Are you ready to discover the secret to spotting profitable trading opportunities? Look no further than the Cup and Handle pattern—a simple and reliable way to identify bullish price action. Here’s how to spot and capitalize on the cup and handle.

Named for its distinctive shape, the cup and handle pattern is a powerful, bullish signal that can indicate a stock or crypto is likely to see a price increase in the future. This top chart pattern is a favorite among swing traders, who have been relying on this pattern for decades to spot potential opportunities for profit.

In this post, we take a closer look at what the cup and handle pattern is, how to spot it, and how to use it in your swing trading strategy to make profitable trades.

Whether you’re a seasoned trader or just starting out, this powerful post provides you with key information to help you succeed in the markets. So, let’s dive in!

What is the Cup and Handle Pattern?

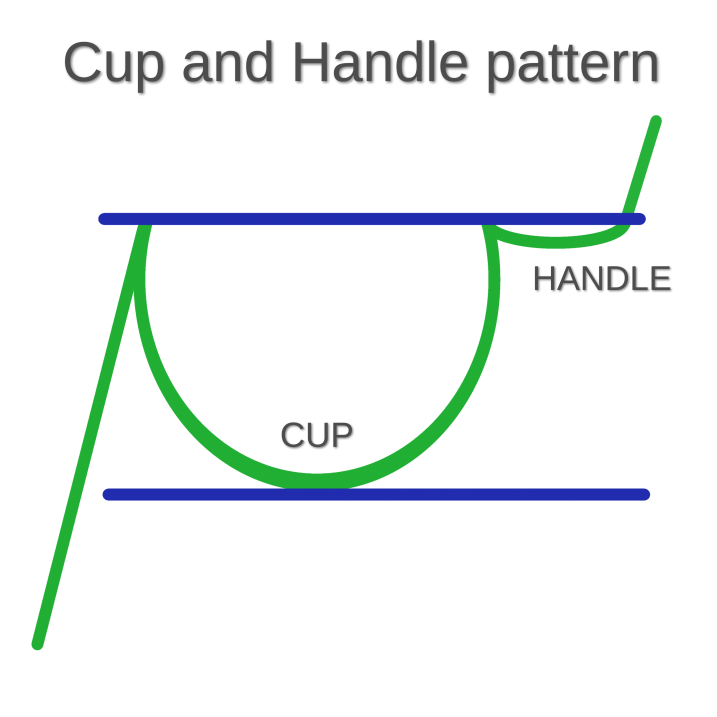

First defined by technician William O’Neil in his classic book, How to Make Money in Stocks, the cup and handle is a bullish continuation pattern that forms when a stock or cryptocurrency falls, forms a sideways base, then rallies back to the previous high.

The “cup” part of the pattern is the round, downward-sloping portion of the chart that develops after the price pulls back and forms a base.

The “handle” is the relatively flat part of the pattern that develops after the price has rallied back to the prior high and consolidates. Sideways price consolidation forms the handle.

Completion of the cup and handle pattern occurs after the price breaks out above the high of the handle and zooms higher.

Formation of the bullish pattern resembles a tea cup; hence the name “cup and handle.”

The cup and handle is one of the most well-known types of base breakouts among swing traders—but don’t be fooled!

Not every chart that looks like this is a PROPER cup and handle pattern.

But don’t worry, we’ve prepared an easy 10-step checklist to help you identify a valid cup and handle pattern. Check it out below.

10-Step Checklist: How to Properly Identify a Cup and Handle Pattern

In order to prevent a false signal, it’s important to receive cup and handle pattern confirmation before buying. Use this simple, 10-step checklist below to discover how to identify a cup and handle pattern—the right way.

See the annotated chart above as you review the 10 steps below:

- Near the high is best – The best cup and handle patterns develop within an existing uptrend and with the price near 52-week highs. Near the 52-week high is ideal, but #2 below is also okay.

- At least 30-40% off the low – If the stock or crypto is not already in a strong uptrend near its high, then the price should be at least 30-40% above the 52-week low BEFORE the cup develops.

- Moving average confirmation – The 50-day moving average should be above the 200-day moving average, and both moving averages should be trending higher.

- Base criteria – The base (bottom of the cup) should form on a pullback of 20-35% below the prior high. The base should also be at least 7 weeks in length.

- Rounded cup – The sides of the cup formation should have a rounded look, rather than a V-shape.

- Pullback not too steep – If in an uptrend, the bottom of the cup should be no more than 35% below the high. Cups that are 40-49% deep is too wide, which creates too much overhead price resistance. Measuring the distance is a key step to validating the pattern.

- Light volume – Volume should dry up at some point near the bottom of the base of the cup. This indicates the sellers are gone and enables the bulls to resume control.

- Proper handle length – The ideal length of the handle is 3 to 4 weeks. At a minimum, the handle should be at least 5 days long. The handle should also be less than two-thirds the length of the cup below it.

- Proper handle depth – Handles typically slope lower, but the low of the handle should not be more than 12% below the handle high. More than 15% below the high is too deep, and increases the odds of pattern failure.

- Mid-point maximum – The mid-point of the handle should be above the mid-point of the base. Most of the handle should be above the 50-day moving average.

How to Trade the Cup and Handle with a Low-risk Entry Point

When the cup and handle follows through, it typically generates gains of +20% to 30% over several weeks (see above).

But merely identifying the cup and handle chart pattern is not enough to profit. Rather, you must also know exactly when to buy for ideal, low-risk entry points.

Cup and Handle Pattern Rules: Buying with the Lowest-risk Entry Point

The traditional buy point is a breakout above the high of the handle, which clearly puts bullish momentum on your side.

However, many swing traders prefer earlier entry points before the actual breakout above the handle.

- Buying a breakout above the short-term downtrend line (from the high of the handle)

- Buying a low-volume pullback to support of the 20-day moving average (within the handle)

If seeking an early point, then be sure to enter with partial share size to minimize risk.

Then, you can add the rest of your position size after receiving confirmation of the handle breakout.

Don’t Forget Your Stop

Proper technical analysis puts the odds of winning in your favor, but you must always be prepared to cut your loss if the pattern fails.

With a typical breakout entry above the handle high, your stop loss should be not more than 7% to 10% below your entry price.

Early entries can benefit from tighter stops, such as several percent below the downtrend line or 20-day moving average (depending on the basis of your entry).

With a typical profit target of 20% to 30% for a cup and handle breakout, a maximum stop of 10% still gives you a positive risk-reward ratio of 1:2 to 1:3.

Conclusion

The cup and handle is a powerful and reliable chart pattern of technical analysis that frequently leads to big gains. As such, it is one of the top chart patterns we consistently target in our flagship stock and crypto swing trading services.

The next time you come across a potential cup and handle pattern, use our simple 10-step checklist above to verify the pattern is valid (be sure to bookmark this page for easy reference).

For the lowest-risk entry point, set a buy stop for entry above the high of the handle. Early entries can provide you with a lower buy price, but reduce your share size to compensate for slightly higher risk.

Of course, keep in mind that the cup and handle pattern can fail, so always use stops. Don’t risk more than 7% to 10% below your entry price—even less with an early entry point.

Continually scanning hundreds of charts to detect this pattern is challenging and time-consuming, but we’ve got you covered! Just sign up for your Wagner Daily PRO membership to receive the best swing trade alerts for the cup and handle and other top patterns. Trade crypto? We also alert you to this pattern with Morpheus Crypto PRO service.

FAQ: Frequently Asked Questions about the Cup and Handle Pattern

Is cup and handle pattern bullish?

Yes, the cup and handle pattern is a bullish signal, with the right-hand side of the pattern typically experiencing lower trading volume. The pattern’s formation usually signals an impending rise in the stock price.

How successful is cup and handle pattern?

The cup and handle pattern success rate is quite high. However, note that cup and handle pattern failure may occur more frequently in overall bearish markets. Always use stops to minimize risk in case of a failed cup and handle pattern.

Is a cup & handle pattern bullish or bearish?

The cup and handle is considered to be a bullish signal in technical analysis.

The pattern is formed when the price moves in a U-shaped pattern, creating a “cup,” and a subsequent smaller downward movement creating the “handle.” This pattern indicates the stock or cryptocurrency is likely to see higher prices in the future.

Can cup and handle be bearish?

The standard cup and handle pattern is a bullish signal, but there is also a bearish version of this pattern called “Inverse Cup and Handle” pattern.

An inverse cup and handle pattern forms with the bottom of the cup being at the top of the stock’s price movement. The handle forms as a subsequent, smaller upward movement at the top of the cup (near the bottom of the chart pattern).

Just flip the chart of a typical cup and handle upside down and you will see an inverse cup and handle. This pattern is considered to be a bearish signal that indicates a stock may see a price decrease in the future.

What does a cup and handle pattern indicate?

The cup and handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. It is considered a signal of an uptrend in the stock market and is used to discover opportunities to go long.

The pattern starts when a stock’s price runs up, then pulls back to form a cup shape. After that, a handle forms, which is a slight downward drift in the stock’s price.

The breakout from the handle’s trading range signals a continuation of the prior uptrend.

How do you find a cup and handle pattern?

To identify the pattern, you need to look at the price chart of a stock or cryptocurrency. The pattern consists of two parts: the cup and the handle.

The cup is formed after an advance and looks like a bowl or rounding bottom. As the cup is completed, a trading range develops on the right-hand side and the handle is formed.

The handle typically has a slight downward drift. When the handle is completed, a breakout from the handle’s trading range signals a continuation of the prior advance.

To qualify as a cup and handle pattern, the retracement of the cup should be 1/3 or less of the previous advance. The handle should have a retracement of 1/3 or less of the cup’s advance and should complete within 1-4 weeks.

To confirm the pattern, there should be a substantial increase in volume on the breakout above the handle’s resistance.

What happens after a cup and handle pattern?

After a cup and handle pattern forms, the price should see a sharp increase in the short- to medium-term.

The cup forms after an advance and looks like a bowl or rounding bottom. As the cup is completed, a trading range develops on the right-hand side and the handle is formed. A subsequent breakout from the handle’s trading range signals a continuation of the prior advance.

Volume should increase on the breakout, signaling increased investor interest and confidence in the stock. This often results in a rally that can last several weeks or months, and reach the target price that was calculated from the cup and handle pattern.

How do you scan for a cup and handle pattern?

To scan for a cup and handle pattern, you can use manual charting techniques to look for the U-shape pattern in a stock’s price action. You can also use automatic screeners such as TC2000 to look for the pattern. Our daily swing trading report, The Wagner Daily, also highlights top cup and handle patterns as they develop.

It’s important to remember to look at the chart pattern over a longer-term time frame, such as daily, weekly, and monthly charts, in order to identify the pattern correctly. Additionally, when you identify the pattern, you should wait for the handle to form completely before entering a trade.

Do you trade the “cup and handle” pattern? What other criteria do you look for? Drop us your comments below.