Morpheus Swing Trade Setups

Best chart patterns for swing trading stocks

In The Wagner Daily stock trading report, members receive swing trade alerts for only the best swing trade setups.

We specifically focus on rule-based swing trade setups that provide a highly positive risk-reward ratio for entry.

When listing the exact buy trigger and stop price for swing trade setups in our report, we ensure the projected profit target is at least 2 to 3 times greater than the stop.

We also list the position weighting within the Morpheus portfolio, which enables members to maintain consistent capital risk per trade.

Continue below for chart examples of the typical types of swing trade setups we target.

Best Stocks To Buy For Swing Trading

Breakout Setup

A breakout swing trade setup occurs when a stock or crypto breaks out above resistance from a valid basing pattern.The reliable, bullish cup and handle pattern is one of our most profitable swing trade setups, but we also swing trade breakouts from a flat base:

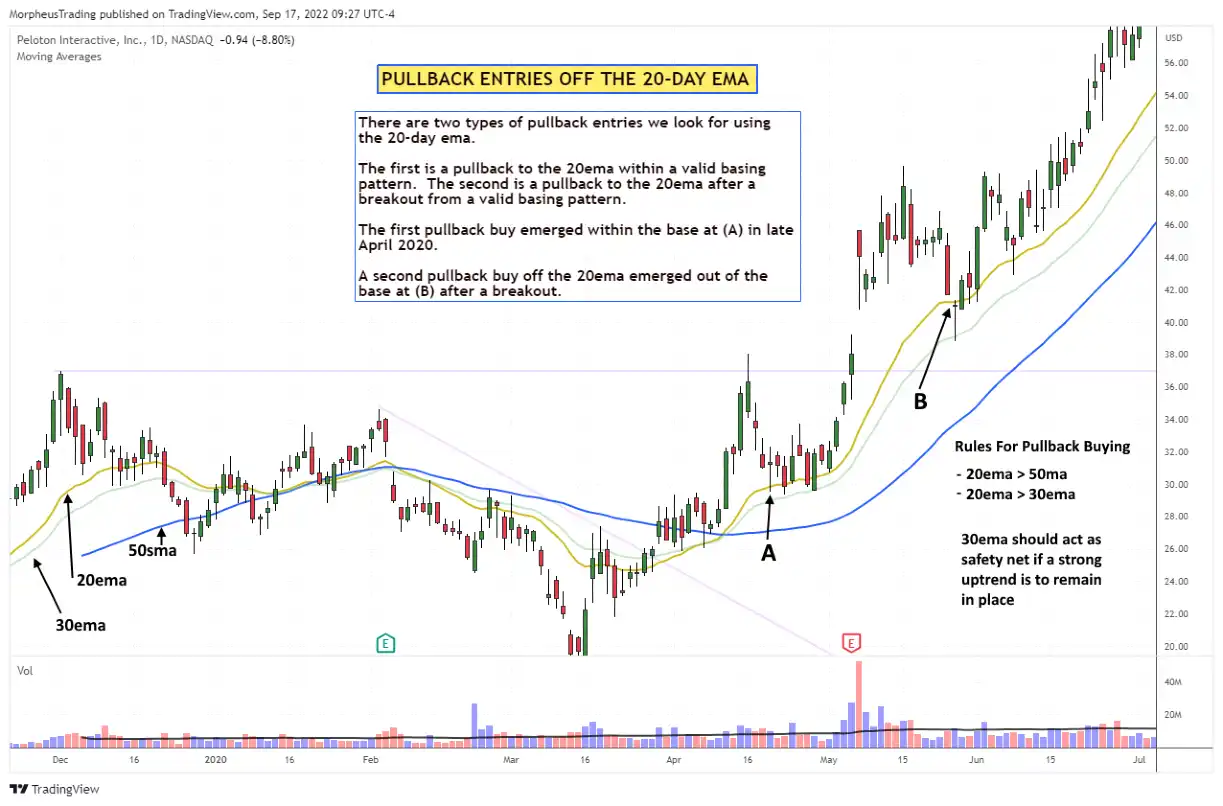

Pullback Setup

A pullback setup forms after a stock or crypto breaks out from a valid base, then pulls back to a technical support level.Pullbacks to the 10, 20, or 50-day moving average after a breakout often present low-risk buy points for swing trade entry into leading stocks and cryptos:

Breakaway Gap Setup

A breakaway gap occurs when a stock opens at a new 52-week high (gap up above the high of a valid base).Breakaway gaps are backed by massive volume surges, and are often driven by news.

In our flagship swing trading service, members often profit from our proven strategy for buying stocks gapping up on earnings.

Press HERE to learn more about The Wagner Daily, our flagship swing trading report since 2002.

Color