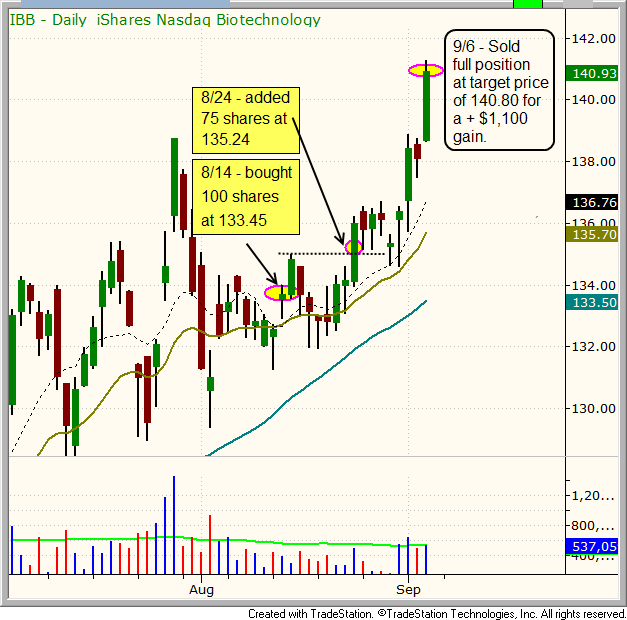

In this August 14 post to our trading blog, we explained the technical setup for our swing trade entry into iShares Nasdaq Biotechnology Index ($IBB). We then followed up with this August 23 post that showed the technical analysis criteria for a secondary buy setup for swing traders who missed our initial buy entry. Last Thursday, September 6, we sold IBB for a 7-point gain when it hit our original price target of $140.80. In case you missed our initial explanation for swing trade entry into this bullish ETF, we suggest reviewing those two posts above, then read the next paragraph, which details last week’s exit strategy.

Because our stock and ETF trading newsletter, The Wagner Daily, is fully designed to be an end of day stock picking service, the rules our trading system dictate that we automatically sell our open positions whenever they hit their price target or protective stop loss (whichever comes first). On September 6, via Courtesy Trade Confirmation alert to subscribers, we confirmed the exit of our $IBB position when it hit the official target price of $140.80. Upon doing so, we locked in a solid gain of $1,100, which was a 5% gain from our entry point (equal to a 2% gain in our model trading portfolio).

Although $IBB can easily move higher from here in the intermediate term, we do not mind selling into strength and moving on to the next trade. This is especially true considering the general lack of follow-through we’ve been seeing in the stock market for the past several months until only the past week or so.

The daily chart pattern below details our exact entries and exit prices for the $IBB swing trade. As explained on the chart, our initial buy entry was on August 14, but we initially entered the trade with reduced share size in order to minimize risk. However, the tight price action over the next seven days was bullish, and allowed us to increase our exposure with a second low-risk entry point on August 24:

For individual stock swing trades, we typically seek to gain 15 to 20% returns on the stock price. However, for ETF trading, our average returns are usually 5 to 10% because ETFs are usually less volatile than individual stocks. The combination of trading both individual stocks and ETFs in our newsletter enables us to realize maximum gains in strongly trending, healthy markets, while still having the ability to profit from from trading currency, commodity, international, or fixed income ETFs, all of which typically have a low correlation to the direction of the stock market, in choppy or range bound market environments. You can learn more about the details of our swing trading system by clicking here.

If you profited from this $IBB trade with our entry and exit signals, or perhaps managed the trade in a different way, feel free to leave us a comment below. We’re always interested in what our fellow swing traders are up to.