The Wagner Daily – May 19, 2022

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

MTG Market Timing Model – Sell

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

today’s watchlist (potential trade entries):

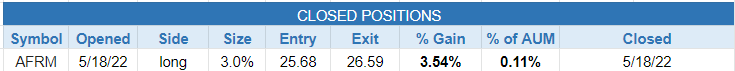

closed positions:

position notes:

- Bought and sold $AFRM for a small gain.

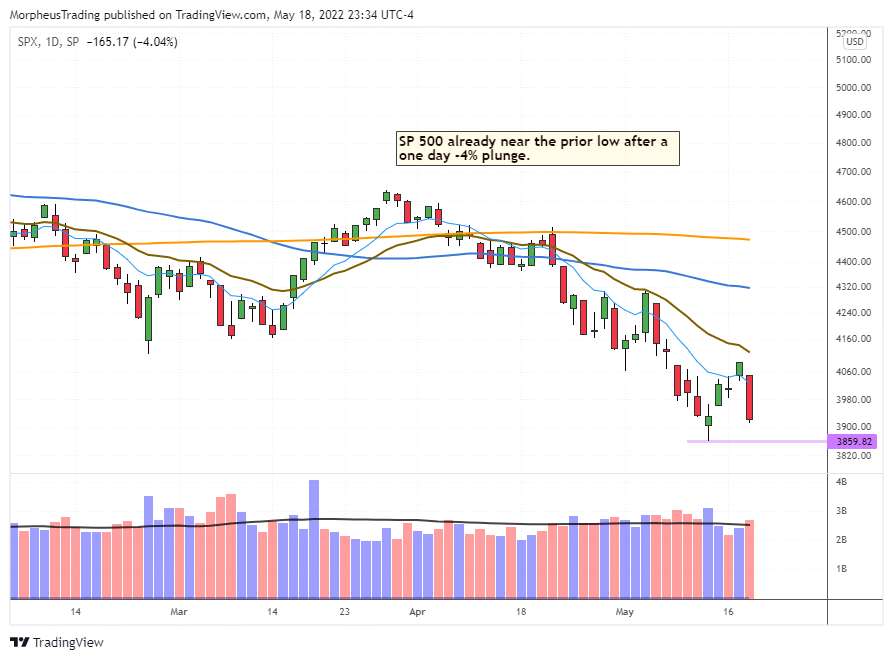

Stocks were run over by an 18-wheeler on Wednesday, as the indexes reversed lower from a short-term bounce and put in a trend day to the downside. The damage was a -4% down day in the S&P 500 and Nasdaq Composite, with both indexes closing less than 2% off the prior low.

There are no new official setups for Thursday. It’s tough to enter new shorts with the indexes so close to the swing low.

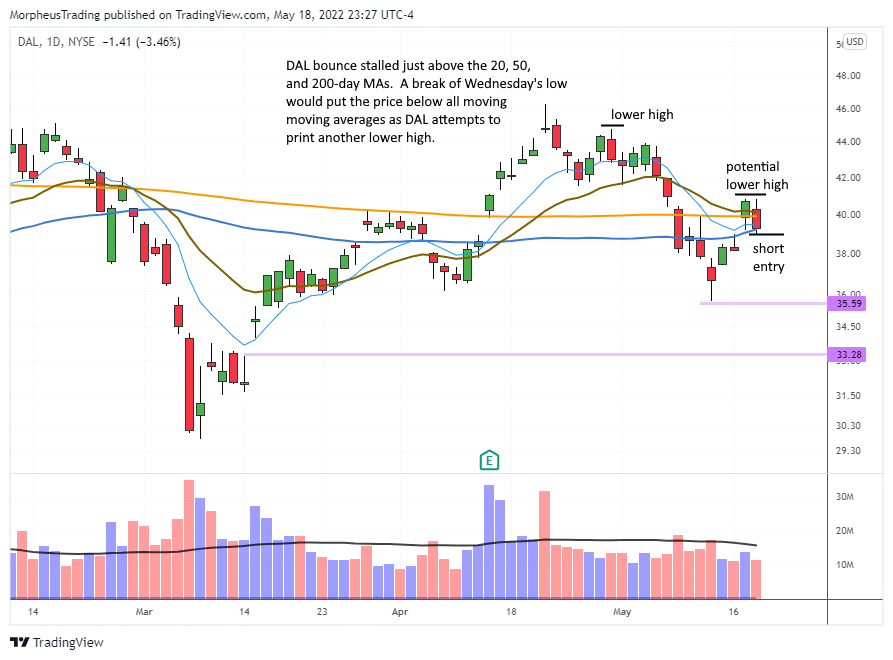

We do have one unofficial setup that could be in play on the short side.

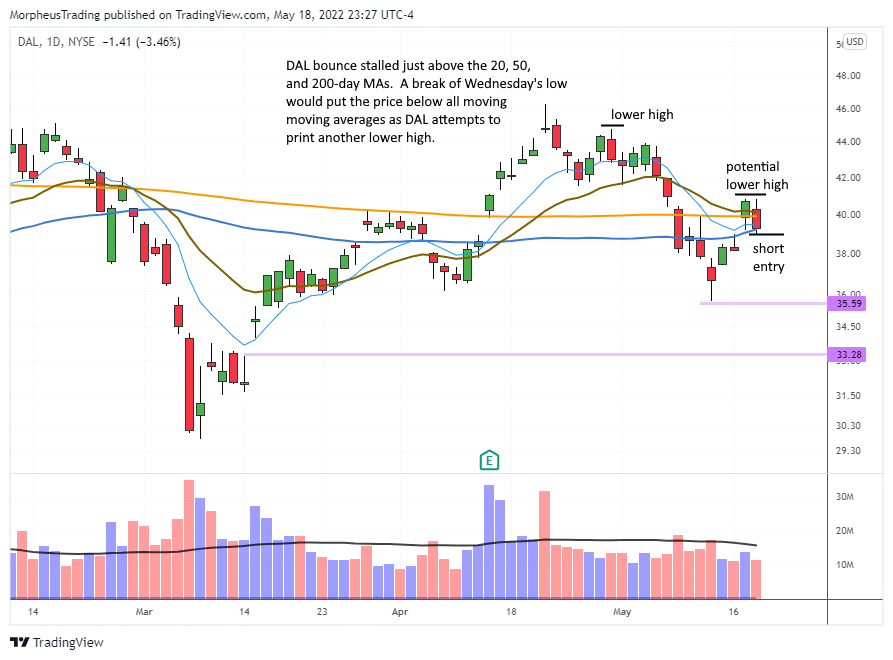

$DAL bounced into resistance from the 20, 50, and 200-day MAs on Tuesday with a close below the 50-day MA the next day. A break of Wednesday’s low is the trigger with a target of the prior low around $35. This is not an official l setup.

For now, cash is king as we wait for new setups to emerge.

For those who are new to the service, our system is based on trading growth stocks that can explode higher in a short period of time…when conditions are ideal. For most of 2022, conditions have not been ideal, so we have been playing the short side when setups are there while waiting for a new buy signal. Below are a few things we are looking for in a buy signal.

Keys to market turning bullish:

- Buy signal in the timing model, such as a FTD (follow through day) or reclaim of 21-day EMA

- Stocks begin to breakout on volume and hold… indexes hold the 21-day EMA

- Number of stocks making new 52-week highs vs 52-week lows enters into positive territory

- After first wave of breakouts, new setups emerge

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- Longs – none

- Shorts – $DAL or $UAL,

See you in the chat room,

Rick

This list is a good starting point for monitoring the health of the market for those who have limited time.

https://morpheustrading.com/services/swing-trade-alerts

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.