1. While yesterday’s session was convincingly indicative of selling among banks, mutual funds, hedge funds, and other institutions, it was the first such “distribution day” we have seen in recent weeks. Although higher volume selling is typically a bearish indicator, it is normal for the broad market to experience a few days of distribution within the course of a healthy rally. Nevertheless, we will be on guard for further instances of institutional selling. As a general rule of thumb, it takes at least four to six “distribution days” within a three to four week period to destroy an uptrend.

Not surprisingly, most of our open ETF positions registered losses yesterday. However, one exception was US Natural Gas Fund ($UNG), which bucked the trend by zooming 2.2% higher amidst the broad market losses. Two days ago, in the September 24 issue of The Wagner Daily, we pointed out the potential bullish trend reversal that was setting up in UNG. Yesterday, our analysis follow-through as anticipated, as UNG convincingly broke out above long-term resistance of its 200-day moving average. In the process, it triggered our buy entry in the model ETF trading portfolio, and the trade is now showing a small unrealized gain. The breakout above the 200-day MA is shown on the daily chart pattern of UNG below:

Although it’s positive that UNG closed well above key resistance of its 200-day MA, it also did the same thing on September 12. Two days later, however, the breakout attempt failed and the ETF fell back below that resistance level. But this time, we believe there are greater odds that the trade will follow through to the upside because the length of time between the previous breakout attempt and the current breakout attempt was very short. Additionally, as previously pointed out, the ETF has also formed several “higher lows” since bottoming in April of this year. The only thing we did not really like about yesterday’s price action is that volume failed to jump above its 50-day average level, but we will see how if it picks up in today’s session.

Although most traditional long-term investors would not be pleased by yesterdays selloff in the broad market, we view the pullback as positive because the main stock market indexes were due for a correction. Whenever stocks start trading too far above their 20-day moving averages for too long of a period of time, the reward to risk ratio of new trade entries becomes diminished. However, once the inevitable pullback finally comes, it creates new, lower risk opportunities for new trade entry within the existing uptrend.

Given yesterday’s broad-based decline, now is a good time to take an updated look at the daily chart patterns at ETFs of the most popular stock market indexes, in order to see where the next support or resistance levels may be found. Let’s start with a look at the S&P 500 SPDR ($SPY), a popular ETF proxy for the benchmark S&P 500 Index. This is followed by daily charts of the Nasdaq 100 ETF ($QQQ) and Dow Jones DIAMONDS ($DIA):

On the surface, yesterday’s selloff may have seemed severe. However, in context with the strength of the recent rally, notice on the charts above that not a lot of technical damage has been done. SPY closed just below near-term support of its 20-day exponential moving average (the beige line), while DIA is still holding above it. QQQ looks a bit worse because it is closed below both its 20-day exponential moving average and horizontal price support of its prior highs. However, the index was also showing relative strength on the way up.

For now, it’s too early to tell whether or not bearish momentum will build on yesterday’s decline. Given that it was the first “distribution day” in recent weeks, there is not yet any indication of significant danger in the near-term. Even if stocks continue lower over the next several days, much more significant support of the 50-day moving averages (the teal lines) should halt the decline.

More so than actual price action, will be closely monitoring subsequent volume patterns for any further instances of institutional selling (higher volume losses). Until that happens, our rule-based market timing model mandates that we view the current pullback as a buying opportunity, rather than the time to exit long positions and go to cash or sell short. Nevertheless, we are not interested in taking on additional long exposure until the market confirms yesterday’s selling will be short-lived and subsequently lead to a resumption of the dominant uptrend of the past several months. Remember that we are not in the business of making stock market predictions; rather, we merely react and take action in tangent with what the market gives us. As always, our newsletter subscribers will be immediately notified if there are any changes to our current market timing mode.

stock commentary:

Let’s start off with a quick recap of open positions:

- NSM – Raised the stop below Tuesday’s low on half the position and moved the stop to breakeven on the remaining half. NSM is showing great relative strength to the broad market so we want to keep some size on.

- ELLI – We’d like the price action to hold the 20-day EMA (give or take a few percentage points) on any pullback.

- PATK – Moved stop up to yesterday’s low on 150 shares. Stop remains the same on the last 200 shares.

- AOL – Raised the stop on 150 shares to just below the 2-day low. Stop remains the same on the last 150 shares.

- LNKD – Failed breakout yesterday. Not good action. No change in stop.

Although yesterday’s heavy volume selloff was ugly, we are standing at only one solid distribution day on the major averages, which is not enough to stop a rally. When the market is acting well many stocks go with the flow and everything looks great. But with the major averages basically sideways to lower the past seven days the weaker stocks have been exposed. We are certainly not in panic mode, but we have raised stops on partial size in stocks that have failed recent breakout attempts like PATK and AOL. If the averages are simply in pullback mode, then we should see new buy setups emerge from our scans later this week or early next week. As always, we plan to be patient and wait for quality setups to bring us back into the market with heavy size.

If you are a new subscriber, please e-mail [email protected] with any questions regarding our trading strategy, money management, or how to make the most out of this report.

relative strength combo watchlist:

Our Relative Strength Combo Watchlist makes it easy for subscribers to import data into their own scanning software, such as Tradestation, Interactive Brokers, and TC2000. This list is comprised of the strongest stocks (technically and fundamentally) in the market over the past six to 12 months. The scan is updated every Sunday, and this week’s RS Combo Watchlist can be downloaded by logging in to the Members Area of our web site.