The Wagner Daily – January 5, 2022

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

today’s watchlist (potential trade entries):

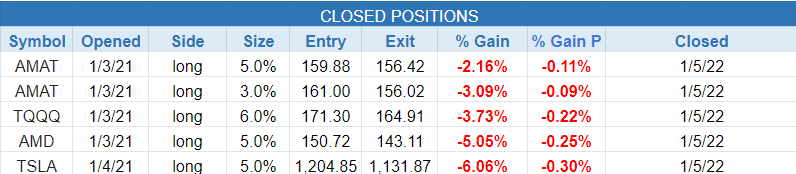

closed positions:

position notes:

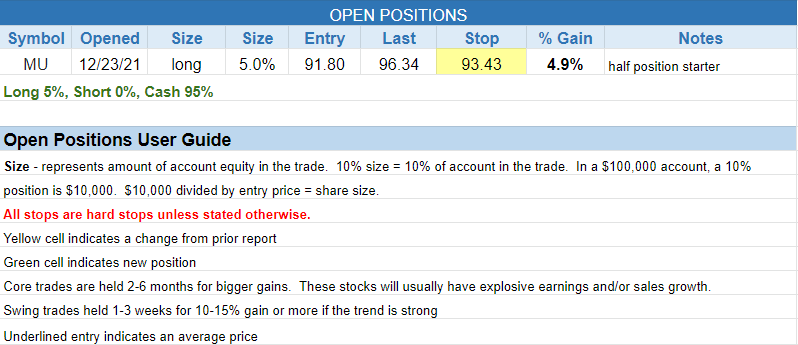

- Still long $MU.

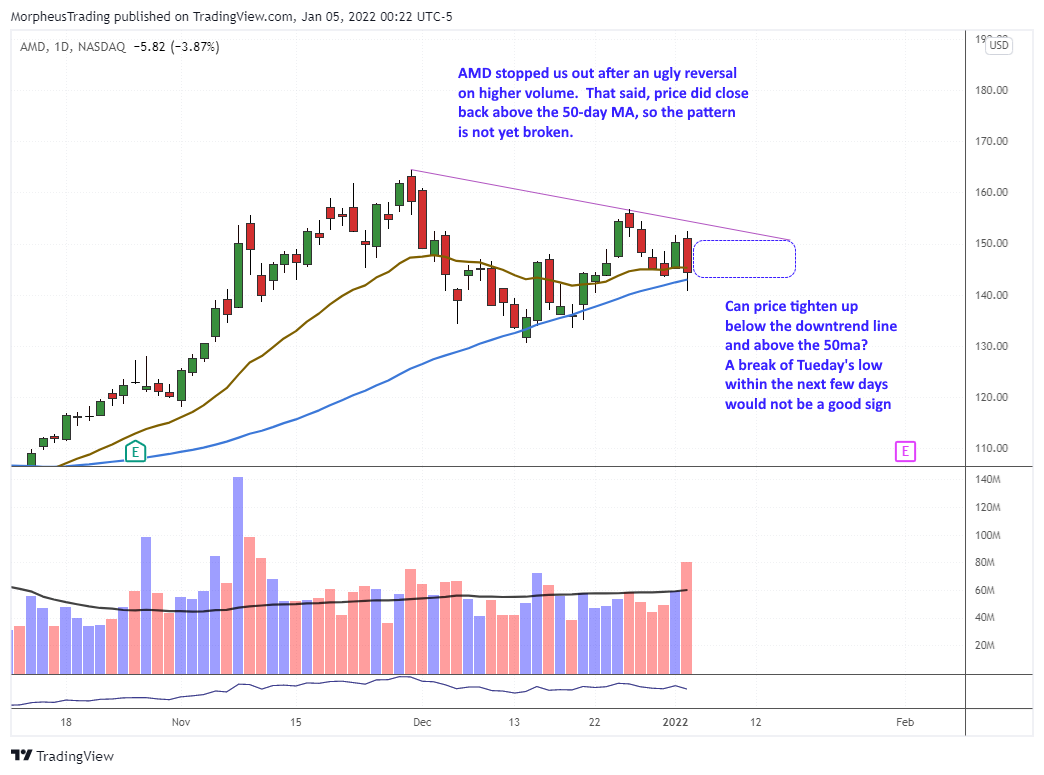

- Stopped out of $AMD, $AMAT, $TSLA, and $TQQQ.

During a strong rally, most broad market indexes are pointing in the same direction and trading above key intermediate and longer-term moving averages such as the 50 and 200-day MAs. Generally speaking, leadership is strong or improving with plenty of valid basing patterns in stocks within 15-20% of 52-week highs. Breakouts should be working and following through to the upside after a short-term pause, along with new breakouts/pullbacks on deck.

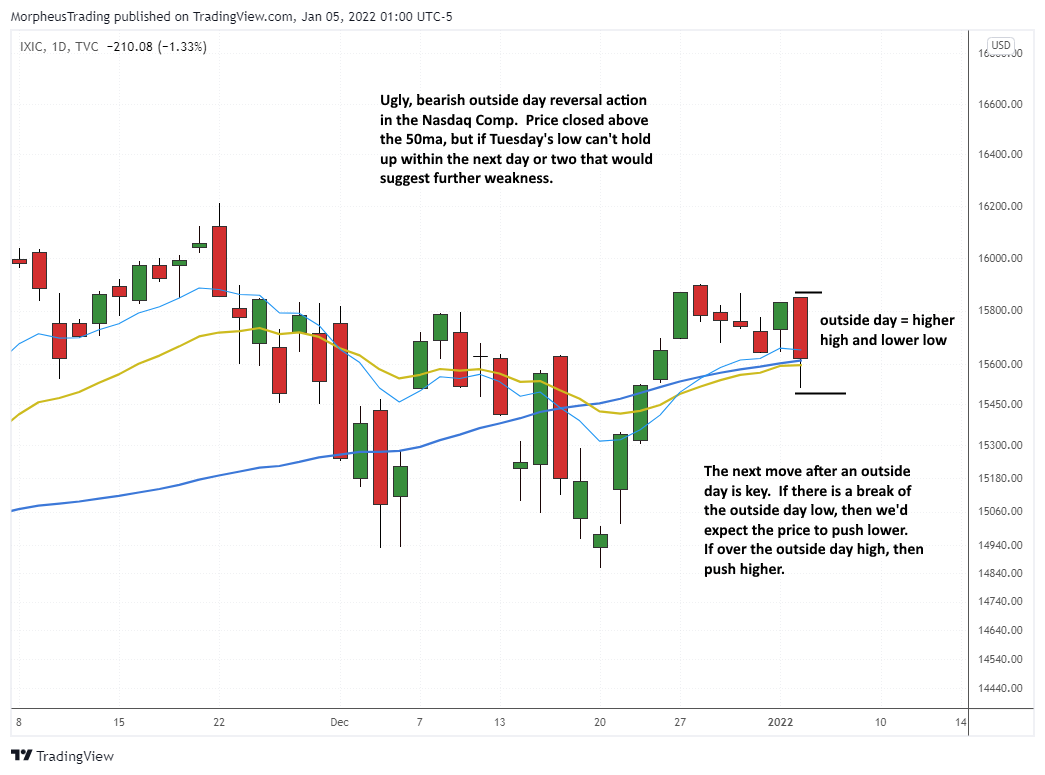

In looking at the current rally, broad market averages are all over the place on the daily and weekly charts. $SPY and $DIA are at new highs while the Nasdaq Composite is at the 50-day MA. $IWM is below the 50-day MA but just above the 200-day MA. Growth ETF $IWP is below the 50-day MA and in danger of losing the 200-day MA. On Tuesday alone, there was plenty of divergence from $DIA +0.6% $SPY flat, $QQQ -1.3% and $IWP -1.4%. Leadership is shifting with mixed results on new breakouts and not much in the way of new setups on deck. This is not an easy environment especially with volatility increasing.

For several weeks now, we’ve seen a clear shift in leadership with the market turning into a risk-off environment. Growth is out and utilities, REITs, oil, semis, banks, and transports are in.

The Nasdaq Composite is holding on to the 50-day MA for now.

Tuesday’s bearish reversal action in tech land stopped us out of $TQQQ, $AMAT, $TSLA, and $AMD. We remain long $MU with a tight stop to lock in a +4% gain.

With the exception of $TSLA, growth is off the table and we may stay clear of semis if they fail to hold Tuesday’s lows.

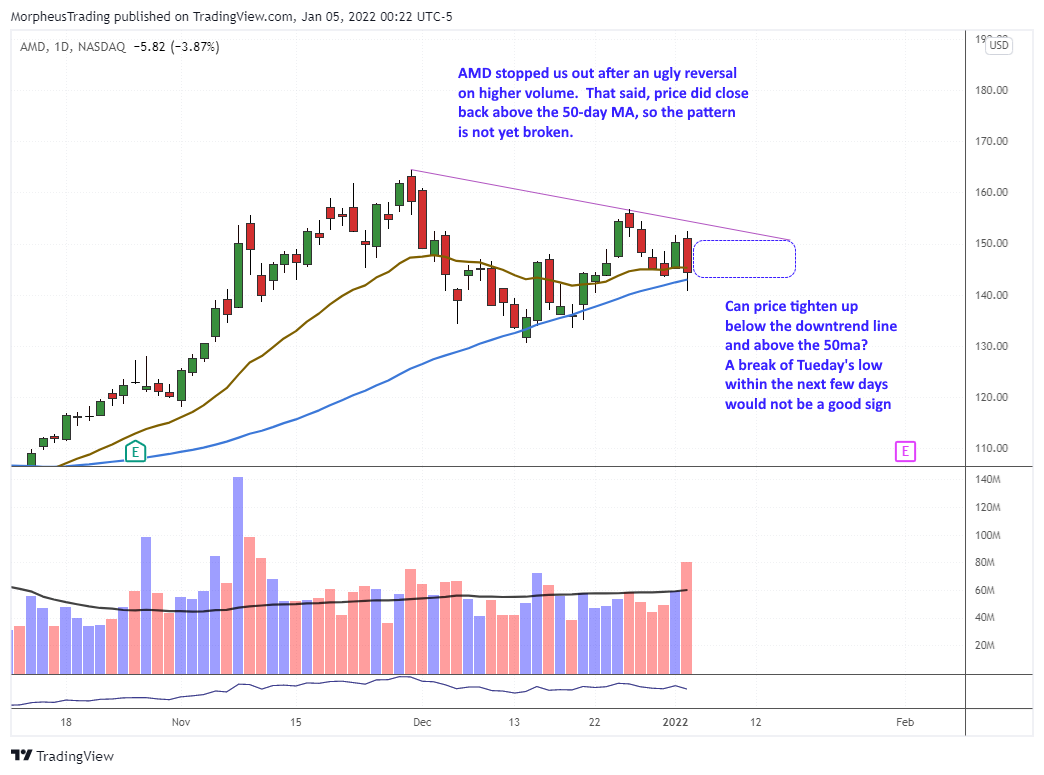

$AMD is a big leading stock within the group that has struggled as of late. The pattern remains intact for now.

$AMAT closed off the lows but would like to see the price retake and hold above $160.

$QCOM closed higher up in the day’s range and could be the one to turn to if money flows back into semis.

$TREX is chopping around in a fairly tight range while finding support at the 20-day EMA. Tuesday’s NR7 day offers a low-risk entry over the day’s high. This is not an official entry.

There are no new official setups for Wednesday as our nightly scans did not produce much in the way of low-risk buy points other than $TREX.

Our short-term plan is to patiently wait for new setups to develop in leading groups mentioned above.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- Other stocks to watch: $COST $BJ $SLAB $WIRE $SI (pop)

See you in the chat room,

Rick

For those new to this report, our share size is pretty conservative with max. size around 10% of equity per trade. We do this because we prefer to trade 10-12 names to keep the report active. However, if your goal is to maximize returns, taking 18-25% positions is the way to go. If trading in a non-margin account, this will limit the portfolio to 4-5 positions. If on margin, then 8-10 positions. Our risk per trade on average is just over 1/2 of 1%. Experienced traders may want to risk 1% to 2% per trade. For example, a 20% position in a 100k account with a 6% stop loss would result in a $1,200 loss (1.2%).

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.