The Wagner Daily – April 22, 2021

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

| quick jump to:today’s watchlistopen & closed positionsmarket commentary | resources:subscriber guideour trading strategyblog | handy links:live mentorship room (members login) |

S&P 500 buy, Nasdaq Composite buy

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

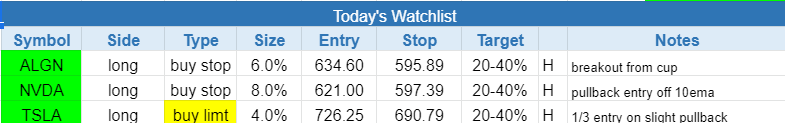

today’s watchlist (potential trade entries):

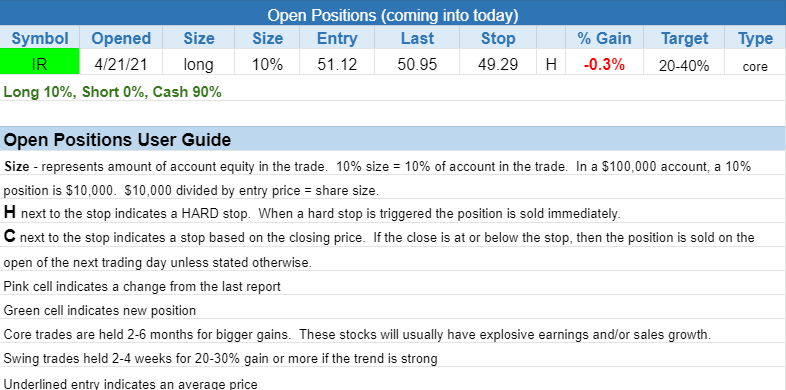

closed positions:

position notes:

- Per intraday alert, bought $IR.

The Nasdaq remains a laggard to the S&P 500 but the price action has been constructive since reclaiming the 50-day MA.

There are three new setups for Thursday’s session.

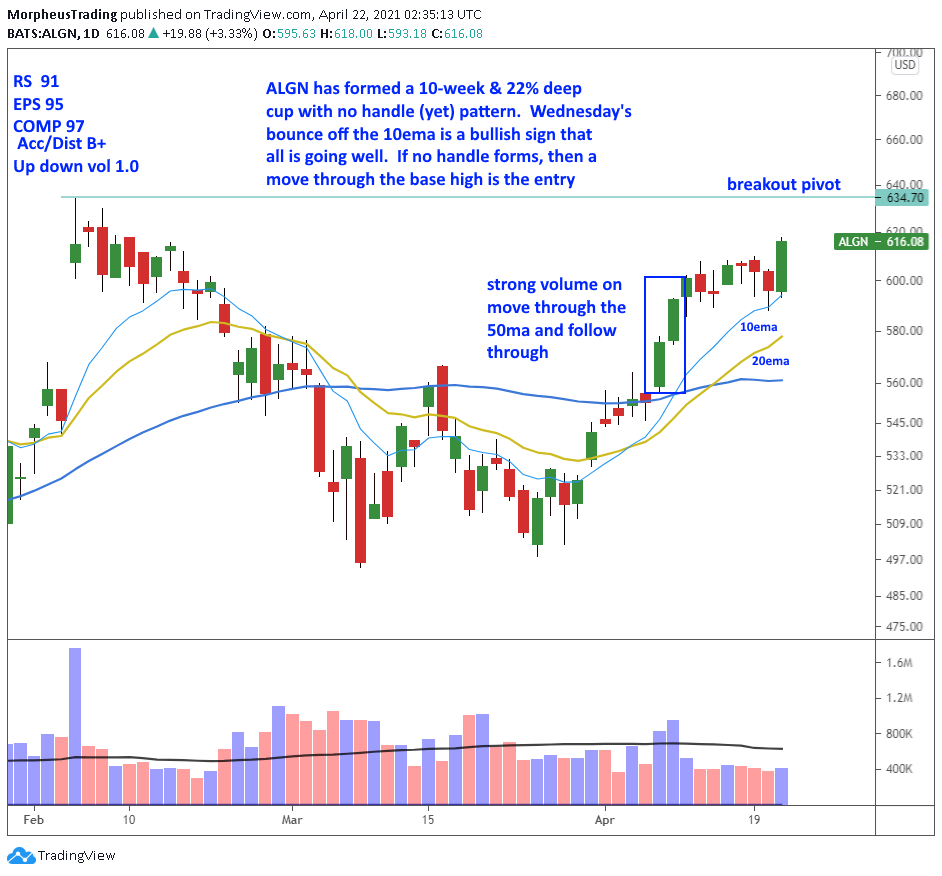

First up is a breakout entry at the base high in $ALGN, which has formed a 10-week cup with no handle. We like the strong advance off the lows of the base, followed by support at the 10-day EMA. If no handle forms, then the highs of the base will serve as our entry. A handle is five days in length and should drift lower.

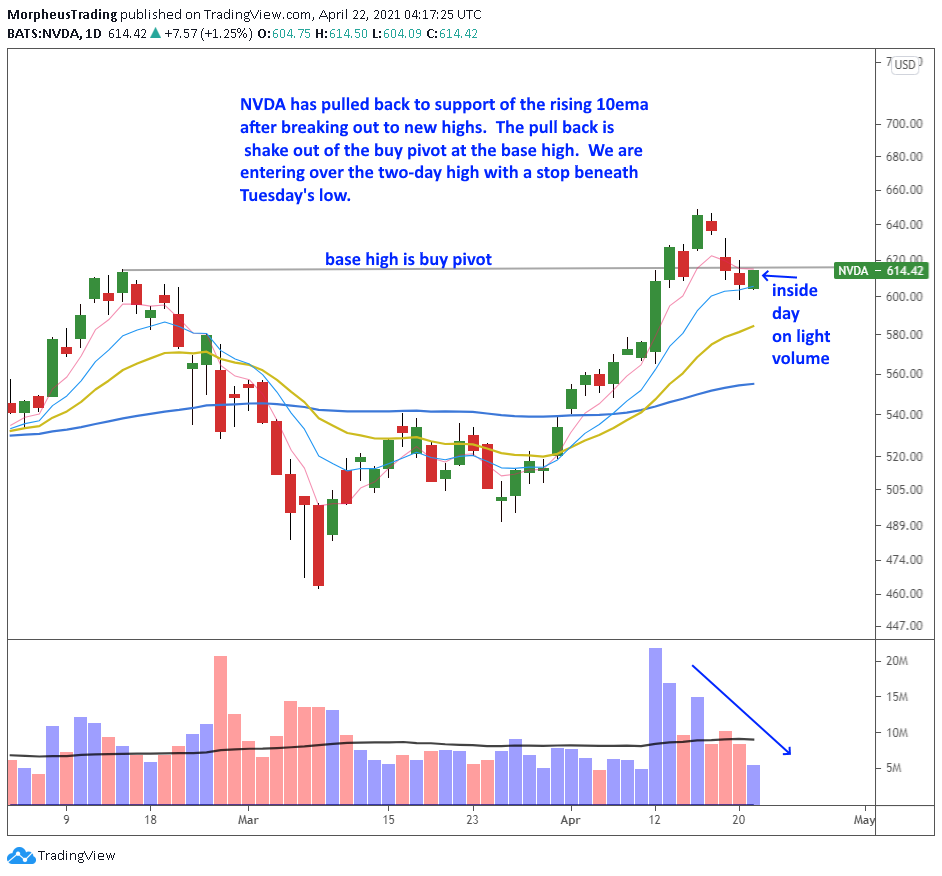

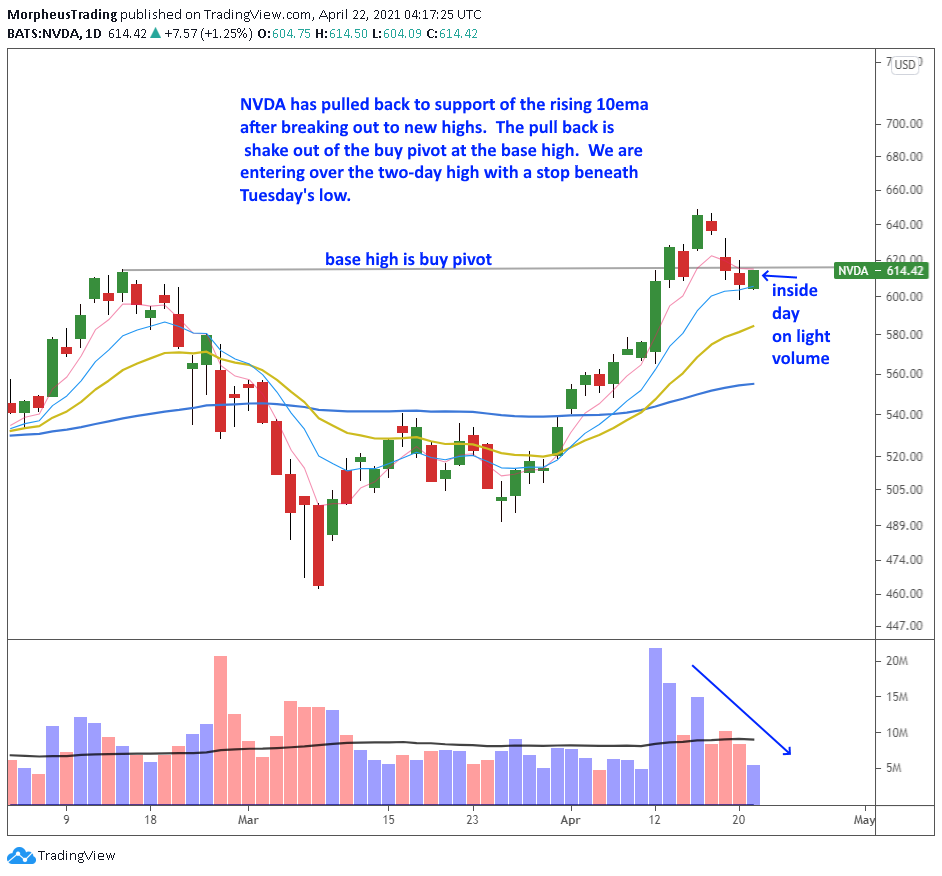

$NVDA broke out to new highs on a pick-up in volume last week. The price has pulled back to the 10-day EMA and undercut the base high, which was the buy pivot. As mentioned above with $ALGN, the base high serves as a buy pivot when there is no handle.

Wednesday’s light volume inside day is constructive (dry up in volatility and volume) and suggests that the stock may be ready to reverse higher. We have a buy stop in place over the two-day high.

$TSLA is back in play for us after defending the 50-day MA in two of the last three sessions. The last swing (from 414 to 4/19) could serve as a lower handle because it is above the 50-day MA and the midpoint of this swing is slightly above the midpoint of the base.

We have a buy limit in place to enter on slight weakness.

Per intraday alert, $IR was added to the model portfolio over the two-day high. The entry failed to follow through but volume was solid along with a close near the highs of the session. Note the price swings tightening up on the chart from left to right, which is constructive action.

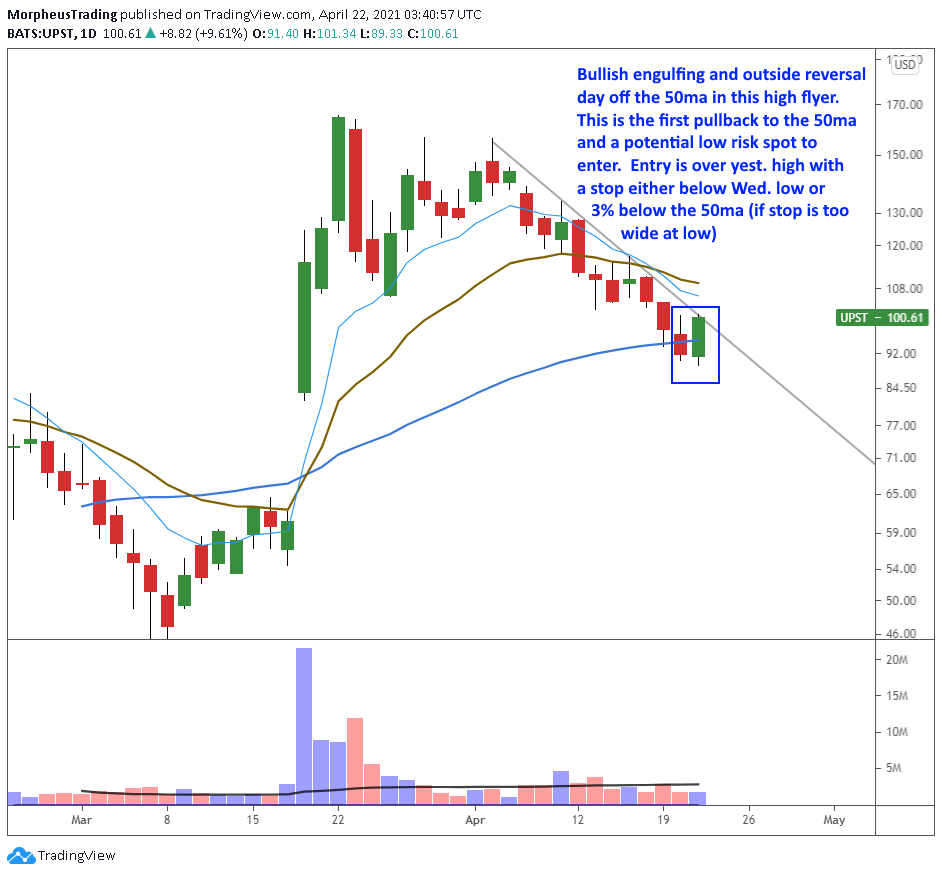

This is not an official setup. $UPST reversed off the 50-day MA and is potentially in play over Wednesday’s high. Note that the stop can either be placed beneath the prior day’s low or 2-3% below 50ma if the prior day’s low is too wide of a stop.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- $UPST – buy at 1020.00

- $AMAT – buy near Wednesday’s close or on a slight pullback

- $CARA – buy at 28.51

- $NVAX – buy at 218.00

- $WSM – buy at 174.00

- Watching – $TSLA $SQ $FB $ISRG $RBLX $VZIO $PYPL $CRWD $SNAP $HUBS $TWTR

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.