The Wagner Daily – October 15, 2021

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

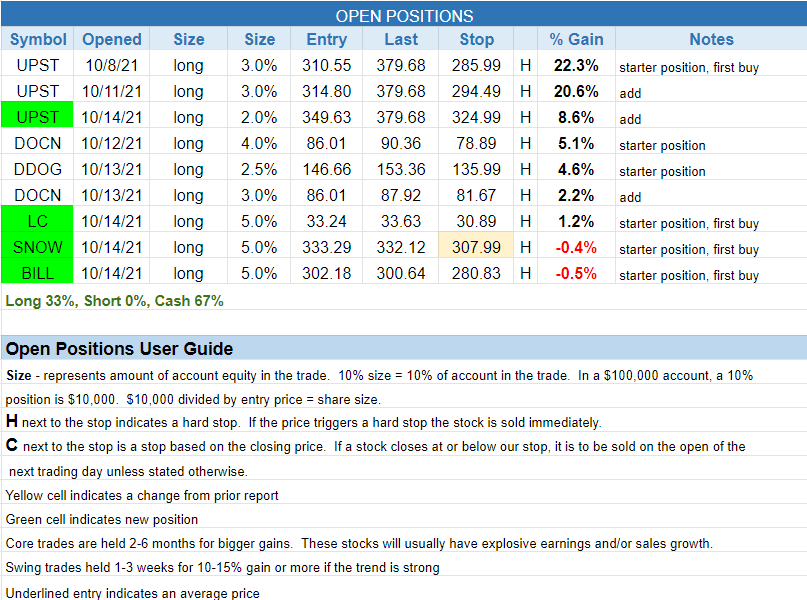

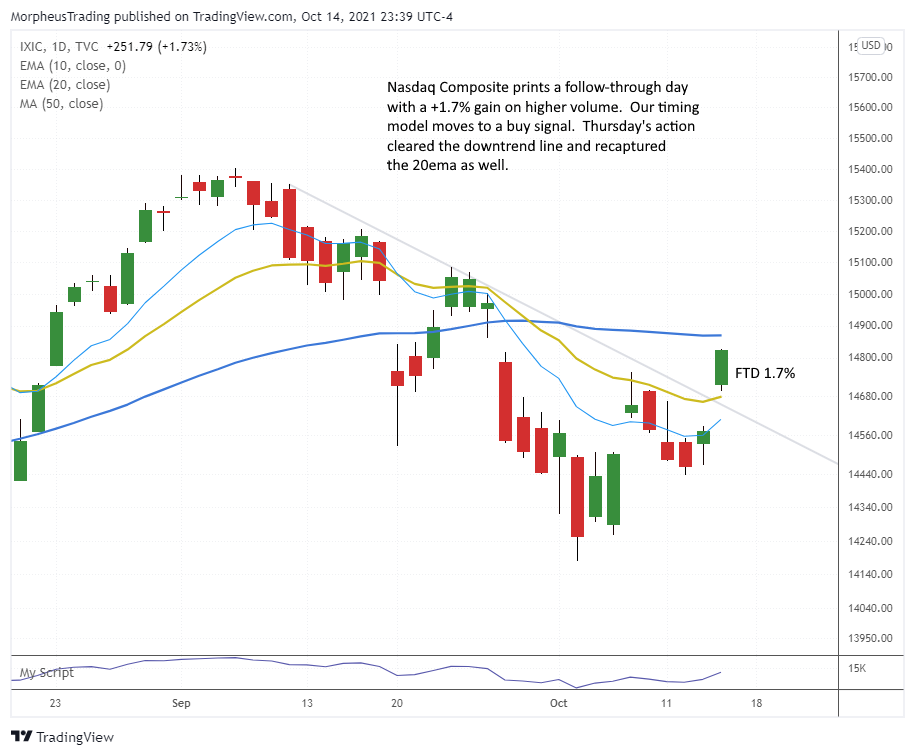

MTG Market Timing Model – Buy (from FTD on 10/14)

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

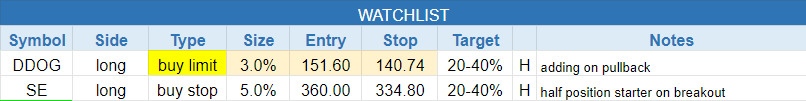

today’s watchlist (potential trade entries):

closed positions:

position notes:

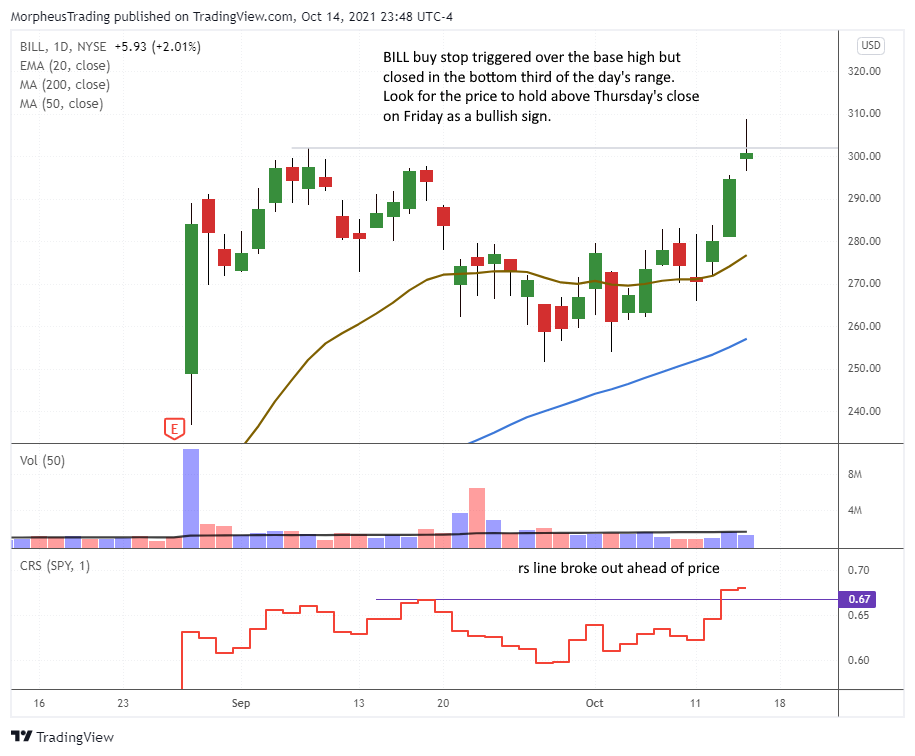

- Added half positions in $BILL, $SNOW, and $LC.

- Added 2% to $UPST.

I apologize. No video for tonight’s report, but it will be back next Thursday.

The MTG timing model is on a buy signal after Thursday’s follow-through day (FTD) in the Nasdaq Composite, which gained +1.7% on higher volume. The Nasdaq also reclaimed the 20-day EMA.

With a FTD in place, let’s see if recent breakouts can push higher while new setups emerge.

Midcap ETF $IWP reclaimed the 50-day MA, a positive sign for growth.

The model portfolio added another 2% to $UPST on the open, which cleared the highs of a high tight pattern on its way to a 10% gain on heavy olume.

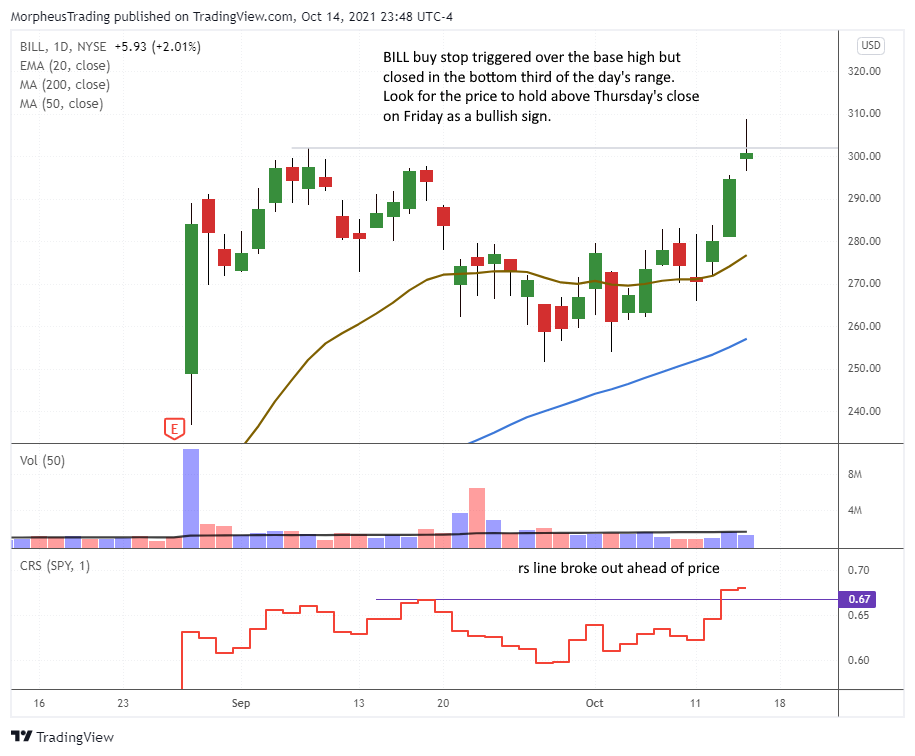

$BILL buy stop triggered on the open. The close was well off the highs and below the breakout pivot. Look for Friday’s action to hold above $300.

Per intraday alert, bought the breakouts to new highs in $SNOW and $LC.

There are no new setups for Friday. Please note the changes to $DDOG buy limit order. $SE buy stop remains live.

We have a decent amount of exposure as the Nasdaq puts in a follow-through day, so let’s see how these trades play out next week.

Just a reminder that the model portfolio looks to buy liquid growth stocks with accelerating quarterly EPS or sales growth near 52-week highs. These stocks for the most part will have IPO’d within the last 5-10 years. The portfolio will also buy stocks that lack eps or sales growth but have a strong relative strength rating of 90 or higher. The relative strength ratings are based on a 3, 6, and 12 month RS rating from IBD.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.