The Wagner Daily – May 19, 2021

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

MTG Market Timing Model – S&P 500 sell, Nasdaq Composite sell

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

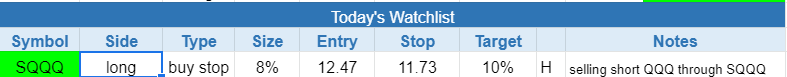

today’s watchlist (potential trade entries):

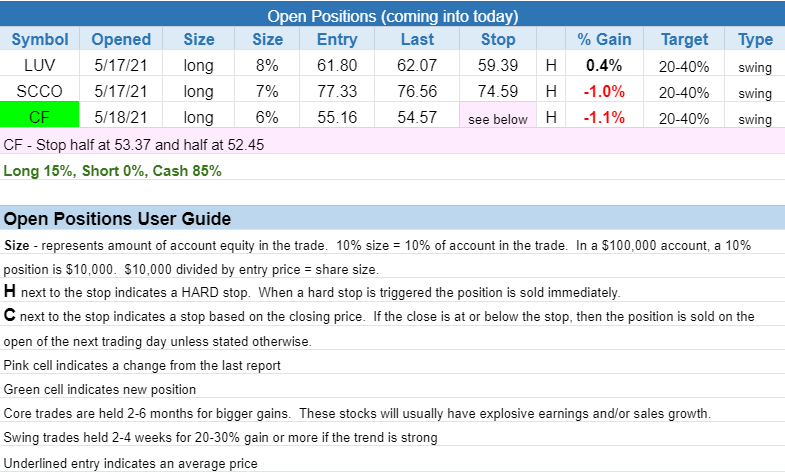

closed positions:

position notes:

- $CF buy stop triggered.

The S&P 500 closed below the 20-day EMA for the second time in six sessions and is vulnerable to further selling in the short term…unless it can reclaim the 20-day EMA on Wednesday,

If there is follow-through on Tuesday’s selling, then the 50-day MA around 4,080 should serve as support.

The Nasdaq Composite and Nasdaq 100 have failed to reclaim the 10-day EMA and are still below the 20 and 50-day MAs.

Based on the stalling at the 10 and 50-day MAs the past few days, we are taking a short position in $QQQ by going long the inverted ultra-short ETF $SQQQ over the three-day high, with a stop below last Friday’s low.

The target area for the short is around $307, which is the March 25 low on the daily chart of $QQQ.

There isn’t much to discuss tonight in terms of new buy setups, which isn’t much of a surprise given Tuesday’s weak close. Please note the new split stop in $CF.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- none

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.