The Wagner Daily – January 26, 2022

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

MTG Market Timing Model – SELL

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

today’s watchlist (potential trade entries):

closed positions:

position notes:

- No trades triggered

Stocks chopped around ahead of Wednesday’s Fed meeting. The S&P 500 held the 4,300 support area but was rejected near the prior day’s high. Not much to do with regard to longs (energy being the exception) when the S&P 500 is in a downtrend and still trading below a declining 5-day MA.

The Nasdaq Composite is also below the declining 5-day MA.

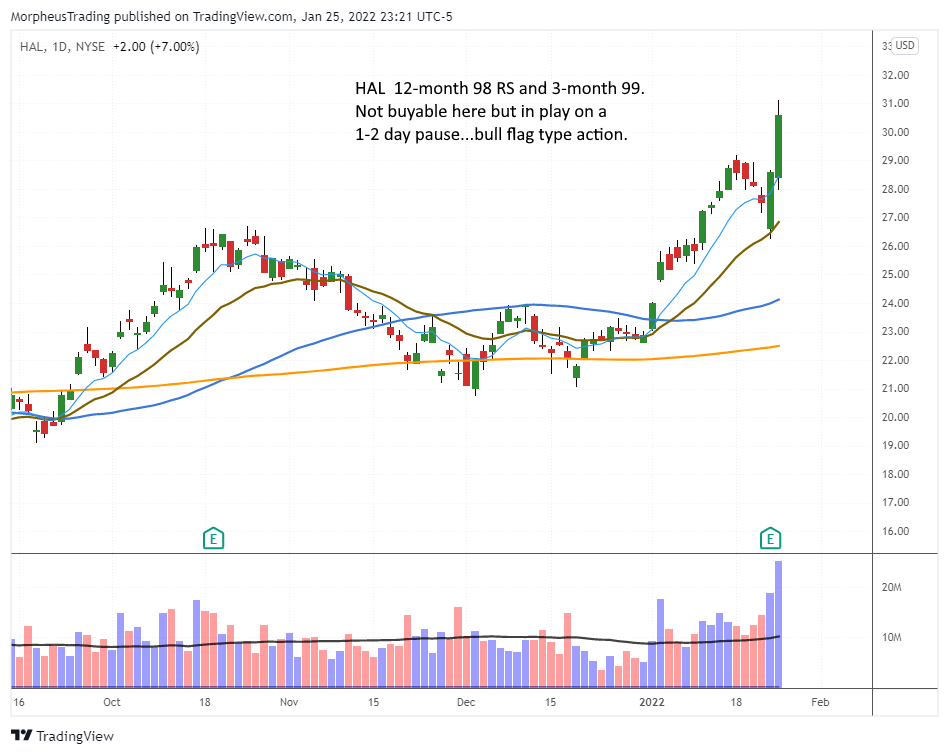

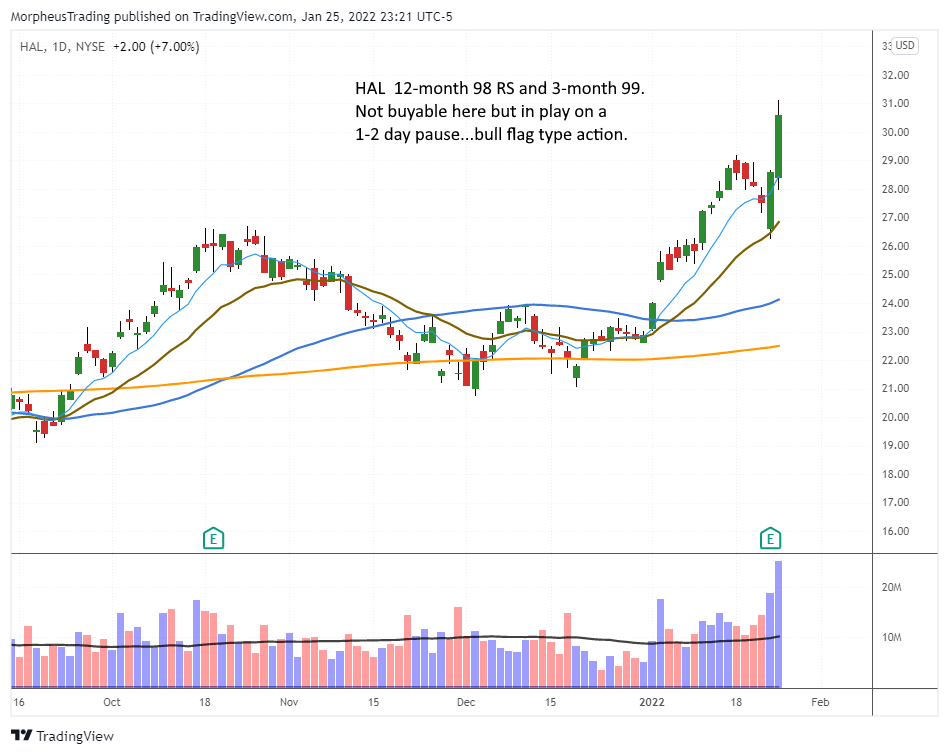

In last night’s report, we mentioned that energy stocks are holding up well and could be in play after some chop. Given the action of the past two days, energy could be in play within the next few days if bull flag-like patterns emerge.

Energy ETF $XLE rallied 9% off the two-day low. $HAL, $CLR, $DVN, $SLB, $APA, and $OXY are a handful of energy stocks potentially in play. Would like to see some sort of short term pause in these stocks to allow for lower-risk entry points (may just run without stopping).

Note the strong accumulation the past few days.

No official entries yet, just monitoring the action.

$HAL is not an official setup.

There are no new official setups for Tuesday’s session. Other than energy and possibly gold, there isn’t much out there worth owning on the long side for a swing trade.

The Fed will release its decision on rates tomorrow at 2pm EST. If the major indices can punch through the two-day high and hold, then we could see some follow-through to the upside. For the time being, there isn’t much to do other than sit in cash and wait for setups to develop.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- none

See you in the chat room,

Rick

For those new to this report, our share size is pretty conservative with max. size around 10% of equity per trade. We do this because we prefer to trade 10-12 names to keep the report active. However, if your goal is to maximize returns, taking 18-25% positions is the way to go. If trading in a non-margin account, this will limit the portfolio to 4-5 positions. If on margin, then 8-10 positions. Our risk per trade on average is just over 1/2 of 1%. Experienced traders may want to risk 1% to 2% per trade. For example, a 20% position in a 100k account with a 6% stop loss would result in a $1,200 loss (1.2%).

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.