The Wagner Daily – December 28, 2021

Below is the full, archived issue of The Wagner Daily swing trading report (sent to members the night before the publication date).

Subscribe now for your access to the best stocks for swing trading, proven Morpheus stock trading strategy, and market timing model with a 20-year track record.

Just drop us a comment with any questions or comments–we’d love to hear from you!

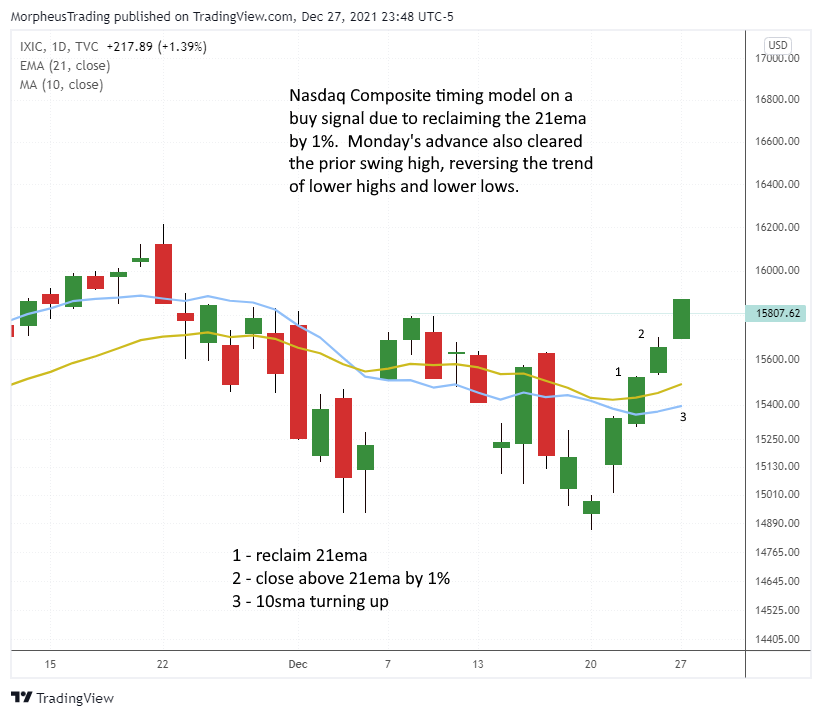

Our timing model was designed to keep our trades in line with the prevailing market trend, not to call tops or catch bottoms in S&P 500 or Nasdaq Composite.

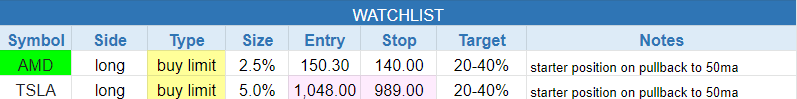

today’s watchlist (potential trade entries):

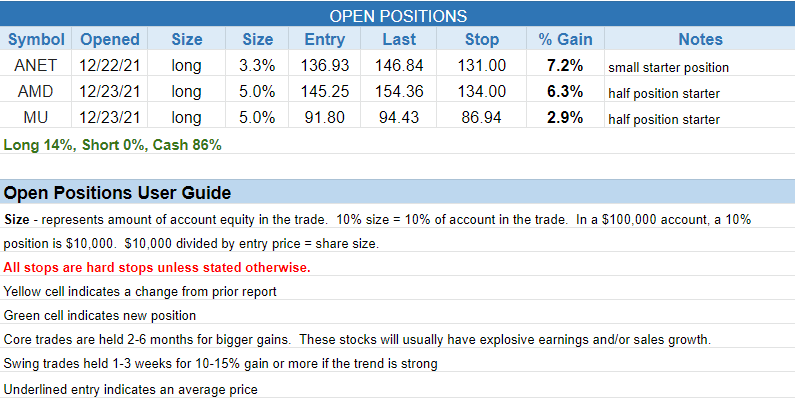

closed positions:

position notes:

- No trades triggered.

Just a reminder, US markets are open this Friday and the following Monday as this Friday is the end of the month, quarter, and year (no New Year’s Holiday this year).

The Nasdaq Composite closed with a fourth straight day in a row of solid gains. Monday’s advance cleared the prior swing high, negating the pattern of lower highs and lower lows that have been in place since the correction began. Volume remains light, but the Nasdaq is on a buy signal due to the price closing more than 1% above the 21-day EMA with the 10-day SMA turning up.

Given the quick run up off the lows, there aren’t many setups out there with a low risk entry point. However, we only need a one or two-day pause in the stronger names to create a buy point, so we could be adding new positions on strength by Wednesday.

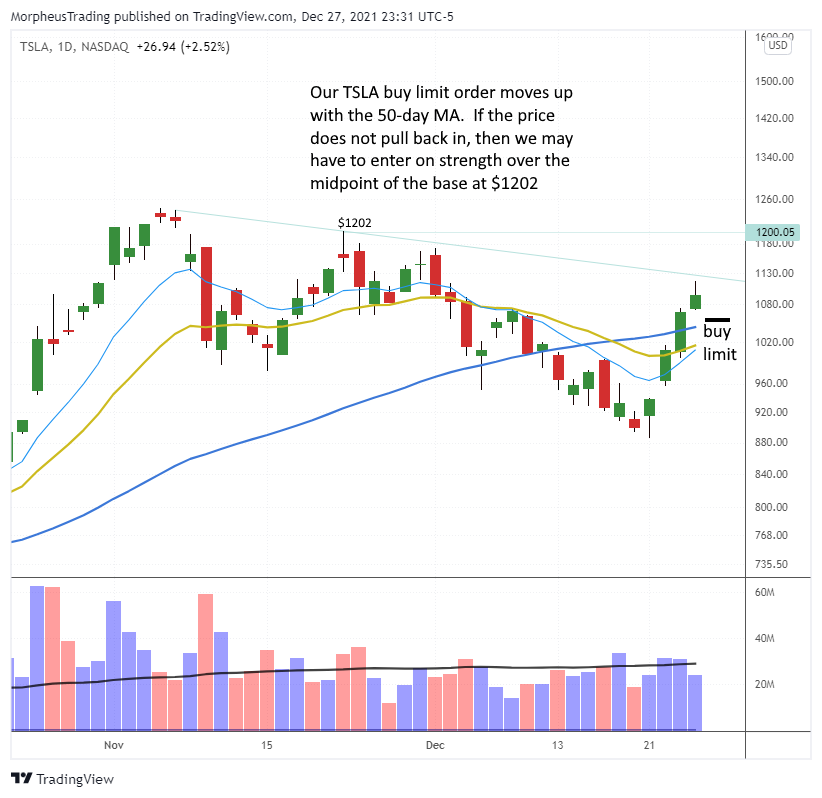

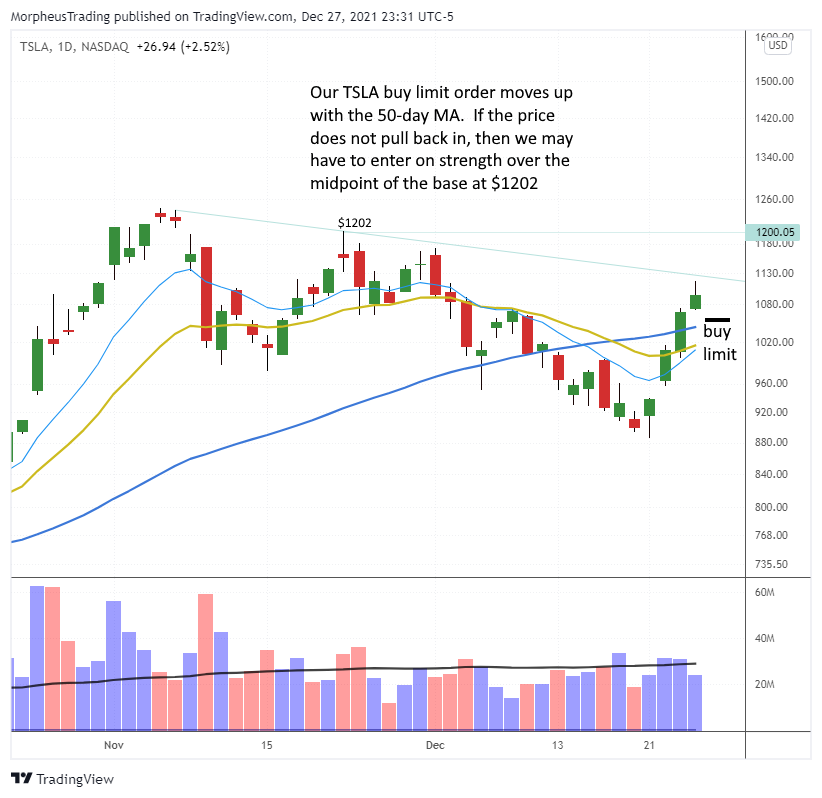

There is one new official setup on Tuesday’s watchlist, a pullback entry in $AMD near $150. The $TSLA pullback entry remains live (note the new entry and stop prices).

$PFE is an unofficial entry over the prior day’s high which should put the price above the short-term downtrend line. We like the light volume pullback to the rising 10-day EMA.

$DDOG is also in play unofficially over Monday’s high looking for the price to follow through on Monday’s inside day trigger.

Unofficial Setups – For experienced traders only, no guidance is given for these setups.

- $DDOG – buy stop 185.00

- $PFE – buy stop 59.58

- $TRT – buy stop 13.36

Start my Wagner Daily membership now to start receiving winning Morpheus stock trade signals, including a stock portfolio you can easily follow. The Wagner Daily PRO includes live swing trader room for daily, real-time trade ideas and powerful stock trading education.