I grew up in York, Pennsylvania, which is only about a thirty minute drive to Hershey, home of America’s favorite chocolates.

As a teenager, I used to love visiting Hersheypark, a pretty cool amusement park on the Hershey grounds, specifically to ride the roller coasters.

As a middle-aged adult with responsibilities, I rarely get the pleasure to visit Hersheypark these days, but lately I’ve been getting plenty of thrills and chills from the stock market alone.

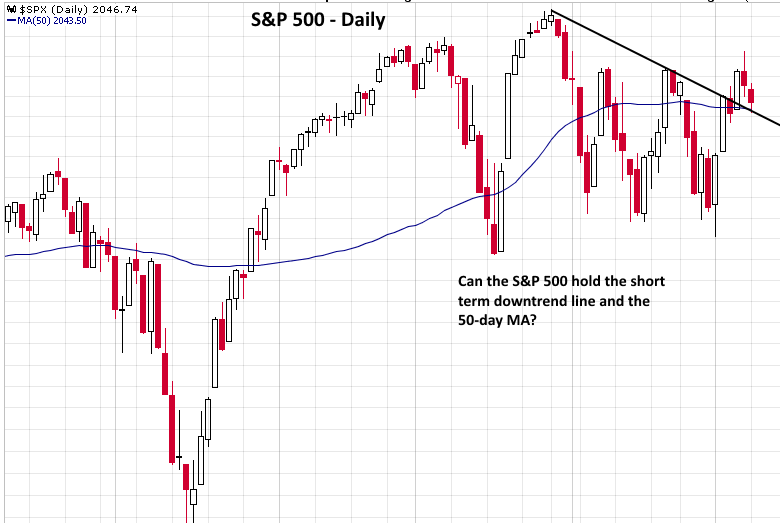

Lately, the S&P 500 Index has been a roller coaster with lots of hills and valleys, but ultimately looping back around to the starting point (though may soon break out above the range if current price holds).

Although day to day volatility has been pretty substantial in the S&P 500, the benchmark index has merely been oscillating up and down in a wide, sideways range over the course of several months:

When stocks are so indecisive on a day to day basis, it may be a decent market environment for daytraders who exit all their positions by every day’s close.

But it has admittedly been a challenging environment for trend traders who typically hold stocks for weeks to months.

Gold – Low-Correlation Trading Solution

Without even looking at a chart, I can tell you one of the best things about trading a Gold ETF or the spot gold futures is that the shiny yellow metal is typically not closely tied to the day to day movement in the stock market.

As such, the challenge of the roller coast stock charts becomes a moot point and it only comes down to a matter of making sure gold is sitting a technically buyable level.

Is it?

Right now, select gold ETFs are indeed presenting low-risk buy entry points, but the patterns will soon lose their bullishness IF gold shares do not catch a bid and start rallying again within the next few days.

The two main ETFs we trade are SPDR Gold Trust ($GLD), which tracks the price of spot gold futures, and Junior Gold Miners ($GDXJ), which is comprised of a basket of smaller gold mining stocks.

Between the two, $GDXJ has clearly been showing relative strength to $GLD, so the Junior Gold Miners ETF has better odds of rallying to a new swing high before $GLD. Take a look:

In late December, $GDXJ made a sharp move off the lows that lasted three weeks.

Since peaking in late January, the ETF has been in pullback mode, and is now holding above its 50-day moving average (teal line), but stuck just below resistance of its 20-day exponential moving average (beige line).

After $GDXJ pops back above its 20-day EMA (above the $27.60 area), buyers should step in due to break of key moving average resistance, as well as a break of the downtrend line from the January high.

Don’t Cross That Line

The first pullback to a rising 50-day moving average after a couple months of bottoming action is bullish, and typically presents a low-risk buy entry point.

In this case, further support is provided by the highs of the last base (resistance always becomes support after the resistance is broken).

However, all bets for another rally are off if $GDXJ fails to hold above its 50-day MA, which is definitely the “line in the sand” with this setup.

Furthermore, this trade setup will no longer be appealing if $GDXJ does not wake up and rally above the highs of its recent range within the next few days.

Pullbacks off the highs that are succeeded by tight-ranged price action should snap back quickly after shaking out the “weak hands.”

Go Confidently, But With Vigilance

Given the lack of follow-through in the stock market lately, we are pleased that the chart pattern of this low-correlation ETF is presenting traders with such a low-risk buy entry point.

Still, we must remain vigilant with all new trades now, and not be afraid to quickly scratch the trade, or bail for a small loss, if this gold mining ETF does not catch a bid soon.

If you’re tired of riding the stock market roller coaster and are looking for sound, short-term trading alternatives, subscribe now to receive our exact entry, stop, and target prices for this $GDXJ trade setup (and others like it, sent to you every night).

What is your price for this service?

thanks!

I believe,this is high time to start accumulating gold. Downside is limited.

I’m always hesitant to say “downside is limited” unless the stock/ETF is already near zero.

HOWEVER, I definitely think the risk/reward ratio for buying gold remains firmly positive right now.