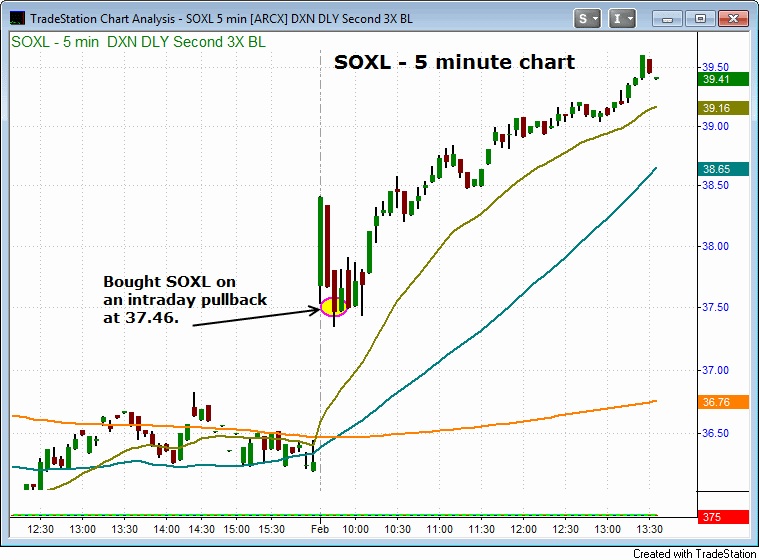

Coming into today, we had a buy trigger in the Wagner Daily newsletter on SOXL just above the January 31st high (Our buy signal was based off the bullish reversal candle of January 30th). However, SOXL gapped to open above our trigger. When stocks gap beyond our trigger, we wait to see if it can rally above its 5 minute high. Shortly thereafter, SOXL sold off sharply and provided us with a pullback buy entry just above the two-day high. In essence, we were able to get filled on the trade very close to our original tigger. This vastly improved the reward-risk ratio of the trade. Further, had we not implemented the five minute rule, we would have gotten a terrible fill and may have been shaken out of the trade.

Here is the original setup on the daily chart:

Here is an intraday 5-minute chart that show’s our entry price:

Although this swing trade is still open, it is already showing an unrealized gain of approximately 2 points (5.3%) since our morning entry. We will continue to monitor price action and look to sell into strength as it nears our target, while trailing a protective stop higher to lock in gains along the way. Subscribers to our newsletter will be kept updated and notified when we exit the position.

“When stocks gap beyond our trigger, we wait to see if it can rally above its 5 minute high.”

Not doubting this great trade, just confused. It does not look like you waited for the stock to rally above the 5 min high. Did I miss something?

Hi Kevin,

On Jan 31 we had to wait for the 5-minute high before entering to prove that the price action had a reasonable chance of holding above the Jan. 30 reversal bar high….there simply wasn’t enough evidence to buy the pullback………

The next morning (Feb 1) we did not wait for the 5 minute high because there was already enough evidence suggesting that the price action was going to hold above the high of Jan 30….so we were ok getting in on a pullback…………We do not buy a pullback on the first day of the gap up….but with the second gap up we were comfortable doing so.

Regards,

Rick

Thank you Rick.

Kevin