After weeks of heavy selling, the Nasdaq has formed a bullish reversal pattern. Will the rally attempt have legs?

Continue reading to discover four simple, reliable signals to know when the market may be forming a significant bottom.

In the February 24 issue of The Wagner Daily that we sent to members on Wednesday evening, we discussed the possibility of a gap-down reversal in the next session.

Fueled by initial selling pressure from the announcement of war in Ukraine, US stock futures were down more than 2% in after-hours trading.

This news-driven gap down was already following a two-week selloff in the Nasdaq and S&P, and caused the major indices to undercut support of a major prior low.

All of this set the stage for a bullish reversal on open–though we certainly did not expect such a massive advance!

The Nasdaq Composite gained +3.3% for the day, as volume ticked higher as well.

Even more impressive is that the Nasdaq rallied 7% off the day’s low and almost formed a bullish engulfing day!

The big green candle on the chart below shows the Nasdaq’s huge gap down, below the prior January lows, followed by the huge reversal higher:

Will the bullish reversal have legs?

In order to help determine if a market index like the Nasdaq may be forming a significant bottom, we look out for four key signals below:

4 Key Signals to Look for a Potential Market Bottom

- Higher lows – The market index should hold the low set on day one of the new rally attempt.

- Moving averages – The index must reclaim its 10-day moving average, and eventually reclaim the 20-day EMA within a few weeks.

- Follow-through day – A follow-through day buy signal (explained below) must occur on day 4 or later after the start of a new rally attempt (may occur before or after the index reclaims the 20-day EMA).

- New leadership – A small group of stocks will start to emerge as new leaders by showing top relative strength to confirm the fresh new buy signal.

The IBD follow-through day occurs when a market index gains at least +1.5% on higher volume on day 4 or later after a bullish reversal off the low.

Although the well-known follow-through day is still a valid buy signal, we place more weight on the index also reclaiming the 20-day EMA.

Good things tend to happen once an index is above the 20-day EMA, so there is no need to rush to buy.

3 charts of previous Nasdaq bottoming action

Below are three examples of bottoming action on the Nasdaq daily charts since 2016.

Of course, not every bottom will play out like these examples–these charts are just a guide.

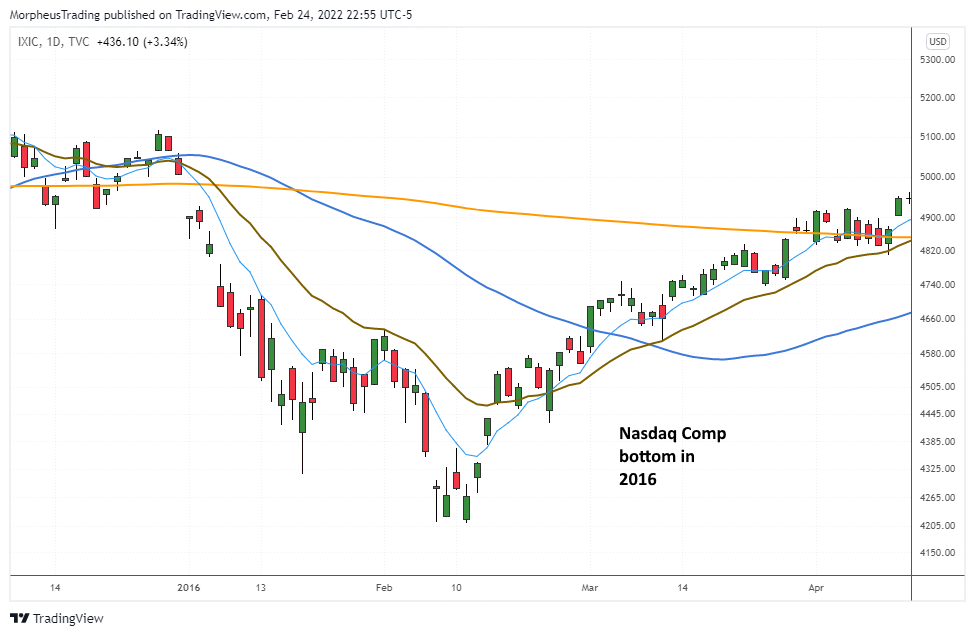

Nasdaq – February 2016 bottom

In 2016, the Nasdaq Composite reclaimed its 20-day EMA (beige line) in four sessions:

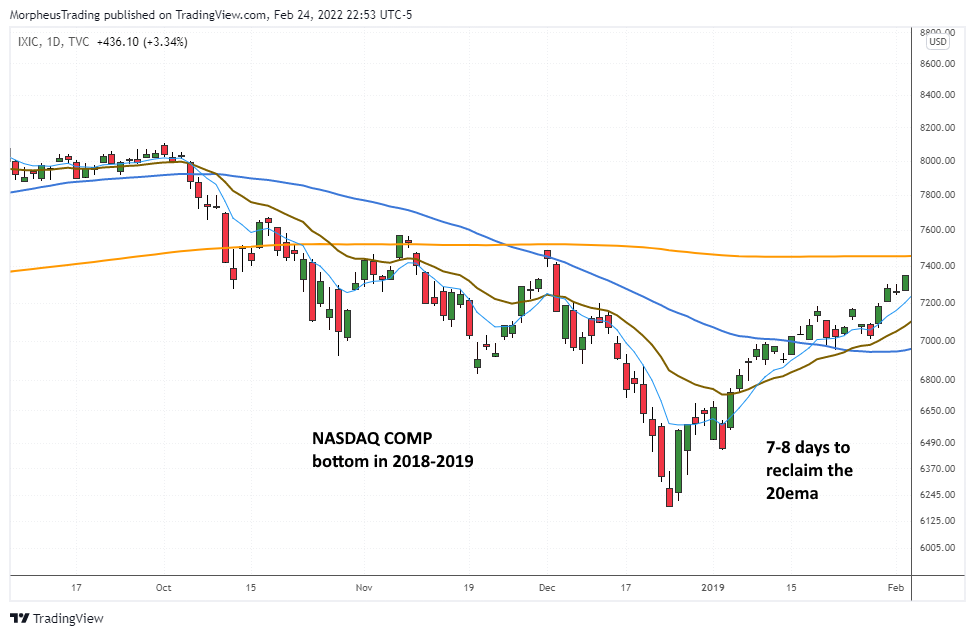

Nasdaq – December 2018 bottom

In 2018, the Nasdaq Composite moved back above its 20-day EMA in about 8 days:

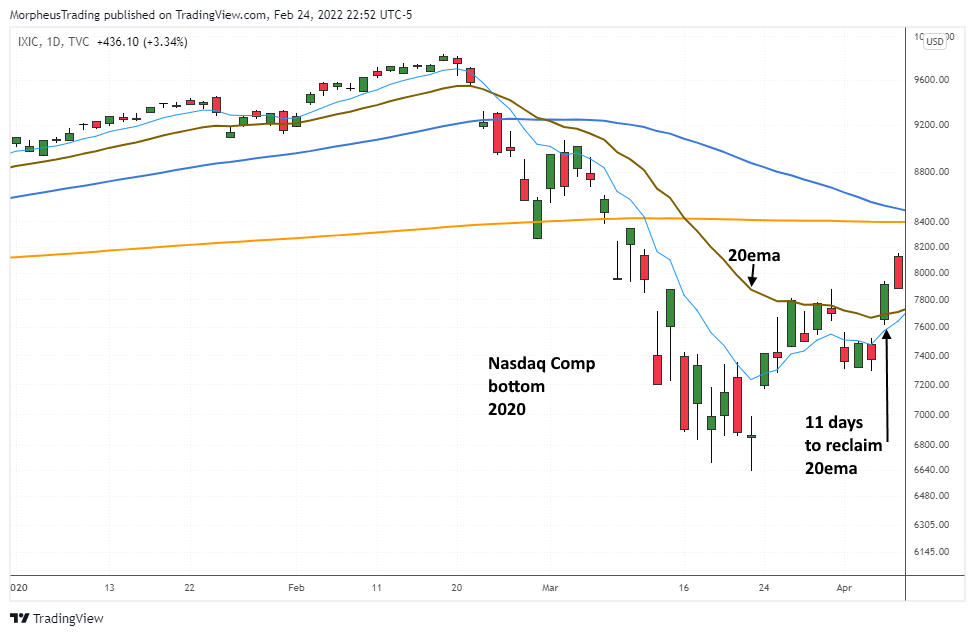

Nasdaq – March 2020 bottom

In 2020, the Nasdaq Composite took 11 days to reclaim its 20-day EMA:

The Trading Plan

It’s only the second day since the Feb.24 bullish reversal day, so we do not yet have confirmation that the Nasdaq has put in a significant bottom.

From here, we will be looking for a follow-through day to occur after day 4 or later of the rally.

We also are looking for the Nasdaq to reclaim support of its 20-day exponential moving average, currently at the 13,910 level.

Finally, we are also looking for the emergence of new leading stocks to lead the Nasdaq higher.

For now, our short-term plan in the Wagner Daily portfolio is to wait for some sort of low-risk buy point, such as a tight-ranged inside day in faster-moving stocks bouncing from deeply oversold levels.

If the rally attempt begins to show signs of sticking, then we will focus on the more classic CANSLIM patterns such as the cup with handle, flat base, or double bottom.

SIGN UP NOW to receive our nightly stock trading report to be instantly alerted to our next explosive stock pick.