When the market enters correction mode, leading stocks often provide low-risk buy entries as they pull back to key support of their 10-week moving averages. Here’s how to profit from applying this simple trading strategy to top stocks on a pullback now.

With both the NASDAQ and S&P 500 recently breaking below support of their year-long uptrends, most stocks in the market are now well off their highs.

Many under-performing stocks now have badly damaged chart patterns that will take a long time (if ever) to revert to a bullish trend again.

However, select leading growth stocks with relative strength are still holding above key support levels that could enable them to ascend to new market leadership when the bulls return.

One simple way to find the next potential big winners is to buy strong stocks that are now pulling back to their 10-week moving averages.

Continue reading to discover how to pump up your portfolio from applying this basic trading strategy to the current market.

Why the 10-week MA matters so much

Most of the stocks we buy in The Wagner Daily model portfolio are breakouts from a solid base of consolidation.

However, we also score big gains from buying pullbacks of explosive growth stocks pulling back into key support of their 10-week moving averages (10-week MA).

Mutual funds, hedge funds, and other institutions often buy hot stocks when they retrace to their 10-week MAs–a closely-watched indicator of intermediate-term trend.

Following institutional money flow into leading stocks is always a great way to put the wind on your back.

What to look for when buying a pullback to the 10-week MA

Whenever a stock breaks out from a solid basing pattern and goes into trend mode, we then monitor for pullback entries using moving averages on the daily and weekly timeframes.

As short to intermediate-term swing traders, most of our pullback entries into leading stocks is on pullbacks to the shorter-term 10 and 20-day moving averages.

However, we also look for pullbacks to the 10-week MA on the weekly chart.

This type of pullback does not occur as frequently as a pullback to the 10 or 20-day MA, but it is a highly reliable buy signal that often offers a lower-risk entry point.

Below are a few examples of what to look for when buying a pullback to the 10-week SMA.

First, we look for a strong breakout from a valid basing pattern.

The breakout (before the pullback) should be a move to new 52-week highs, and confirmed by increasing volume.

Look for stocks that may have recently touched the 200-day moving average, or have come close to touching the 200-day MA during the base that preceded the breakout.

This helps identify candidates that are not too extended and have room to run.

In stocks that are extended 20%-30% or more above the breakout level, look for pullbacks to the rising 10-week MAs that do not touch the 50-day MAs on the daily chart.

This occurs quite often.

Chart walk-throughs: Putting it all together

Let’s walk through the charts of a few examples to show you exactly how it works.

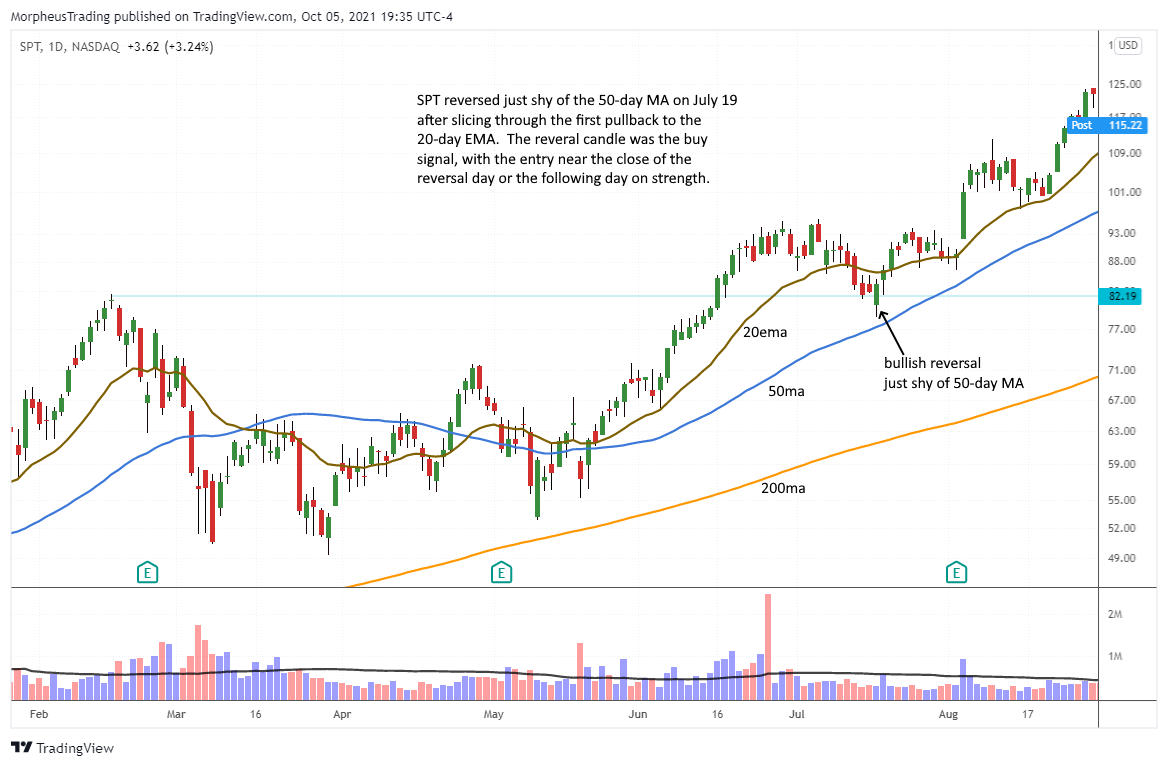

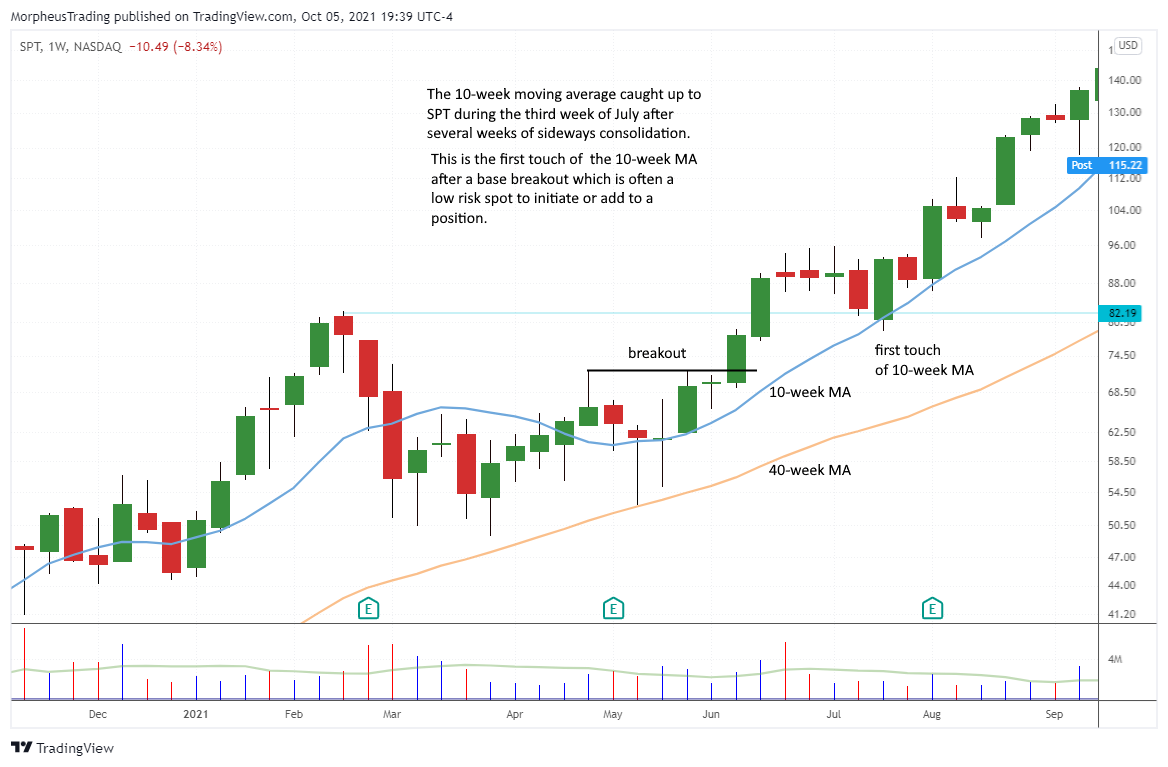

Sprout Social ($SPT)

Recently, Sprout Social ($SPT) enjoyed a strong breakout on high volume from a lengthy base.

As we look for, this was followed by a pullback to the rising 10-week MA.

The breakout and subsequent pullback to the 10-week MA is shown on the weekly chart of $SPT below:

When you first spot a stock that has retraced to its 10-week MA, it is a signal to begin looking for an entry on the daily chart timeframe.

We typically look for the confirmation of a short-term bottom by waiting for a bullish reversal candle (such as a hammer).

Drilling down to the shorter-term daily chart below, notice how $SPT stopped just shy of its 50-day MA and closed with a bullish reversal candle:

When you see this type of reversal bar on the daily chart, one possible swing entry is waiting for the price to move above the high of the reversal candle.

Once triggered, the price should not come back down beneath the low of the reversal candle, which is an ideal level to place your protective stop.

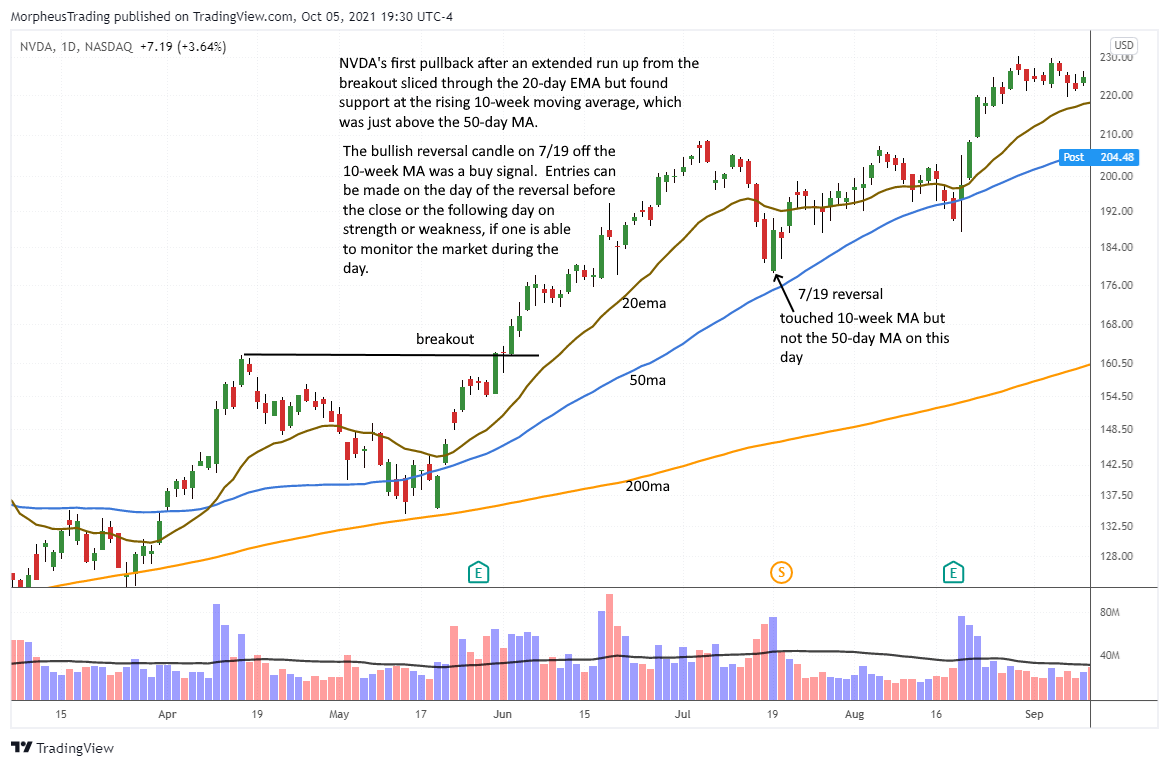

Nvidia ($NVDA)

The weekly chart of leading tech company Nvidia shows a strong breakout on volume from a lengthy base on base type pattern, followed by a pullback to the rising 10-week MA.

Again, the first touch of the 10-week MA is a signal to begin looking for some sort of entry on the daily chart.

The pullback to the 10-week MA is shown on the weekly chart of $NVDA below:

Like $STP, the pullback in $NVDA stopped just shy of the 50-day moving average on the daily chart and formed a bullish reversal candle:

On this chart, a potential entry trigger could be a rally above the July 19 high, which triggered two days later.

Again, a protective stop can be neatly placed beneath the low of the reversal candle.

4-step checklist for buying top stocks pulling back to their 10-week MAs

The pullback to the 10-week moving average is often a fantastic, low-risk entry to climb aboard a leading stock in a strong uptrend.

Here is a simple, 4-step summary checklist to help you find top stocks pulling back to their 10-week MAs:

- Stock breaks out from a valid basing pattern on higher volume and rallies to a new 52-week high.

- Stock pulls back to touch support of the 10-week MA and ideally just missed the 50-day MA.

- Wait for bullish reversal pattern on daily chart, then buy above high of the reversal bar.

- Set protective stop below the low of the reversal bar.

Of course, not all pullback entries will quickly rally back to new highs within a week or two–like $SPT did.

Some stocks, such as our $NVDA example, may need a bit more time before moving out.

Regardless, these pullback entries are pretty low-risk and tend to hold up well.

Subscribe now to The Wagner Daily to be instantly alerted to the next hot stock we buy on a pullback to the 10-week MA (and many other explosive swing trade setups).