The Wagner Daily – January 13, 2023

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

MTG Market Timing Model – Buy (based on S&P 500 reclaiming the 20-day EMA)

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

today’s watchlist along with open and closed positions:

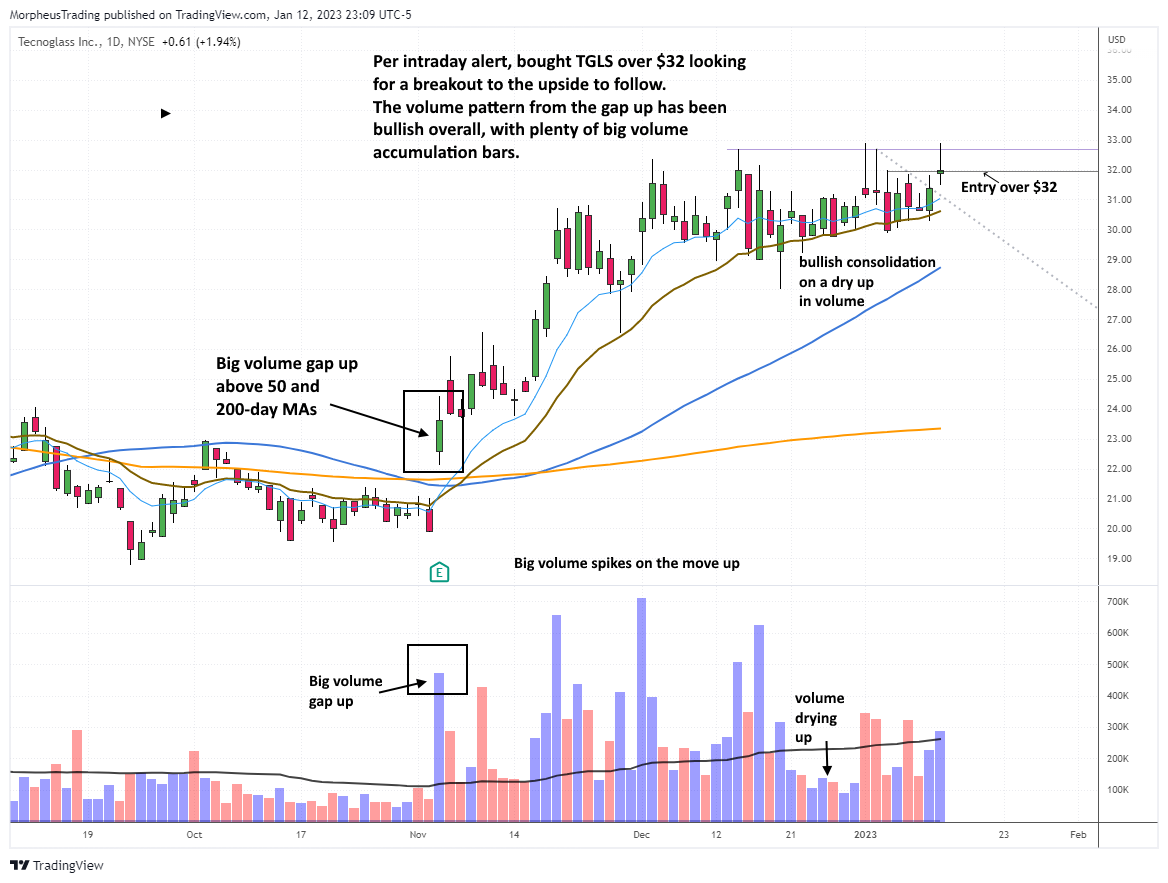

- Per intraday alert, bought $TGLS.

Note that the US markets will be closed on Monday, January 16. The Wagner Daily will not be published Sunday night but will return Monday night for Tuesday’s session. Enjoy the long weekend!

Broad-based averages continue to push higher fueled by short covering.

The S&P 500 futures contract has rallied into resistance of the 200-day MA and downtrend line. There is quite a bit of support just above 3,900 from a few moving averages.

Nasdaq 100 futures just reclaimed its 50-day MA, but has room to run before hitting downtrend line resistance. Support is from the rising 8 and 20-day EMAs (11,275ish)

Per intraday alert, $TGLS was added to the model portfolio on a breakout above $32. We liked the strong rally from the gap up with bullish price and volume action. The consolidation was tight with volume drying up.

The weekly chart is sitting just below all-time highs.

There is one new setup for Friday’s session in $JD.

We like the tight action on the daily chart with the 8-day EMA catching up. Our buy entry is over the two-day high with a stop below the 20-day EMA to allow for some wiggle room. One could also use the current two-day low as a stop.

Unofficial Setups

- Longs – $DE $PEN $PODD $PDD $SUPN $AMBA

- Shorts –

See you in the chat room,

Rick

Click here to view this week’s watchlist in google sheets

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.