Seven of the eight ETF swing trades in the model swing trading portfolio of our Wagner Daily newsletter are presently showing unrealized price gains (no complaints there).

Seven of the eight ETF swing trades in the model swing trading portfolio of our Wagner Daily newsletter are presently showing unrealized price gains (no complaints there).

However, most of our current ETF positions are industry sector ETFs with a significant correlation to the direction of the main domestic stock market indexes.

As such, we are now seeking to add a bit of international ETF exposure to the mix, and we now have three Asian ETFs on our potential breakout watchlist: iShares South Korea ($EWY), iShares Hong Kong ($EWH), and PowerShares China ($PGJ).

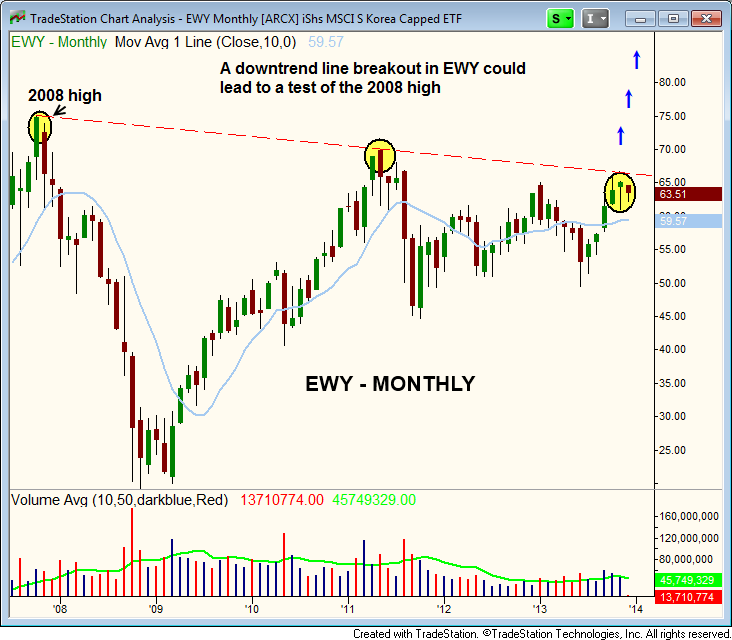

Korea Confirmation – $EWY

When stalking stocks and ETFs for potential breakout buy entry, we always prefer to see confirmation on charts of multiple timeframes (as opposed to just the daily or weekly charts) because it increases the odds of a successful breakout that follows through to the upside.

$EWY is one such ETF that fits the bill because it is setting up for potential breakout on the daily, weekly, and monthly charts (though the daily chart has not yet presented us with a low-risk buy entry point).

Below, the daily chart shows the recent bullish crossover signal when the 50-day moving average crossed above the 200-day moving average. The 200-day MA is beginning to trend higher as well.

This indicates a bullish reversal of the dominant trend:

Notice that $EWY is attempting to set its first “higher low” since pulling back in off the swing high in October.

Over the next week or two, we would like to see the price action tighten up around the 50-day moving average, which would present us with a low-risk buy entry point.

Zooming out to the weekly chart, we see the current base of consolidation that has formed right at the highs of 2012.

The current base is seven weeks old, and for the most part has held above the 10-week moving average (similar to the 50-day moving average).

From here, a breakout above the high of the seven-week base should produce enough bullish momentum to take out the highs of 2012:

The long-term monthly chart below shows the tight price action of the past few months. A breakout above the $66 level should lead to a test of the 2011 high (around $70), and potentially a test of the 2008 high at $75:

Hong Kong Crossover – $EWH

After breaking down below the 40-week moving average (orange line below) during the summer, $EWH popped back above the 40-week MA in September.

A few weeks later, the 10-week moving average (teal line) crossed above the 40-week moving average.

This is a known a bullish moving average crossover (which was also present on the daily chart of $EWY).

As a sole technical indicator, this moving average crossover does not create a valid buy entry, but it shows that bullish price momentum is building in the right direction:

In addition to the 10-week moving average crossing above the 40-week moving average, notice that $EWH has also formed a very tight range above its rising 10-week moving average (yellow rectangle).

If the price of $EWH can continue to trade in a tight range, we should soon see a breakout to a fresh 52-week high.

Nevertheless, the price action needs to stay pretty tight because we do not want to see another test of the 40-week moving average (just below $20).

Chinese Contraction – $PGJ

After an explosive run throughout this past summer, $PGJ eventually ran out of gas and stalled out just above the $30 area.

However, it has since been forming a bullish and constructive base of consolidation (learn about the importance of basing action here).

On the daily chart below, notice that $PGJ has mostly been holding above intermediate-term support of its 50-day moving average.

There were a few minor “undercuts” below that key moving average, but such price action is to be expected when a stock/ETF is basing out:

$PGJ has already established a “higher low” within its base, and a second higher low could be in place by the end of the week.

While forming a base of consolidation, these higher lows and lower highs lead to a tightening of the price action (from the left side of base to the right), which is exactly what we want to see.

Overall, basing action is a pretty simple concept.

Volatility expands when the price begins to decline from the highs, then eventually contracts when a bottom starts to form (higher lows within the base).

After a few weeks of contracting volatility on lighter volume, volatility once again picks up when the stock/ETF eventually breaks out again and resumes its dominant uptrend.

As always, regular subscribers of our ETF and stock picking newsletter will be alerted to our exact entry, stop, and target prices if/when any of these three Asian ETFs meet our specific criteria for buy entry.

I’ve just come across your trading site now, got some great content! 🙂