The Wagner Daily – May 27, 2021

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

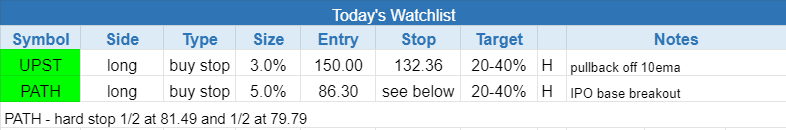

today’s watchlist (potential trade entries):

closed positions:

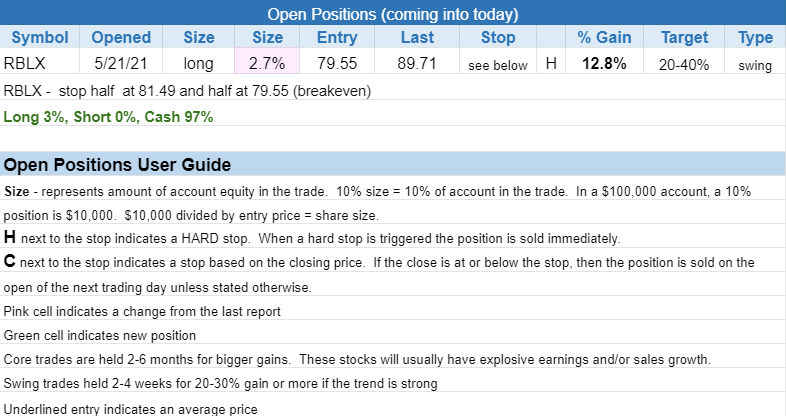

position notes:

- No trades triggered.

Note – US markets will be closed on Monday, May 31. The Wagner Daily will not be published on Sunday night but will be back on Monday night for Tuesday’s session.

The Nasdaq Composite is on a buy signal after reclaiming the 20-day EMA. As mentioned earlier this week, a follow-through day was not needed to produce a buy signal as long as the price recaptured the 20-day EMA and held.

With the Nasdaq above the rising 10 & 20-day EMAs, as well as the 50ma, we can begin to put money to work.

There are two new official setups for Thursday’s session in $PATH and $UPST.

$PATH has been chopping around the past few days after breaking out to new highs from an IPO base. Although we would have preferred a touch of the 8 or 10-day EMA, Wednesday’s inside day on lighter volume is a dry up in price and volume. Note the split sell stops. >/p>

$UPST is an IPO from December of the last year that ripped off the lows of its base and paused for a few days allowing the 8-day EMA to catch up. Our entry is over Wednesday’s high with a stop beneath the two-day low.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- $PLBY – buy stop 44.60 (break of the downtrend line and reclaim 10 and 20-day EMAs

- Watching $APP $NVDA $AMAT $ZS $PANW $CRWD $SNAP

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.