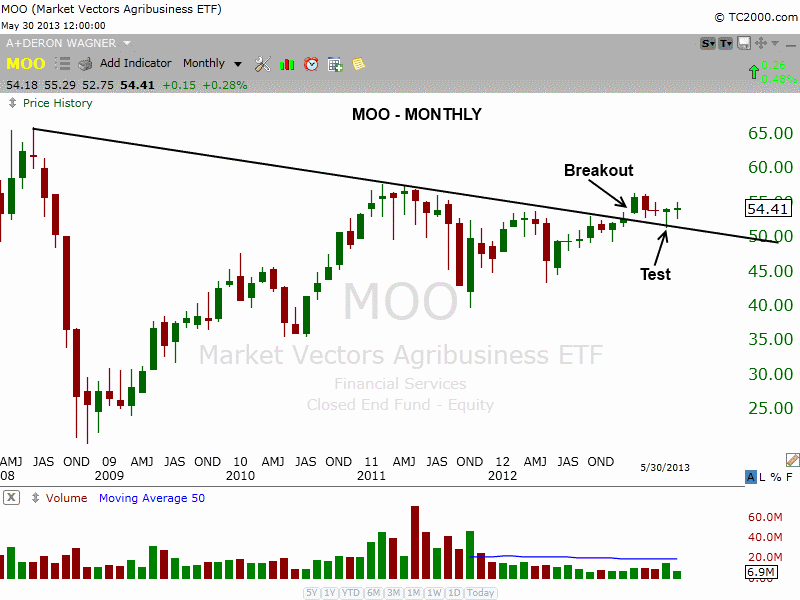

Although commodity-based stocks have been a big laggard this year, we have noticed some relative strength in Market Vectors Agribusiness ($MOO). After breaking a long-term downtrend line and successfully testing that line last month, we could possibly see a breakout entry emerge down the road (if the price action remains in a tight range. $MOO is not actionable now, but should be added to your radar screen as a potential buy entry. Here is the monthly chart:

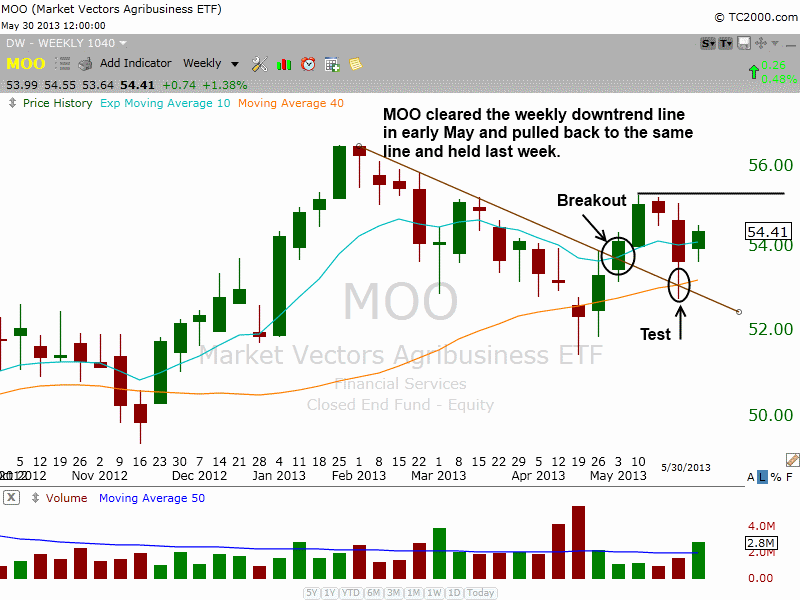

Dropping down to the weekly time interval, we see the 10-day MA (teal line) above the 40-week MA (orange line). Like the test of the downtrend line on the monthly chart above, we see the same below, with last week’s test of the downtrend line and the 40-week MA.

For this setup to remain constructive, the price action should hold above the 40-week MA and the higher “swing low.” It may take several weeks for the price to tighten up on the right hand side, so we will place $MOO on a second tier watchlist (one that is reviewed only on the weekends):

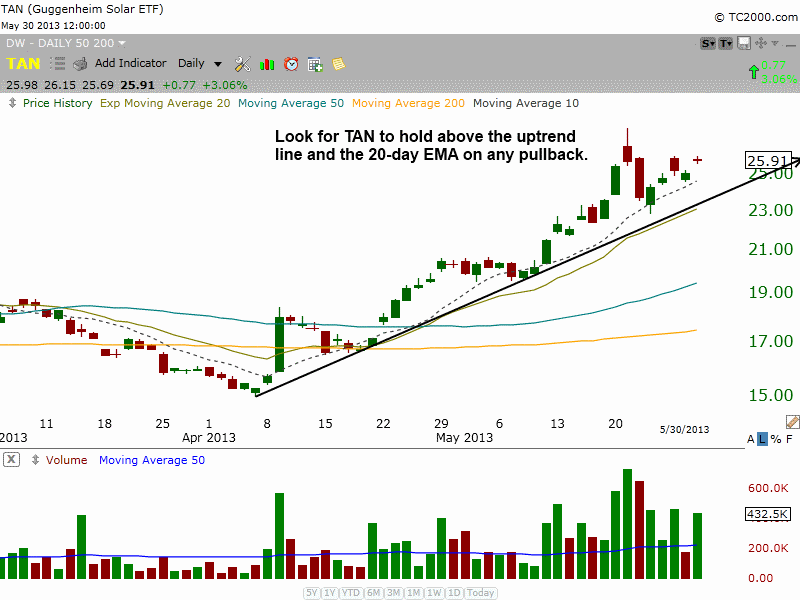

After finding support around the $23 area, Guggenheim Solar ETF ($TAN) continues to push higher, above the rising 10-day MA. As you may recall from this recent blog post, we’re holding a long position in this ETF (currently showing an unrealized gain of 10.5% since our May 23 pullback entry). The daily chart below details the support in $TAN:

Should $TAN fail to punch through the $26 level and pull back in (for a week or two), there is solid support from the uptrend line and the 20-day EMA around $23. Overall, this ETF continues to show great relative strength as the broad market consolidates.

In addition to $TAN, we also bought Market Vectors Semiconductor ETF ($SMH) when it pulled back on May 23. It too continues to act well, and closed yesterday right at resistance of its prior swing highs from mid-May. As such, we are selling partial share size on today’s open, just to lock in a decent gain on this short-term momentum trade. We will trail a protective stop higher on the remaining shares.

As mentioned earlier this week, our ETF scans have not produced much in the way actionable setups, so a short-term break in the market should eventually produce some low-risk buy points. Until then, we will simply remain patient and focus on managing existing positions.

The commentary above is a shortened version of the May 31 issue of The Wagner Daily swing trade newsletter. Sign up today for your risk-free 30-day trial subscription by clicking here.