Jack Loftis has been snagging an 80-90% win rate on his ETF and option swing trades in this volatile market. Continue reading to find out how.

Note from Deron: Following is a new guest blog post from Jack Loftis I thought you might enjoy. Jack is the founder of ETFSwingTrader.net and my long-time trading friend. Enjoy!

I’ve been using the same swing trading methodology at my website for the past 10 years.

Trading with my own funds, most years have averaged around a 2% monthly increase to my large retirement fund.

But between a dysfunctional D.C., Trade Wars, Brexit, etc., the first part of this year has challenged my discipline more than any time in recent memory.

Yet this market CAN be successfully traded.

Continue reading to see two actual examples of winning ETF trades I recently sold with my rule-based trading system.

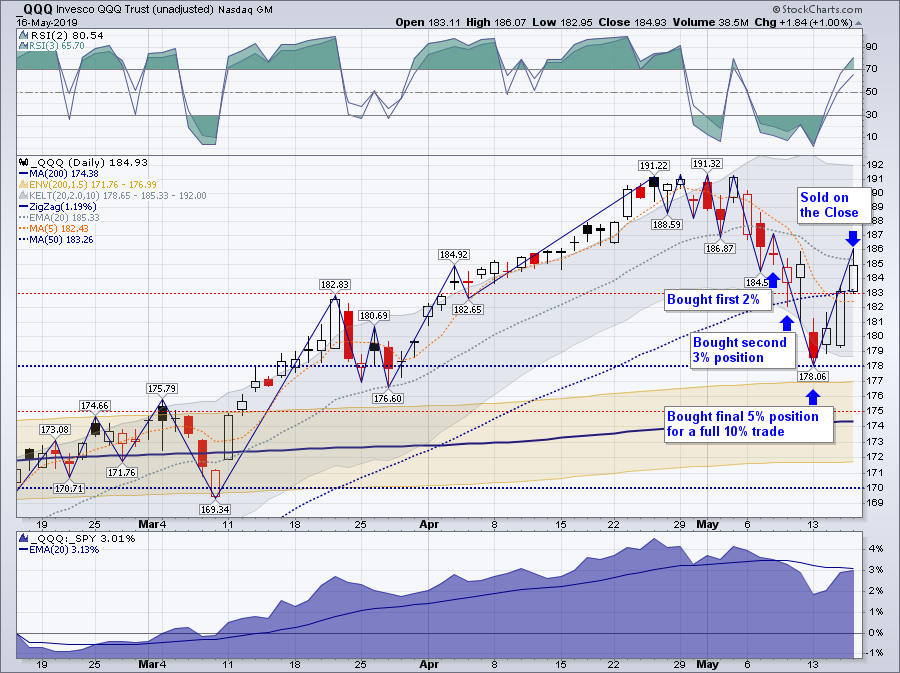

$QQQ – Profiting from “mean reversion” method

Below is a swing trade we recently closed profitably, which demonstrates how a progressive, “mean reversion” methodology can yield 8-9 winners out of every 10 swing trades.

The daily chart of $QQQ below shows where we bought and sold $QQQ in my ETF swing trading service:

On May 8, I opened an initial position in $QQQ based on the top panel in my chart, which showed the 2-period RSI indicator oversold for several days.

Since the oversold RSI indicator coincided with $QQQ still being above its 200-day moving average, the dominant uptrend was still in place.

On May 9, this Nasdaq index ETF closed lower, so we methodically added to the position.

I typically use a 2-3-5% progression, enabling me to commit 5% of my total (large) portfolio to this trade by the end of the day.

Keep in mind that a “swing trade” is a quick trade that we hold for an average of just five days.

I only trade ETFs and leveraged ETFs, so this is much less volatile trading than when working with individual stocks.

$QQQ – Mean reversion strategy for a quick gain on a 3-day hold

After a slight bounce the next day, to make me think I was a timing genius, the bottom fell out of the market the next day.

Since $QQQ had fallen to what appeared to be a support level at $178, we made our final addition of 5% to the trade, for a total of 10% committed.

By the way, it has taken me years of seeing this process work to be willing to make this large of a trade based on these setups.

We were rewarded the next day with a bounce.

And then another spike the following day.

On the third day of the trade, the RSI-2 indicator (in my top panel) reached overbought levels, signaling it was time to exit.

The daily chart of $QQQ above shows the trade entry and exit points.

Small gains with a high win rate add up quickly

Between the two ETF swing trades, we locked in a solid profit of several percent in around 7 trading days.

Although this may seem like a small percentage win, we actually executed the trade using $TQQQ, the 3x leveraged version of $QQQ.

As such, I made a 3-4% profit on a huge dollar trade in just a few days. Put another way, I added around 0.4% to my entire net worth over several days.

Now, imagine doing this kind of trade 10 times a month — with never more than 2-3 active trades at a time.

Imagine how focused you could be on those trades.

“Why did you buy too early?”

Right about now is when I usually get the question of whether I entered this trade TOO SOON.

If only I had magically known the exact day of the reversal, I indeed could have done even better. Wish I had pre-vision!

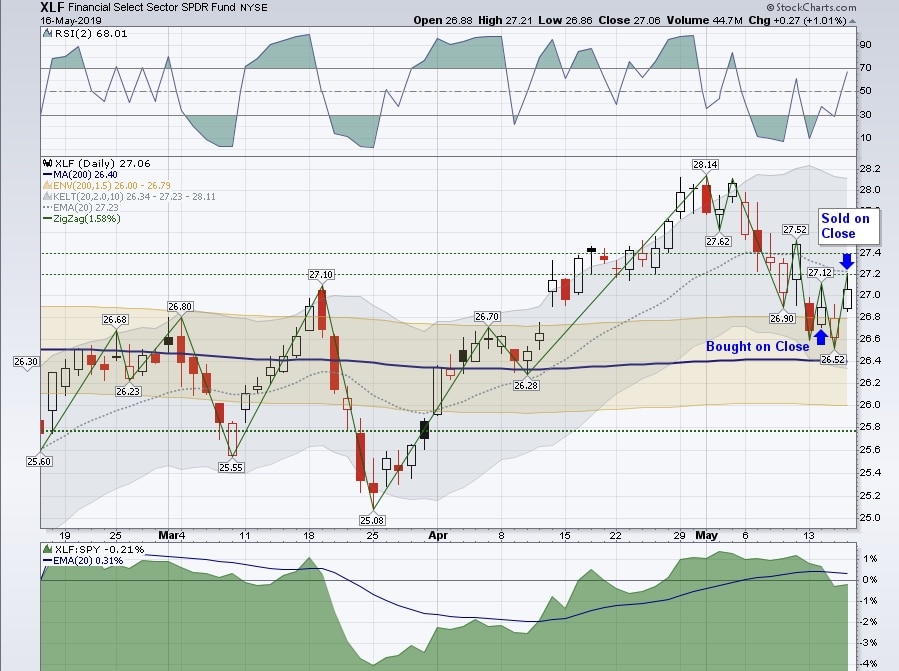

The reason I methodically build my long trades as an ETF falls is shown by a second trade I initiated in the middle of the $TQQQ trade.

I opened a 2% initial position in $FAS (the 3x leveraged version of $XLF Financials) on May 14, which was close to the day we made the final addition to the $TQQQ trade.

$FAS immediately reversed for over a +3.4% two-day profit.

Put another way, I am greedy because I’ll take the quick small profits, as well as the larger longer-term big profits.

As long as my portfolio continues to methodically increase, I’m happy.

By the way, there is no trading during the day with my ETF and option swing trading service – all trades are made when the market closes, using Market on Close orders.

Subscribers who received my Final Trade email (one hour before the market closed) made over +4% on these two trades.

Next time we talk, I’ll point out how this works in a downtrending market or sector (using inverse ETFs).

I will also show you how the OPTION results based on these ETF setups can average +20% profit – taking into account all trades, both winners and losers.

Finally, this is a rule-driven, disciplined trading methodology — not just discretionary trading.

That means these types of results are reproducible – again and again and again.

Check my website for an example of an entire year’s worth of ETF trades and how they added to my net worth.

Options trader? Send me an email at [email protected] and I’ll send you a 3-page discussion of the actual initial options trades I took that matched these ETF trades for the smaller accounts. Also, I’m happy to answer any questions you have. Just shoot me an e-mail.

Good trading to you!

Jack

This is right out of the Larry Connors ETF trading books.

Thanks for your feedback, Anon. However, as we mentioned to John, after 10 years of using a methodology based on Connors work I’ve learned there are a number of challenges to making these strategies work in the real world. One key ingredient for success is the selection of which trade to take — since when there are signals for new trades there tend to be a LOT of signals at once. My use of intermarket analysis and some basic technical charting increases the win rate significantly.

Also, Larry only provided a generic approach to doing OPTIONS versions of these trades. I have greatly finetuned the entry and management rules for these trades, which can be more appropriate for smaller accounts. And I’ve got two options strategies (ETF-ATM and ETF-RS) that have great results, differing in aggressiveness and return rate.

Finally, I find that to successfully implement these strategies is a lot of hard work. I do this work for subscribers, including identifying the best candidates for options trades. And as we discovered when first implementing these contrarian trading strategies, it is very helpful to have a “trading partner” (such as myself) along side you as you learn to trade this methodology.

All in all I provide a means for traders to learn the real world application of this “reversion to trend” methodology in real time. And since I’m basically just posting my own trades and rationale, we make money together. And when there are downdrafts, my money is just as much at stake as any subscribers. It’s a formula that works.

Hope this is helpful.

Jack

Jack Loftis PhD

ETFSwingTrader.net

This is nothing new, right out of the Larry Connors ETF trading book…

Hey John,

After 10 years of using a methodology based on Connors work I’ve learned there are a number of challenges to making these strategies work in the real world. One key ingredient for success is the selection of which trade to take — since when there are signals for new trades there tend to be a LOT of signals at once. My use of intermarket analysis and some basic technical charting increases the win rate significantly.

Also, Larry only provided a generic approach to doing OPTIONS versions of these trades. I have greatly finetuned the entry and management rules for these trades, which can be more appropriate for smaller accounts. And I’ve got two options strategies (ETF-ATM and ETF-RS) that have great results, differing in aggressiveness and return rate.

Finally, I find that to successfully implement these strategies is a lot of hard work. I do this work for subscribers, including identifying the best candidates for options trades. And as we discovered when first implementing these contrarian trading strategies, it is very helpful to have a “trading partner” (such as myself) along side you as you learn to trade this methodology.

All in all I provide a means for traders to learn the real world application of this “reversion to trend” methodology in real time. And since I’m basically just posting my own trades and rationale, we make money together. And when there are downdrafts, my money is just as much at stake as any subscribers. It’s a formula that works.

Hope this is helpful.

Jack

Jack Loftis PhD

ETFSwingTrader.net

Mean reversion trading tries to capitalize on extreme changes in the price of a particular security, assuming that it will revert to its previous state. Thanks for great post

Thanks, Vinay Nair. We’re glad you enjoyed the post!