The Wagner Daily – April 9, 2021

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

S&P 500 buy, Nasdaq Composite buy

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

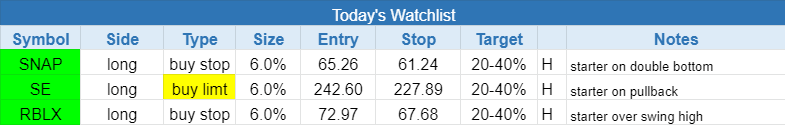

today’s watchlist (potential trade entries):

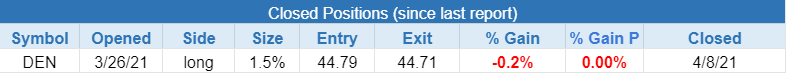

closed positions:

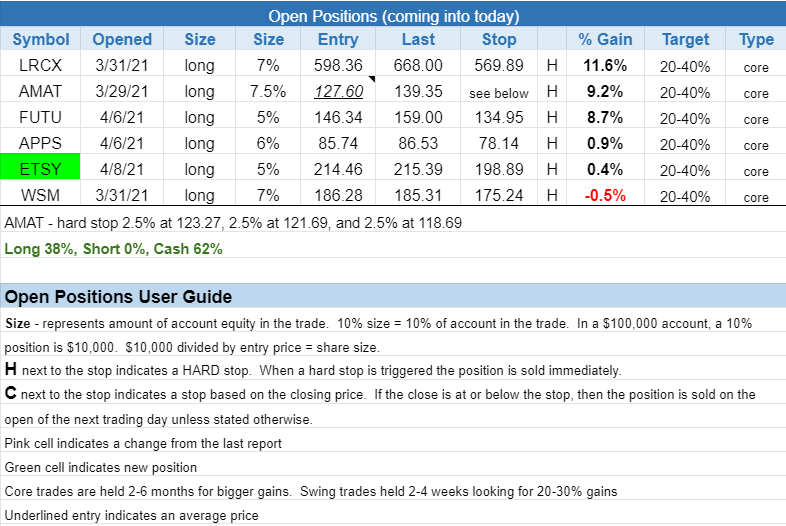

position notes:

- Per intraday alert, added $ETSY over the 50ma.

- Sold $DEN half position at breakeven.

Sorry, no video tonight. We had a lot of scanning to do with market conditions improving the past two sessions. Our weekly video will be back next Thursday night.

In Thursday’s report, we mentioned that growth stocks were lagging big cap tech, which was not ideal for our style of trading. However, the past few days of trading have produced significant accumulation in leading growth stocks with $SQ, $TWTR, $SNAP, and $SE reclaiming the 50-day MA on Tuesday/Wednesday. $BLNK, $SHOP, $GRWG, $PYPL, and $ESTY reclaimed the 50ma on Thursday. This action helps to confirm the recent follow-through day buy signal in the Nasdaq Composite.

While both the S&P 500 and Nasdaq are extended in the short-term, there is enough strength out there to focus on individual setups and not what the market may or may not do in the very short term. As we mentioned a few days ago, these indices could correct by price or time, or continue to rally without much of a pause at all.

Per intraday alert, $ESTY was added to the model portfolio over the 50-day MA. It is still buyable over Thursday’s high using the stop in today’s report. Note that we stopped out of the remaining half position of $DEN at break-even. The initial sell was for a 10% gain.

There are three new setups for Friday’s session.

First up is a double bottom pattern in $SNAP with a standard buy point at the midpoint of the pattern. Our stop is 6% from the entry. The recent surge off the lows is a bullish sign, with a few days of higher than average volume. We will look to add to the position on the first pullback to the rising 10-day EMA.

$SNAP has an RS rating from IBD of 95 and with strong quarterly sales growth at +52% and +62% in the last two quarters.

$RBLX is a fresh new IPO with great liquidity as it trades at $70 with 6 million shares a day average volume. The earnings are not there, but quarterly sales growth is impressive with the last three quarters at +68%, +92% +110%.

The daily chart shows only a few weeks of trading with two swings. The first swing is about 23% deep and the last swing so far is only 7%. We like $RBLX over the four-day high with a stop beneath the recent swing low. Generally, we try to set our stops 5-6% from our entry, but with the swing low at 7% we don’t mind going a bit lower.

The last setup is a potential pullback entry in $SE using a buy limit order. We’d have to get lucky for this entry to trigger, as we are looking for a one-day selloff possibly within the next few days to trigger the limit. If it hits great, if not, then we will continue to monitor the action for a pause or pullback to the rising 10-day EMA.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- $FUTU – add over 165.00

- $BLOK – buy at 58.90 (crypto-related ETF)

- $APPS – add over 89.90

- $W – buy at 384.00

- $GBOX – buy at 19.51

- Energy stocks – $SM $CPE $BCEI $MTDR (potentially in play over high of inside day).

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.