As recently discussed in my March 26 blog post, banks, mutual funds, hedge funds, and other institutional funds have been rotating out of the NASDAQ and into the S&P 500 and Dow Jones in recent weeks.

As recently discussed in my March 26 blog post, banks, mutual funds, hedge funds, and other institutional funds have been rotating out of the NASDAQ and into the S&P 500 and Dow Jones in recent weeks.

Although this has been leading to moderately bullish price action in select blue-chip stocks such as $IBM, more explosive, high-momentum moves have been coming from various commodity-based ETFs (which have a low correlation to the direction of the overall stock market).

Today, I share with you the technical setup of one of the best looking ETF trade setups out there right now, so read on for all the details…

Corn Is Popping!

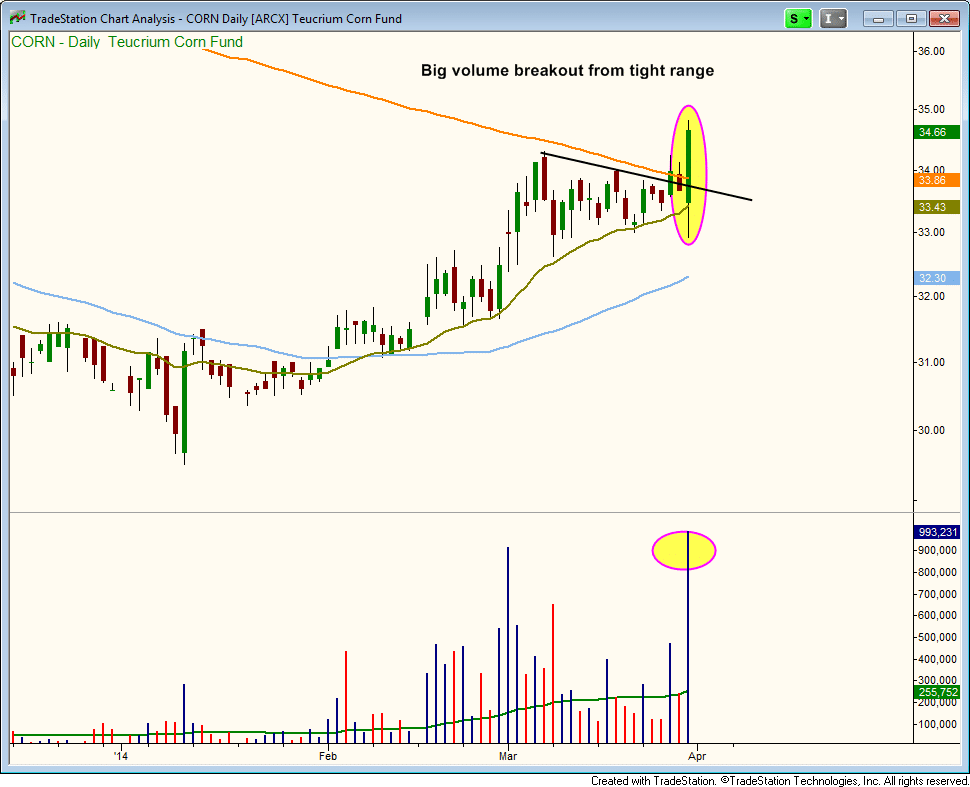

Designed to follow the price of continuous corn futures contracts, the Corn ETF ($CORN) broke out from a short-term consolidation on heavy volume yesterday (March 31), after a three-week consolidation.

Note the drop off in volume during the base of consolidation, which was bullish:

The “undercut” of the 20-day exponential moving average that occurred on the morning of March 31 was followed by a breakout above the high of the recent range (from shakeout to breakout in a few hours).

Confirming the massive intraday reversal and breakout was a huge volume spike (nearly 400% it average daily volume).

Whenever volume suddenly surges so massively as a stock/ETF breaks out above a tight range, it is the undeniable footprint of institutional buying activity, which acts as a gas pedal to propel the stock/ETF higher in the near to intermediate-term.

Corn Confirmation On Weekly

Since a key part of our technical analysis is always looking for confirmation on multiple time frames, let’s zoom out to look at the longer-term weekly chart of $CORN:

On the weekly chart above, notice the tight price action near resistance of the 40-week moving average (similar to 200-day moving average) over the preceding four weeks.

When the price of $CORN broke out yesterday, it pushed above the highs of that 4-week range. It’s also quite bullish that yesterday’s volume alone nearly equaled turnover the entire previous week.

With such strong volume confirming a clean weekly breakout and trend reversal, bullish momentum is likely to carry $CORN substantially higher over the next several weeks.

As such, we have added $CORN to today’s Wagner Daily watchlist as a potential buy entry in our ETF portfolio. Regular subscribers should note our exact buy trigger, stop, and target prices for this trade setup in the “Watchlist” section of today’s report.

Nice ETF To Buy Now, But What About Individual Stocks?

Large-cap tech stocks have had a rough go of it lately, as most completely ignored the solid gains of yesterday’s market rally.

Household tech names like $AMZN, $PCLN, $GOOG, $NFLX, $TSLA, $FB, $EBAY, $BIDU, and $GMCR either closed in negative territory, or near their lows of the session (despite a 1.0% gain in the NASDAQ Composite).

Clearly, market leadership is broken.

Since this is the basis of our intermediate-term position trades in individual stocks, the next step is to simply wait for new leadership to emerge (which eventually happens after each significant stock market correction).

Overall, there simply isn’t much to do on the stock side. We will merely continue to lay low and wait for setups to develop on either side of the market (long or short).

Although our nightly swing trading newsletter is basically a dynamic service that generates specific stock and ETF trade ideas, the main goal of our trading system is to aggressively trade the best technical trade setups when conditions are ideal, but also be ready and able to quickly and cut back market exposure by reducing position size on new trades (or simply not trading at all) when market conditions deteriorate.

It is impossible to trade every single wave in the market, and trying to do so will lead to over-trading and eventual burnout.

In challenging market conditions, simply learning how to hold on to hard-earned profits earned in the good times is a critical skill towards become a winning trader over the long-term.

As such, let’s be patient and wait for our pitch.

What do you think? Have you already learned the importance of knowing when it’s time to lay low? Drop us your thoughts below.

deron…I’m a former subscriber my issue remains this….while you (and perhaps others) may maintain a good performance record to attain it I must trade ALL your trade selections, otherwise I can’t replicate your performance. that is too difficult, both in terms of execution and time……just some thoughts…thanks