The Wagner Daily – January 10, 2022

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

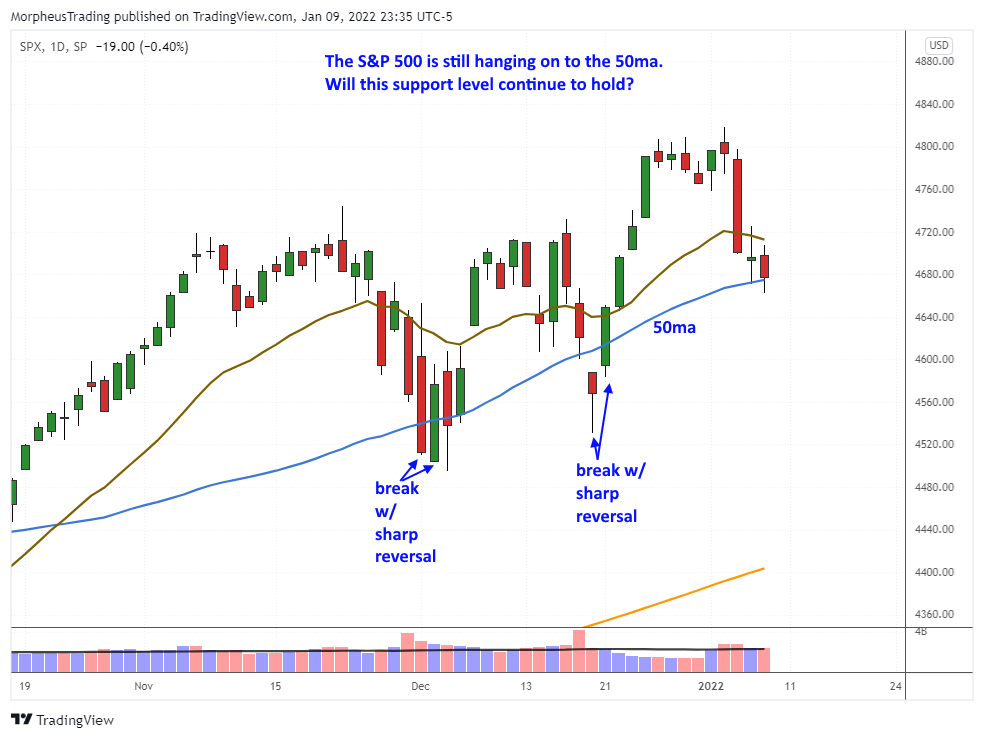

MTG Market Timing Model – Nasdaq sell, S&P 500 still holding on to the 50ma (stand by for sell)

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

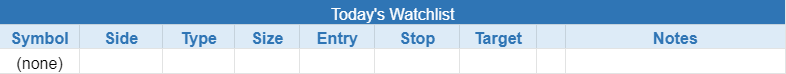

today’s watchlist (potential trade entries):

closed positions:

position notes:

- no trades triggered

The S&P 500 closed out last week’s trading still above the 50-day MA. The last two pullbacks to the 50 were followed by a sharp reversal up….will this time be different?

The Nasdaq 100 closed at a big support level. The current selloff is a bit different than the last two, as the index has clearly broken the 50-day MA.

The Nasdaq 100 lost some leadership last week with $NVDA, $AMD, and $MSFT breaking the 50-day MA. $AAPL broke its 20-day EMA and may be headed to the 50ma if it can’t reclaim the 20ema within the next day or two.

With the S&P 500 and Nasdaq at support, it’s tough to initiate new swing trades on the short side without some sort of bounce. As mentioned last Friday, it’s more of a day trader’s market for shorting.

If the market does find support and reverses higher, then oil or financial stocks are likely the best bet. $OXY is looking pretty good with an entry over the two-day high following Friday’s tight trading range. This is not an official trade.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- If the market rallies, then $OXY, $MUR, $APA, and $JPM could be in play.

- If the market breaks down, then $MU could be in play below Friday’s low for a quick short to the $92 area.

See you in the chat room,

Rick

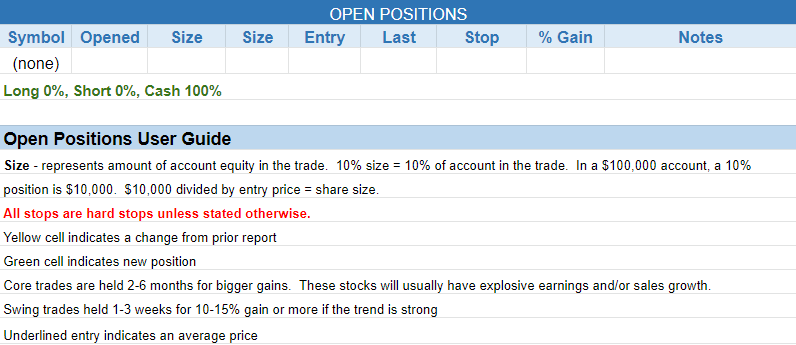

For those new to this report, our share size is pretty conservative with max. size around 10% of equity per trade. We do this because we prefer to trade 10-12 names to keep the report active. However, if your goal is to maximize returns, taking 18-25% positions is the way to go. If trading in a non-margin account, this will limit the portfolio to 4-5 positions. If on margin, then 8-10 positions. Our risk per trade on average is just over 1/2 of 1%. Experienced traders may want to risk 1% to 2% per trade. For example, a 20% position in a 100k account with a 6% stop loss would result in a $1,200 loss (1.2%).

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.