The Wagner Daily – July 15, 2022

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

The Wagner Daily – July 15, 2022

Proven swing trading strategy, top ETF & stock picks, and market timing model…since 2002

MTG Market Timing Model – BUY –

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

today’s watchlist (potential trade entries):

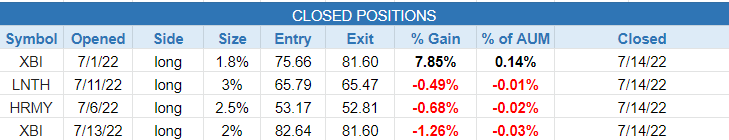

closed positions:

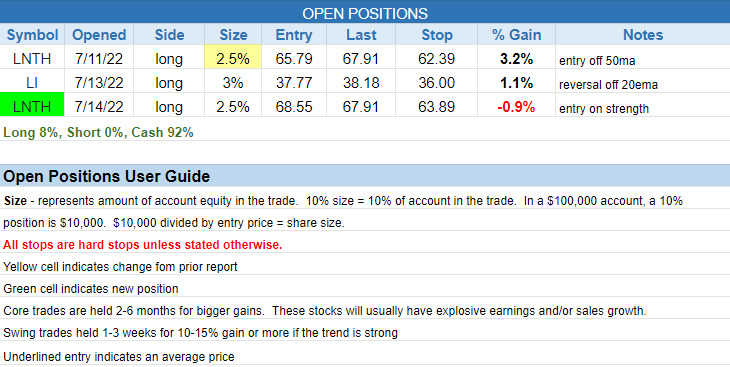

position notes:

- Per intraday alert, sold $XBI, $HRMY, and 1/2 of $LNTH to reduce risk.

- Per intraday alert, re-entered $LNTH over the prior day’s high

For the second day in a row, buyers stepped in on early weakness and pushed the indices higher the rest of the day. The Nasdaq closed in positive territory despite being down 2% and undercutting the prior day’s low during the first hour of trading. Although THE Nasdaq hasn’t made any progress in the last two days, it continues to defend the 11,000 level.

Growth ETF $ARKK is finding support at the 20 and 50-day MAs and may be in play on a break of Thursday’s high.

With the Nasdaq getting hit hard during the first 15 minutes of trading, we took profits in $XBI and sold all of $HRMY and half of $LNTH to reduce risk (both small losses). The market recovered, which is fine as we can re-enter positions as they show strength or put money to work in other setups.

Per intraday alert, we added back the shares of $LNTH we sold when it cleared the prior day’s high and $68 pivot.

$SWAV is not an official setup but is one to watch for further strength above $200 and $208.

$FNKO is not an official setup but could be in play over the high of Thursday’s tight-ranged session off the 20-day EMA.

During the beginning of a new rally attempt, our focus is usually on stocks that have a 3-month relative strength rating of 90 or higher. The ratings are from marketsmith but can be run in TC2000 with the formula below (results are close but not the same).

((((C – C11) / c11) * .4) + (((C – C21) / C21) * .2) + (((C – C42) / c41) * .2) + (((C – C63) / C63) * .2)) * 100

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- Longs – see charts above plus $TMDX $BYND $AXNX $UTHR $LRN $LI

- Shorts –

For those who would like to upgrade to the live trading room, please log into the members area of our site at

See you in the chatroom,

Rick

This list is a good starting point for monitoring the health of the market for those who have limited time.

https://morpheustrading.com/services/swing-trade-alerts

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.