Mainstream financial news is always eager to tell you where stocks are headed next, but that “noise” leads to ill-timed and emotional trading decisions. Here are three simple steps to block out the noise and start developing your own winning trading system now.

“Where are stocks headed next?”

This is a favorite topic of mainstream financial media outlets, each of which are eager to share their “expert insight” with you.

But the problem is they always contradict each other–and even themselves!

In September and October of this year, we saw many headlines warning about an “imminent stock market crash” that was supposedly “just around the corner.”

The main stock market indexes responded by rallying to fresh all-time highs the following month.

Blindly following the “warnings” would have caused you to miss that entire, explosive rally.

Not surprisingly, those same financial news platforms quickly changed their tune after stocks made those bullish moves to new highs.

After November, those apocalyptic warnings turned to headlines such as “Is a massive new bull market on the horizon?”

Financial media can help you gauge overall market sentiment, but you should never let it blindly influence your trading decisions or cause you to freeze.

If you do, you will surely be faced with constant uncertainty and a never-ending emotional roller coaster every time you make a trade.

3 actionable steps to block out the “noise” on your path to trading success

Rather than being influenced by all the “noise” and trying to predict the market’s next move, ask yourself this question:

“How can I profit from stock trading regardless of what the market does next?”

The answer starts with the basics of simply planning your trades and trading your plan.

If you’re a new trader, we’ve got three easy, actionable steps to help you start scoring consistent gains–regardless of the market’s next move.

If you’re an experienced trader, now is a great time to refresh your mind on three key basics as we approach 2021.

1. Create your Risk/Reward trading plan (and religiously follow it)

A risk/reward ratio is a simple way of comparing your capital risk in a losing trade to the potential reward in a winning trade.

To determine risk/reward for any trade, simply compare the amount of risk to your stop loss with the amount of profit potential to your price target.

For example, let’s assume the following:

- You buy a stock at $85 (per share)

- Your initial stop loss is $80

- Your anticipated price target is $100

- Your risk/reward ratio is 1:3 (risking 5 points to gain 15 points)

Knowing your Risk to Reward ratio prior to entry on every trade is paramount to your trading success.

Jumping into a “good setup” without fully evaluating the risk-reward ratio leads to trades fizzling out, burns through your trading account, and lowers your discipline advantage.

Risk-reward plans are simple to understand, but require emotional discipline to stick with over time.

Most traders understand this simple concept, but fail to plan for this prior to entry.

This is where your discipline gets tested.

Don’t rush to trade–trade to win!

Aim for an absolute minimum risk/reward ratio of at least 1:2 for every trade you enter.

Most swing trade setups we list in The Wagner Daily report aim for a risk/reward ratio of 1:3 (or higher).

This means our risk-reward system is designed to remain profitable even with up to three losing trades for every winner.

Of course, determining an ideal risk/reward ratio for your trade setups depends on your personal winning rate percentage as well.

The lower your trade win rate percentage, the higher your risk/reward ratio should be (and vice versa).

Learn more about risk-reward ratios in How Winning In The Stock Market Boils Down To Simple Math.

2. Limit dangerous emotions by automating your trading decisions

When you’re in the heat of the moment monitoring stocks, emotions can run high!

If the stock you just bought suddenly tumbles sharply lower, it can sometimes be mentally challenging to follow your plan and quickly cut the loss.

Dangerous emotions like fear and hope start creeping in.

Likewise, the equally menacing emotion of greed can tempt traders to continue holding onto big winners–even after the price momentum has started to reverse.

With enough self-discipline and experience, you could eventually learn to remove all emotion from each and every trade decision–which should always be your goal.

But until then, setting physical buy and sell stop orders is a fantastic way to automate your trading decisions.

Setting stop orders enables your trade entries and exits to go on autopilot.

This automatically and efficiently removes all emotion from your trading decisions, while significantly lowering stress levels as well.

Most importantly, physical stop orders are a perfect fit for part-time traders and investors who work around their full-time jobs.

Our nightly swing trading report always lists exact, pre-set buy, stop, and target prices for each new trade setup shared with subscribers.

Traders are then able to set their physical stop orders outside of market hours, to be automatically live during the next trading session.

That’s why the Morpheus trading strategy is the perfect side hustle for part-time traders and investors.

3. Use basic technical analysis to gain your winning edge

If your stock picking method is based on the continuous roaring “noise” of financial news outlets telling you which stocks to buy, you will inevitably be pulled in all different directions.

Increase your odds of trading success by implementing a stock picking system based on simple, proven technical analysis methods.

Technical analysis is a method of trading that helps identify and evaluate trading opportunities by analyzing past statistical trends such as price movement and volume.

There are literally hundreds of different technical analysis indicators out there, but we believe the best technical trading systems are also the most simple.

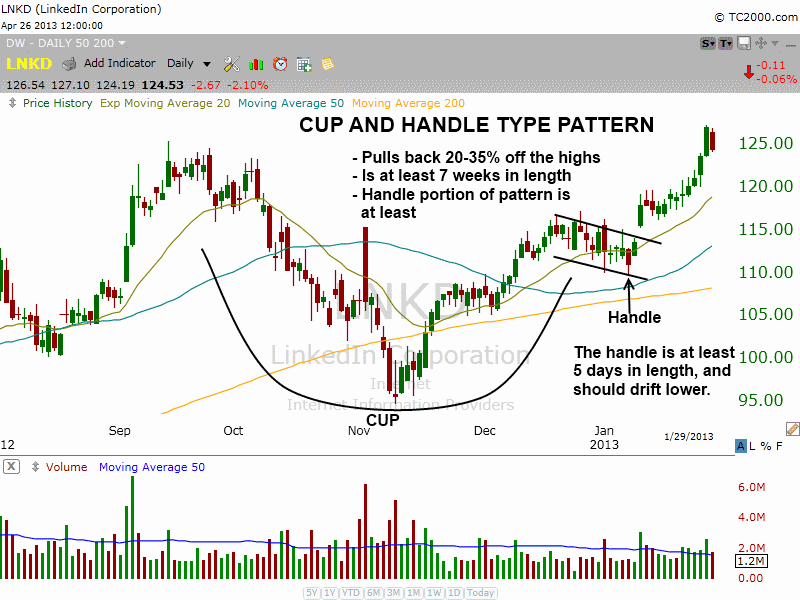

Focus on just one or two of the most popular and reliable chart patterns, such as the “cup and handle”–the secret sauce behind our explosive growth stock picks since 2002.

When I was a new trader, I thought that technical analysis and chart reading was some type of magical “hocus pocus.”

However, I quickly learned that technical analysis and chart reading is simply a way of tracking the levels of human emotion in a market.

For example, uptrending stocks show that greed is in charge, while downtrending stocks indicate increasing levels of fear.

Technical analysis helps determine when those levels of fear and greed are about to change.

By learning to read charts with basic technical analysis, you can learn to gain a profitable edge by anticipating these changes.

Perhaps most importantly, technical analysis even tells you when your best action is to simply do nothing–wait on the sidelines for more favorable trading conditions.

In the model portfolio of our flagship trading newsletter, technical analysis kept us out of stocks during the October sell-off, then enabled us to get back in when the trend reversed higher in November.

Conclusion

As we enter the new year, the mainstream financial news outlets will surely be screaming out conflicting warnings–warnings about getting out of the market now or warnings not to miss the next bull market.

Avoid drowning in the continual “noise” of uncertainty that often leads to freezing like a deer in the headlights…

Instead, simply focus on developing your winning trading strategy with three actionable steps you can take now:

- Know your risk-reward ratio for every trade setup and stick to it.

- Remove emotions and improve efficiency by automating your trading with stop orders.

- Use basic technical analysis to guide your trading decisions.

At Morpheus, we provide Wagner Daily subscribers with pre-set stop prices for all trade setups, backed by “no nonsense” technical analysis and a risk-reward system that simply works.

Follow these three simple steps to fast-track your trading operations on the road to building your wealth as a master trader!