The Wagner Daily – August 31, 2021

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

MTG Market Timing Model – buy mode

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

today’s watchlist (potential trade entries):

closed positions:

position notes:

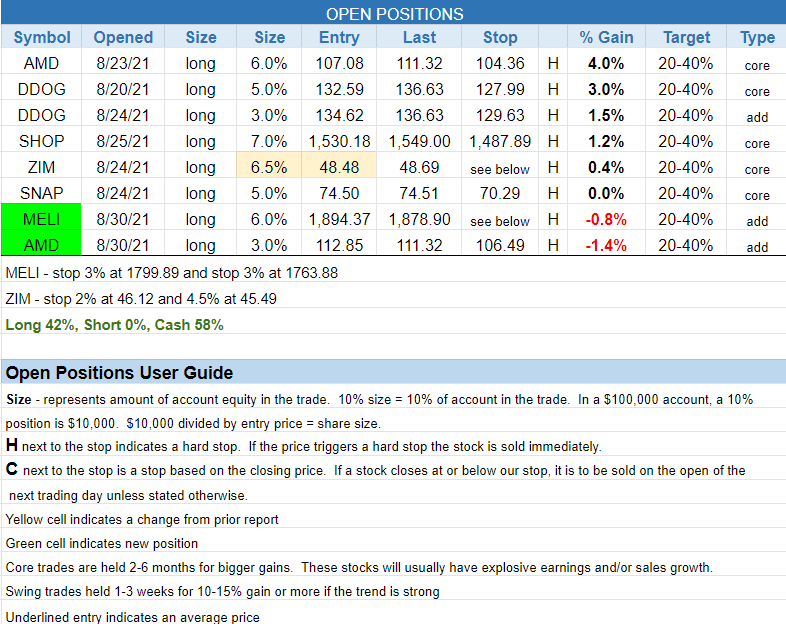

- Per intraday alert, added to $ZIM.

- $MELI buy stops triggered.

- $AMD add triggered.

Large cap tech outperformed with $QQQ up +1.1% vs +0.4% in $SPY. Both ETFs are in a strong uptrend which makes it tough to find quality chart patterns with low-risk buy points.

$MELI was added to the model portfolio on Monday along with the second buy in $AMD. Per intraday alert, we also added to our position in $ZIM looking for the 10-day EMA to hold.

There are no new official setups for Tuesday.

Below are a few charts we are monitoring (these are not official trades):

$DLO has pulled back to the 10-day EMA after a big volume gap up.

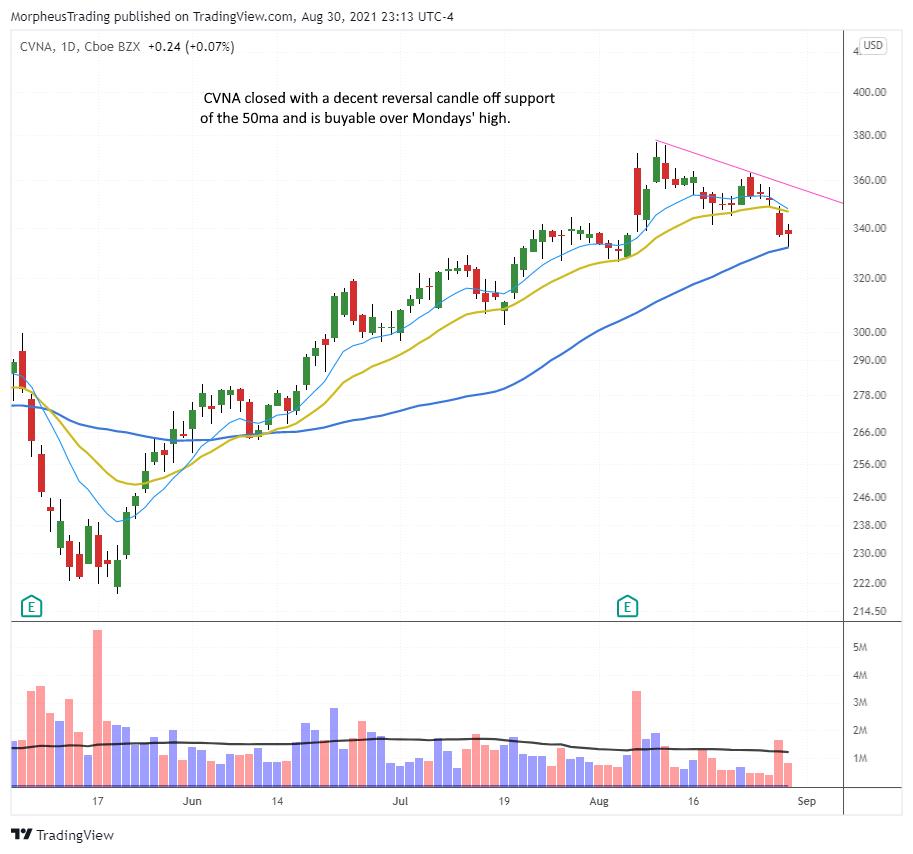

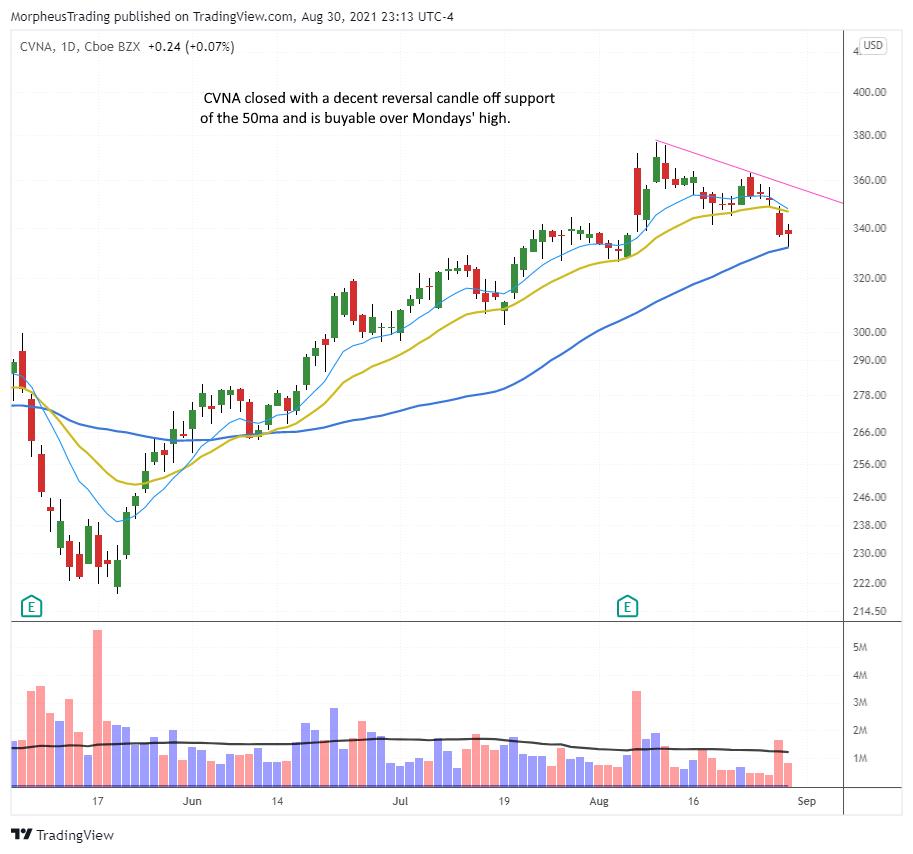

$CVNA reversed off the 10-week MA and stopped just shy of the 50-day MA. This is the first touch of the 50ma in a strong uptrend. Monday’s high is the entry (not official).

$NUE is potentially in play on a downtrend line break but we’d prefer to see a touch of the 20-day EMA first.

Like $DLO, $LC is best purchased on weakness, such as a pullback to/near the 20-day EMA.

The $AMD add failed to follow through but there is support from the rising 20-period EMA a bit lower.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- $DXCM – buy at 529.00

- $CVNA – buy at 342.00

- $DLO – depends on open, but as close to 10ema as possible

- $MELI – buy at 1,911.00 if not already long

- $U and $PLTR could be ready to push higher if the price holds yest. close.

- $WDAY over 2-day high and $MDB over Monday’s high are potentially in play.

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.