The Wagner Daily – January 3, 2023

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

MTG Market Timing Model – Sell (as of 12/15/22) due to a break of 20ema in the S&P 500

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

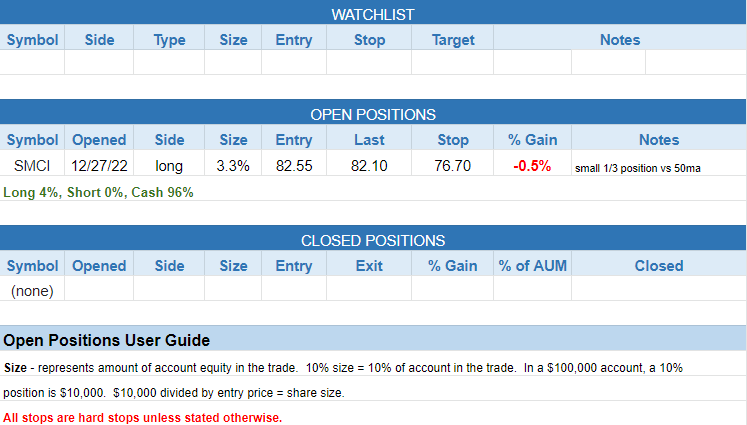

today’s watchlist along with open and closed positions:

- No trades triggered.

The S&P 500 remains range-bound below all key moving averages with the 20-day EMA and 50-day MA as resistance. Even if the S&P is to push higher from here, it will be tough to trust any move until there is a big pick-up in buying interest.

We are also monitoring S&P 400 ETF $MDY for a close above resistance at $450.

The Nasdaq Composite closed off the lows of the week and may see a bounce. Tough to short stocks within the Nasdaq at current levels.

We continue to monitor a handful of setups that are showing relative strength to the broad-based averages.

Below are a few unofficial setups from our internal watchlist.

After clearing its downtrend line, $SLB is sitting in a tight range above the 8, 20, and 50-day MAs.

$HALO is on week 4 of a flat base pattern after breaking out from a cup with handle pattern in November. The high of last Friday’s reversal candle can serve as a buy entry for aggressive traders. This is not an official setup.

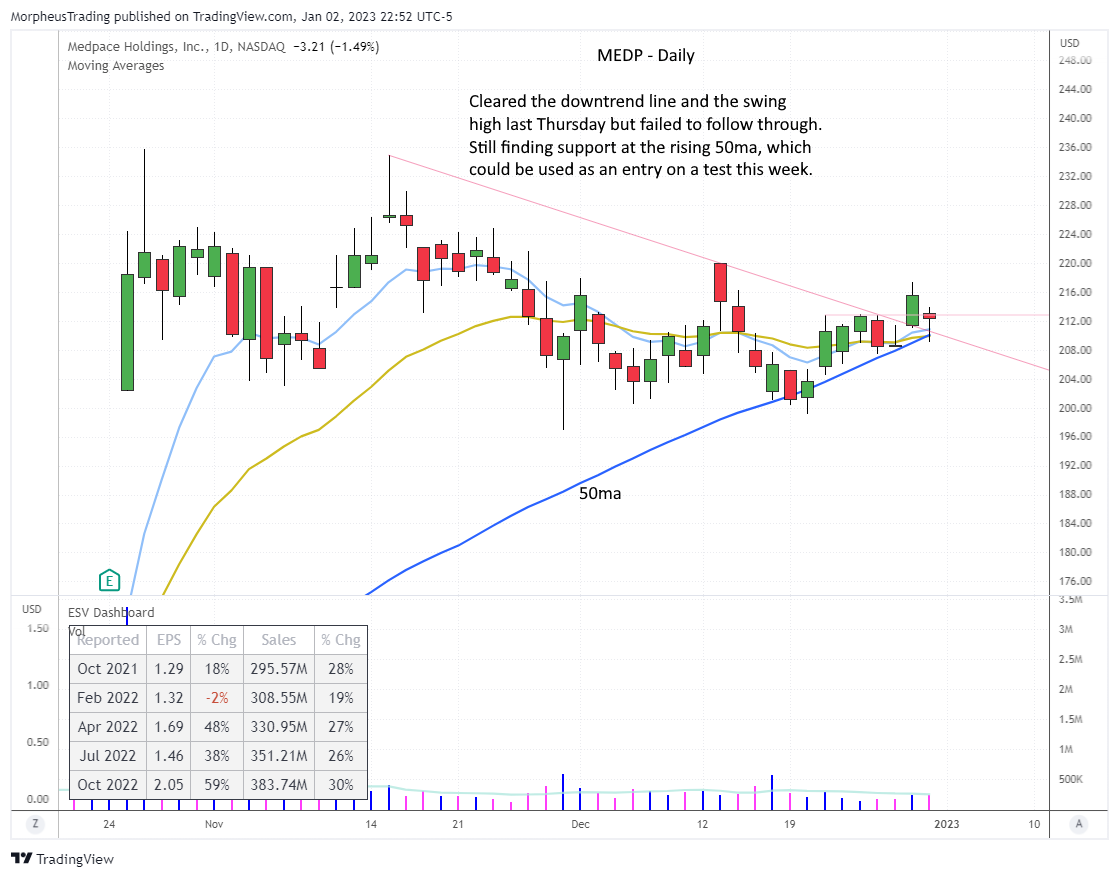

$MEDP is another top-rated growth stock on our list. Last week’s false breakout above the swing high led to another test of the 50-day MA, which held. Any pullback near the 50-day MA can be bought with small size for aggressive traders.

$CPRX has pulled back to the range high while holding above the 8-day EMA. Potentially in play unofficially on a downtrend line break.

Our game plan is to lay low during the first few days of 2023. Although we have a few unofficial setups posted above, there is nothing wrong with sitting mostly in cash.

Unofficial Setups

- Longs – watching the charts above as well as $SMCI $HAL $NBIX $PI $CAT $BOX

- Shorts –

Rick

Click here to view this week’s watchlist in google sheets

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.