The Wagner Daily – August 25, 2022

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

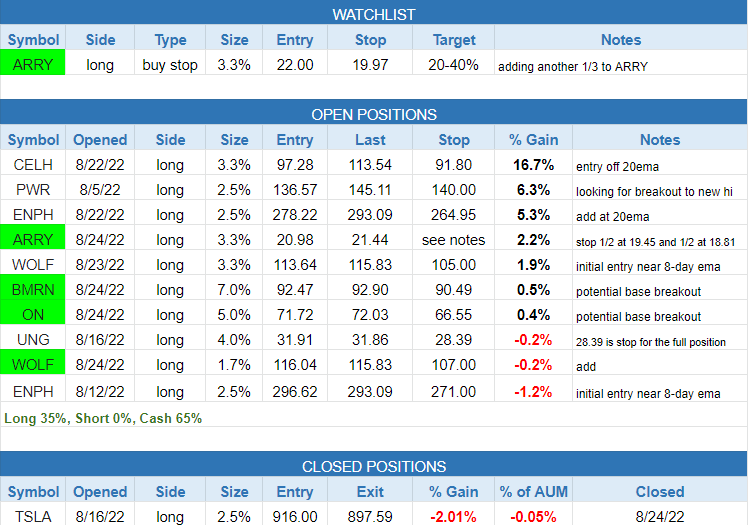

today’s watchlist along with open and closed positions:

- In yesterday’s report: added to $WOLF and bought $BMRN, $ON, and $ARRY.

- Per intraday alert, sold $TSLA on a bounce to focus on stronger stocks.

Last week, leading growth stocks held up well as broad-based averages sold off down to the 20-day ema on the daily chart. This week, leadership is pushing higher as the indices find support, which is what we wanted to see. As long as the S&P 500 and Nasdaq Composite avoid making lower lows, leading names should be able to make some decent progress to the upside.

Nasdaq 100 futures trying to reclaim the 20-day ema after a shakeout below:

The model portfolio was busy on Wednesday, with buys in $ARRY, $BRMN, $WOLF, and $ON. Per intraday alert, $TSLA was sold on a bounce as we believe there are better stocks to own.

At the beginning of a bull market rally, when conditions are sometimes not ideal (volatility is high), we are forced to rely more upon intraday alerts for entries. However, as conditions settle down volatility contracts, which makes it easier to list setups the night before.

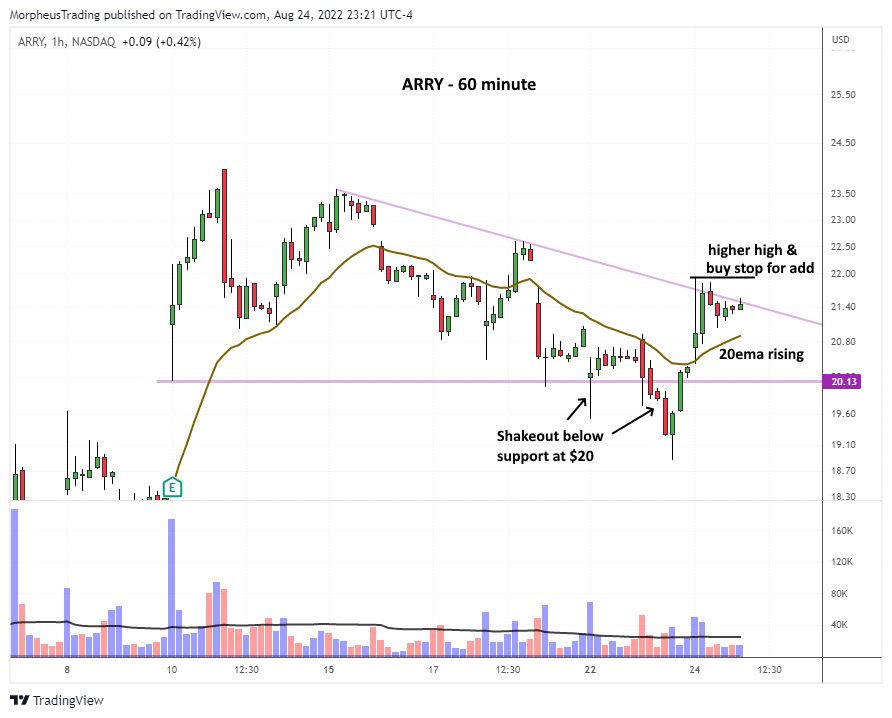

There is one new official setup for Thursday. We are adding to $ARRY over the prior day’s high, looking for immediate follow-through. The stop is placed just below $20. The hourly chart below details the add which is over the downtrened line and prior high. A move above $22 would create a higher high.

We bought on as it reclaimed the prior high. $ON and $WOLF are two of best acting semis.

If $CELH doesn’t blast off right away, then we will look to add to our position on a pullback near the 20-day EMA.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- Longs – Over prior day’s high or 2-day high – $GFS $PANW $FWONK $TH $UNG (on weakness to 20ema) $SPXL

- Shorts – none

See you in the chat room,

Rick

These lists are a good starting point for monitoring the market’s health for those with limited time.

https://morpheustrading.com/services/swing-trade-alerts

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.

Add

Add