The Wagner Daily – April 14, 2021

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

MTG Timing Model – S&P 500 buy, Nasdaq Composite buy

Our timing model is designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

today’s watchlist (potential trade entries):

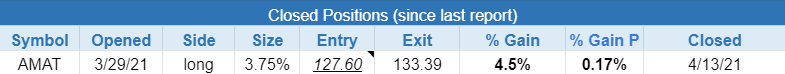

closed positions:

position notes:

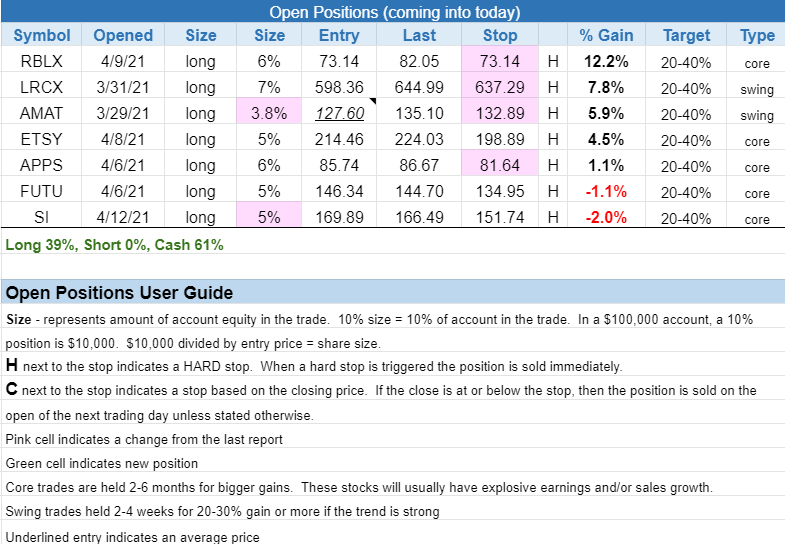

- Per intraday alert, sold half of $AMAT. Stop on the remaining half is below Tuesday’s low.

- Per intraday alert, re-entered the half position in $SI that we sold on Monday.

- Canceled the buy stop add in $APPS.

The technical picture for growth stocks improved on Tuesday, with several leadership quality stocks reclaiming the 50-day MA, such as $TSLA, $CRWD, $SHOP, $NET, $MSTR, and $TWLO. These stocks should go on to form the right side of the base during the next few weeks.

Per intraday alert, we sold half of $AMAT and re-entered the half position of $SI that we sold on Monday.

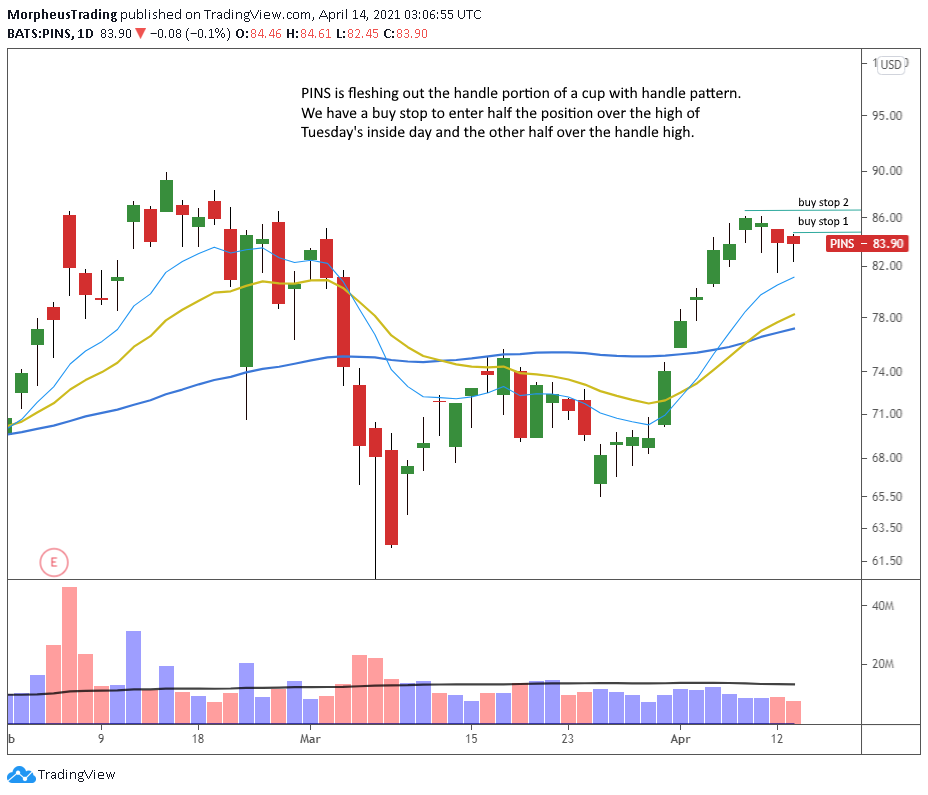

There are two new entries on today’s watchlist. One is an add to $ETSY over Tuesday’s high. The other is a slightly lower entry point in $PINS.

The first buy is over the high of Tuesday’s inside day. The second is over the handle high.

Note that we canceled the add in $APPS due to the recent volatility (a setup is only official if it appears on the watchlist the day it triggers). Since our entry, the price has struggled to push through $90 with hourly swings of roughly 8%. Let’s see if the price can punch through resistance with a solid close before increasing exposure.

Per intraday alert, we sold half of $AMAT below the prior day’s low and 10-day EMA. We originally planned to stop the remaining half position out below the 20-day EMA. However, since Tuesday is already day 6 of the pullback, we really don’t want to stick around if the price can’t hold Tuesday’s low and push higher. Even if Tuesday’s low holds, we may look to sell $AMAT on a bounce and rotate money into a new breakout. The same thought process applies to $LRCX.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- $UPST – buy at 115.00 (bullish reversal candle)

- $NVDA – buy pullback to breakout pivot at 615-617 with 5% stop

- $MARA – buy at 54.63

- SHOP – buy at 1,249, stop 5-6% lower

- $BLOK – buy 59-60 range

- $FUTU – add over 165.00

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.