We recently bought Mazor Robotics ($MZOR) as a breakout trade, held it for two months, then sold for a gain of +57.6%. Continue reading to find out why we picked this stock for buy entry, and how we determined when to sell for maximum profit.

We recently bought Mazor Robotics ($MZOR) as a breakout trade, held it for two months, then sold for a gain of +57.6%. Continue reading to find out why we picked this stock for buy entry, and how we determined when to sell for maximum profit.

Israeli medical device manufacturer Mazor Robotics ($MZOR) first caught our attention as a potential breakout trade in late August of 2017.

Listing the trade setup in the August 23 issue of The Wagner Daily, we said:

The market timing model remains in neutral, but we do have one new official buy setup in $MZOR.

$MZOR has tightened up on the weekly chart the past two weeks after a false breakout above $43. The price and volume action has dried up at support of the 10-week moving average, which is a bullish sign. We are placing a buy stop order above $39 with a stop below the range lows on a closing basis. $MZOR does have impressive revenue growth the past several quarters (but no eps) and a 96 RS ranking from IBD.

The annotated daily chart below shows how the trade setup looked when $MZOR was listed in the newsletter:

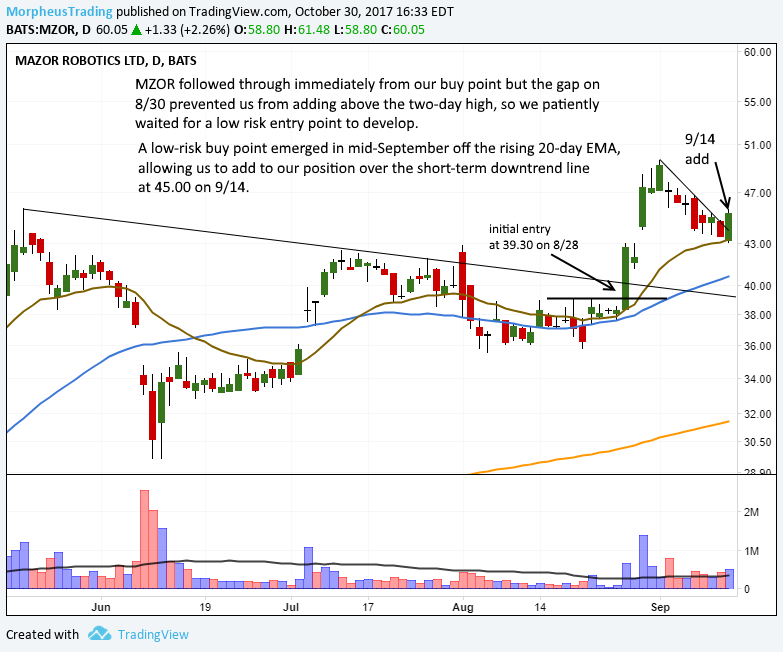

On August 28, $MZOR triggered for buy entry when it broke out above the highs of the range ($39.30 entry).

The trade began moving in our favor immediately after buy entry, which is typically a great sign for a breakout trade.

After the first entry, we planned to add to the position above the two-day high of August 28 and 29.

However, the price action was so strong that Mazor Robotics gapped sharply higher on August 30, well above our planned second entry point (above the two-day high).

Rather than chasing the price action, we decided to patiently wait for a pullback or other low-risk buy entry to develop.

That opportunity for adding shares arrived two weeks later, as the stock pulled back to near-term support of its 20-day exponential moving average (20-day EMA).

We set a buy stop above resistance of the short-term downtrend line that formed during the pullback, enabling us to buy $MZOR at $45.11 on the second buy entry.

We also set a protective sell stop just below the 20-day EMA, minus some “wiggle room” to avoid a shakeout.

Both buy entries are shown below:

Much like the first entry, our second buy entry began working out right away.

Mazor Robotics rallied 13% higher over the next five days, before stalling just above $50.

After a few more days, $MZOR regained its bullish momentum and resumed its steady uptrend over the next few weeks.

This allowed us to hold the full position until October 25, at which time the additional shares hit our tight trailing stop (beneath the prior day’s low at $53.30).

In hindsight, the stop was probably too tight because the stock was still above the 20-day EMA.

However, our goal was to lock in a 20% gain on the additional shares — we scored an 18% gain instead:

After perfectly finding support at its 20-day EMA again, $MZOR rocketed to new highs with an additional gain of +20% over a four-day period.

With an October 31 closing price of $64.56, we tightened the stop on our original shares to $61.95 to lock in profits in case of pullback.

As anticipated, Mazor pulled back the next day and knocked us out of the remaining shares with a gain of +57.6% (from original buy entry of $39.30):

Thanks to this stock’s share price gain of 57.6%, subscribers who bought just 14 shares of $MZOR when we first listed the trade made enough profit to cover the cost of a full-year subscription to The Wagner Daily.

Just 100 shares would have made you enough dough to cover an annual subscription ($299) for the next 7 years.

Obviously, breakout trading is not always this smooth.

But you can clearly put the odds of success in your favor by making sure your breakout trade setups always have the five qualities of the best stock breakouts.

What is your favorite type of breakout trade setup? Drop a comment below to join the discussion.